There was a reason why last night we laid out an analysis on the pros and cons of QE vs negative rates: quite simply, those are the last two "tools" left in the central bankers' monetary "twilight zone" arsenal.

And as Mario Draghi made very clear this morning, both are about to be used much more for the simple reason that because they haven't worked until now, they will surely work when they are expanded. After all that is the full extent of Keynesian 101 logic.

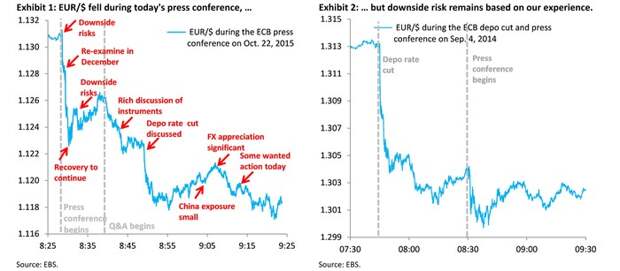

The immediate result: the biggest drop in the EUR in 9 months...

... as Europe prepares to unleash yet another global deflationary wave, in the process likely forcing China to proceed with its second devaluation step now that much of the "benefit" from China devaluation against the EUR has been wiped out.

The move will also lead to substantial pain for US multinationals who have already been screaming Uncle as a result of the soaring dollar. They will do even more of that in the next quarter, even if they will all rush to explain how non-GAAP earnings would be much better if one only excludes the "one-time" pain associated with said strong dollar. It also means that with Draghi now pre-empting the Fed's rate hike, it leaves Yellen in an even bigger box, whose now have little possibility to hike rates as the rest of the world (recall that according to Citi in addition to the ECB, there will be more imminent easing from Japan, Australia and China).

But before we get there, there may be even more pain for those who conduct business in Europe, or those long the EUR.

According to Goldman Mario Draghi's upcoming actions (or merely even more jawboning), implies "downside of at least 5-6 big figures from here, i.e. should see us return to near the 1.05 low that EUR/$ made in March." Goldman's ultimate target on the EURUSD: 0.95 in 12 months.

Here are the full thoughts by Goldman's Robin Brooks:

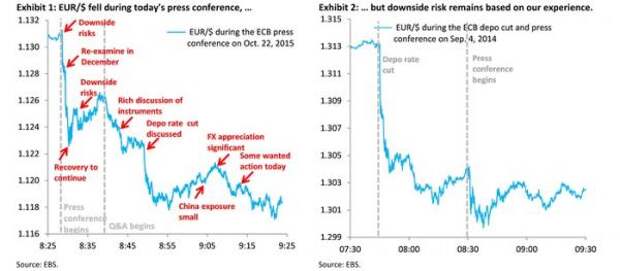

ECB President Draghi today put additional monetary stimulus, above and beyond the measures announced in January, on the map for the December 3 meeting. In particular, he raised the possibility of stepping up the existing QE program and / or cutting the deposit rate further. EUR/$ moved substantially lower during the press conference (Exhibit 1), but we argue in this FX Views that potential downside is still substantial. As we noted in our FX Views earlier this week, we think a 10 bps (surprise) deposit cut is worth two big figures downside in EUR/$. We base that assessment on empirical work we did last year and the September 2014 surprise deposit cut, when EUR/$ fell around two big figures (Exhibit 2). At the very least, following today’s press conference, a December deposit cut is now possible, meaning that EUR/$ – which went into the meeting at around 1.13 – should reprice to 1.11. Of course, there is a good chance that December will instead bring an actual augmentation of the QE program, such that downside in EUR/$ might be larger. The kind of scenarios our European economics team envisage imply downside of at least 5-6 big figures from here, i.e. should see us return to near the 1.05 low that EUR/$ made in March.

From a fundamental perspective, we have argued all year that additional stimulus from the ECB is needed and will come, which formed the basis of our downward revision to our EUR/$ forecast back in March (when we switched to 0.95 in 12 months from 1.08 previously). We developed conviction in our call over the summer, when we showed that developments in the Euro zone, in particular structural reforms on the periphery, look like they are shifting down the Phillips curve, making it harder for the ECB to bring inflation up on a sustained basis. As we argued earlier this week, the Bund sell-off that began in May was harmful to ECB QE, but we think the trend now will be to fix the credibility of the program. Today’s meeting was indeed “decision time” for the ECB, as we had hoped. Given that shift, we think there is plenty of scope for EUR/$ downside from here, in line with our forecasts.