The Farce is strong in this market (so there was only one clip possible today)... as flip-flopping Fed Presidents, Greek risks, and more crappy data turmoiled the markets...

Equity futures did their usual v-shaped recovery in an algo stop-run to yesterday's highs before falling back... as Fed Vice Chair said

- *FISCHER SAYS HE'S EXPECTING A PICK UP IN GROWTH AFTER Q1

- *FISCHER: ONE WEAK JOBS REPORT FOLLOWED 5-6 `SPECTACULAR' ONES

Somewhat signaling rate hikes sooner no matter what...

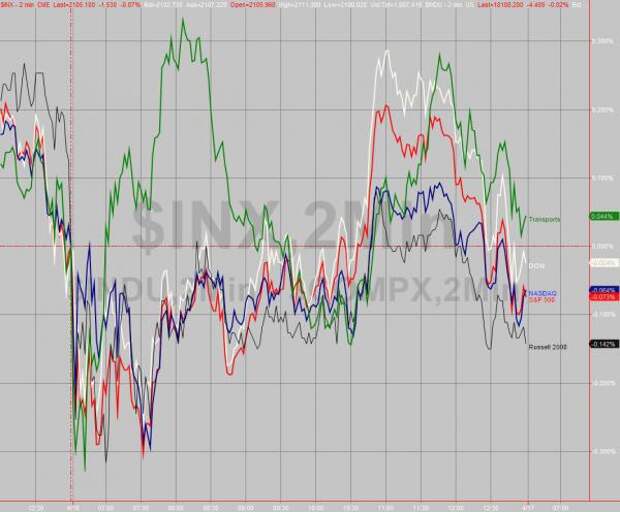

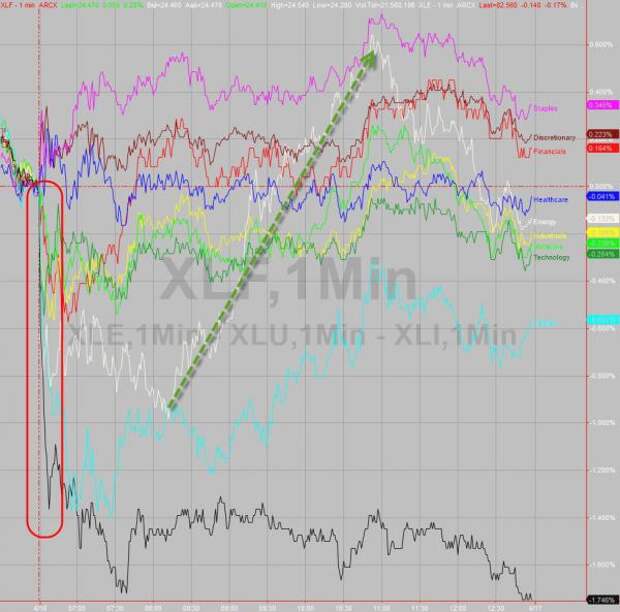

Cash indices opened gap down, filled the gap as we predicted then faded - very narrow range trade in cash today... (NOTE: Nasdaq twice bounced off 5000, S&P perfectly bounced off 2100 and The Dow stayed well above 18000) - Only Trannies closed green

Homebuilders hammered after weak Starts & Permits data...

On the week...Trannies remain red, Small Caps the best performer...

Virtu Financial closed below its post-IPO open price... (priced at $19, opened at $23)

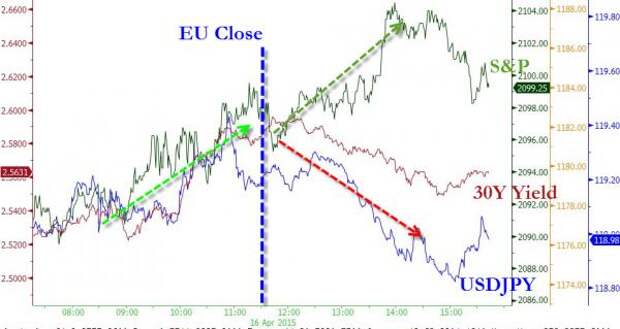

JPY-Carry and Bonds decoupled from stocks soon after the European close....

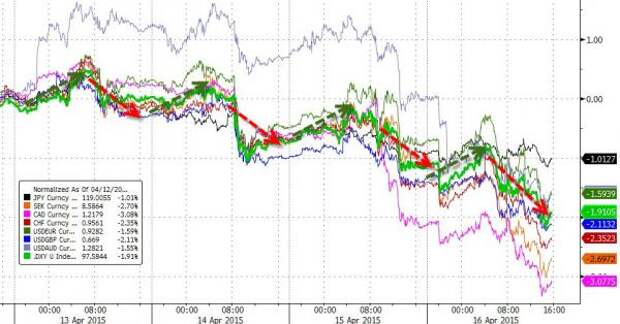

The Dollar was dumped again as EURUSD surged up towards 1.08... biggest 3-day drop in USD in a month and second worst week since July 2013

NOTICE ANY PATTERNS?

Treasury yields had a wild day... yields droppped into the US open (on weak housing), were ramped higher as markets opened and a bevy of Fed speakers flip-flopped around.

..

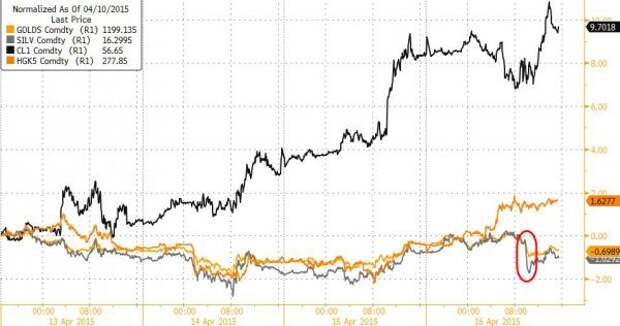

Gold and Silver were dumped early on but closed unch; copper and crude rallied...

Gold dumped on Fischer's comments that markets need to stop relying on The Fed to be there forever...

Crude soared over $57 despite Saudi Arabia pushing production up to record highs.. and then tumbled (as usual) after the NYMEX close...

Charts: Bloomberg