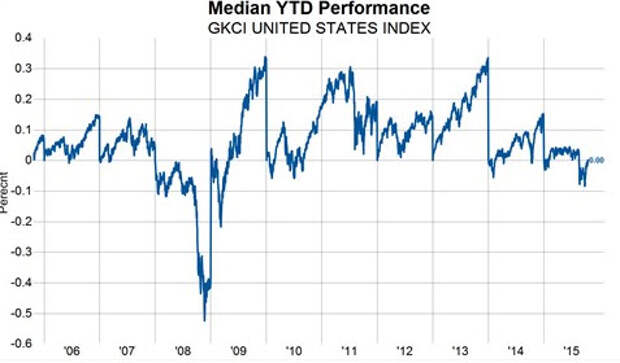

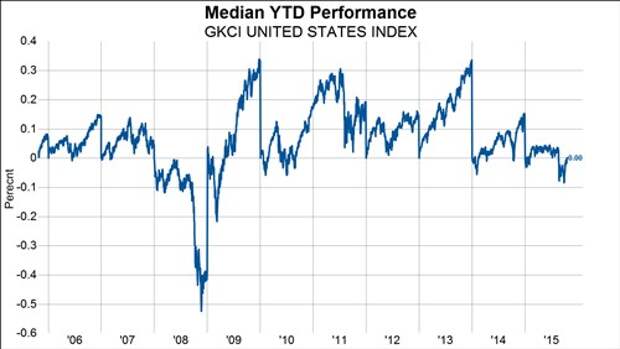

Despite today's ridiculous melt-up in US equities - all driven by USDJPY-correlated algos - after the completion of over 9 months of this year, the median stock in the United States has officially gone nowhere.

As Gavekal Capital's blog details,

We are 9+ months into the year and the median stock in the United States has officially gone nowhere. The good news is that this is major improvement from the 9/29 low when the median stock was down -8%. The bad news is unless we get a major rally into the end of the year we are set to have the worst performance according to this metric since 2008.

It’s definitely paid to have exposure to Japanese stocks this year. The median stock in Japan is up 9% (all returns are in USD). While Australia, New Zealand and Singapore are all down at least 11%.

Overall, broad exposure to European equities has paid off as well. Only Norway (-3%) and Spain (-6%) are the only countries where the median stock is negative. Italy has led the charge higher as the median stock there is up 21%. Denmark and Ireland are both at least 18% higher YTD.

* * *

So to summarize - in the two major regions where open market manipulation and money-printing is being practiced, stocks are higher... but in the nation that has promised the economy is so strong that it can withstand a rate hike any minute, stocks are going nowehere.