When it comes to the world's largest hedge funds, none is bigger than Bridgewater. Yes, some hedge funds may apply massive leverage to their AUM to boost their regulatory assets by orders of magnitude (such as Ben Bernanke's new employer Citadel has done for the past decade), but when stripping away all artificial bells and whistles, nobody can match Ray Dalio's behemoth, which launched in 1975 and which according to whose annual regulatory filing with the SEC, "Bridgewater’s assets under management increased from $150 billion as of 12/31/13 to approximately $154 billion as of 12/31/14."

So, for whatever reason, say because you enjoyed listening to Ray Dalio talk about an imminent beautiful deleveraging, since utterly disproved and replaced with secular stagnation as the theme du jour, because you are impressed with the fund's 14% return YTD due to a huge bet against the EUR, because you want your money to be managed by a robot, or because you just have to be part of the biggest thing out there, you want to have Bridgewater manage your asset for you.

Sure, no problem. there are a few small conditions one must satisfy...

Bridgewater investors must be sophisticated investors who (i) can afford the risks associated with futures, commodities, currencies, options, forwards and other derivatives trading in fixed income and equity securities, and (ii) have sufficient knowledge and experience in financial and business matters to evaluate the risk of an investment in a fund or account managed by Bridgewater and determine its suitability.

... and one slightly bigger one:

Bridgewater generally requires that its Clients have a minimum of $5 billion of investable assets. Generally, the minimum initial investment in a fund managed by Bridgewater is in accordance with the minimum fee requirement for that strategy, as detailed in Item 5.

Oops.

What is Item 5?

For new client relationships, Bridgewater’s standard minimum fee is expected to be $500,000 for its All Weather strategy, $1,000,000 for its Pure Alpha and Pure Alpha Major Markets strategies, and $4,750,000 for Optimal Portfolio. Bridgewater funds often invest in other Bridgewater funds. In such cases, there is no layering of fees.

Yes, you read that right: some hedge funds use 500,000/1,000,000 as the minimum investable capital. Bridgewater, however, makes it clear in advance that that is the "minimum fee" you will be charged, irrelevant of how your assets perform subsequently.

Unable to meet these conditions?

Tough. Then you will have little choice but to give your money to some unverified fraud on Twitter who tweets 24/7 in hopes of attracting even more fools or appearing on financial comedy TV all day long, instead of actually managing your money.

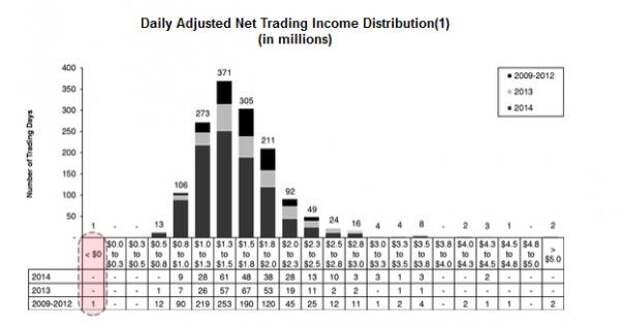

Or, worse, you can trade on your own. As a reminder, here is who you will be trading against.

For everyone else congratulations: because while there are funds of hedge funds, populated by C-grade asset managers who never managed to make it on their own in the front office, there is also a fund for hedge funds. One that doesn't need Ben Bernanke as an "advisor" to help it navigate the very rough waters that are dead ahead.