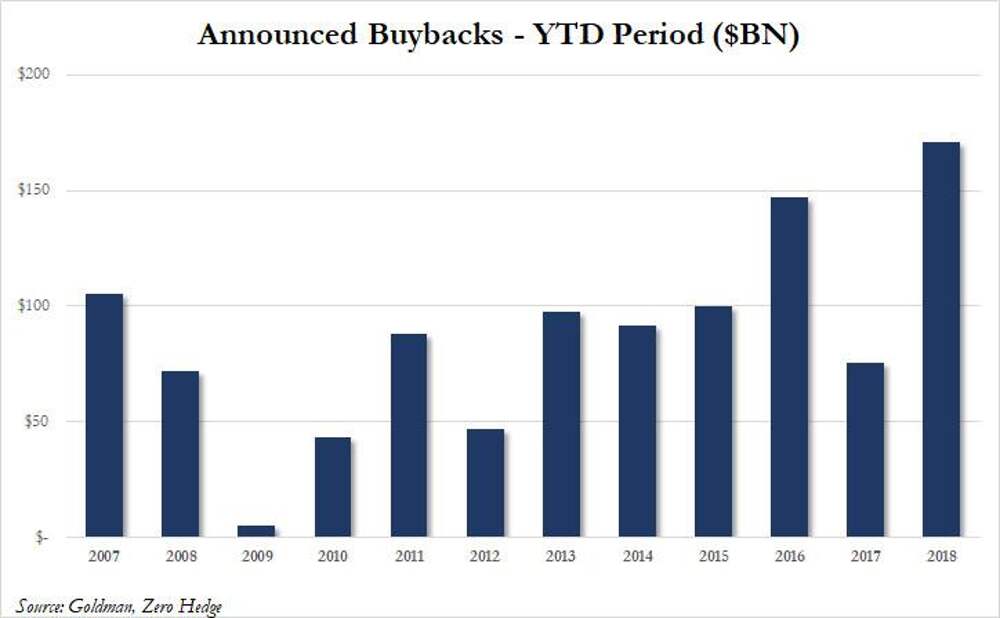

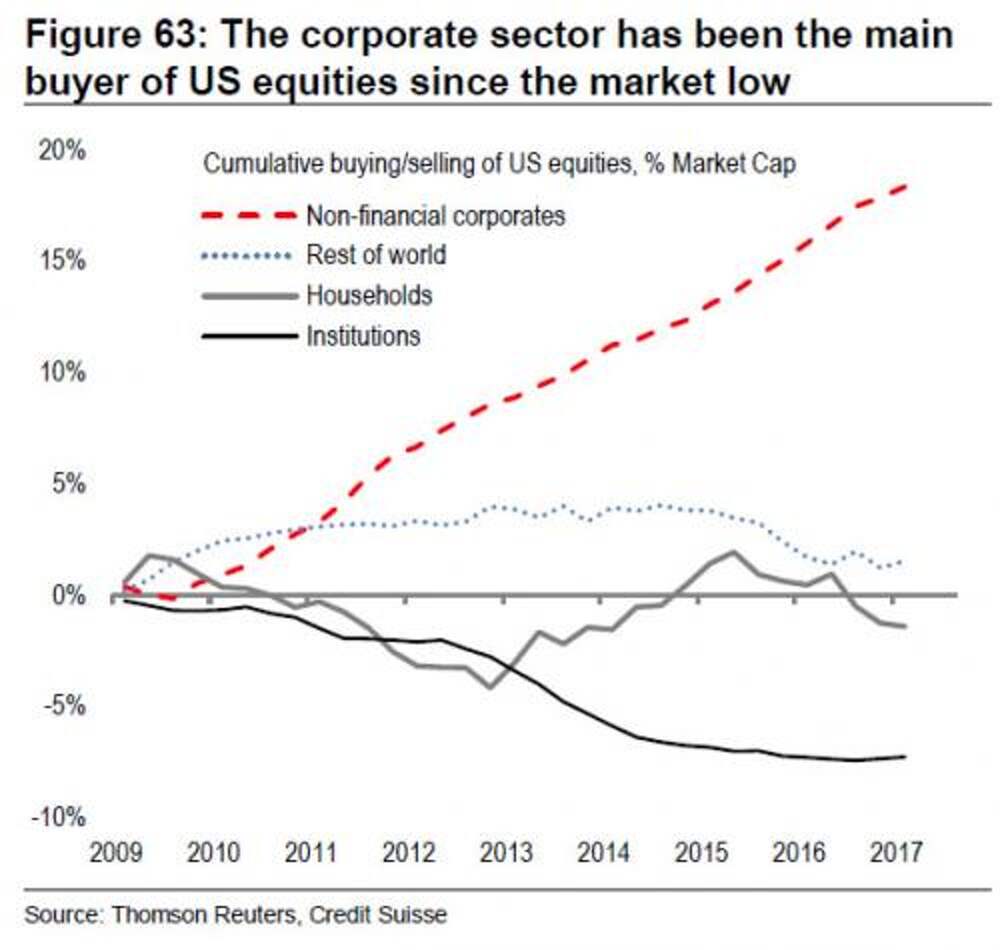

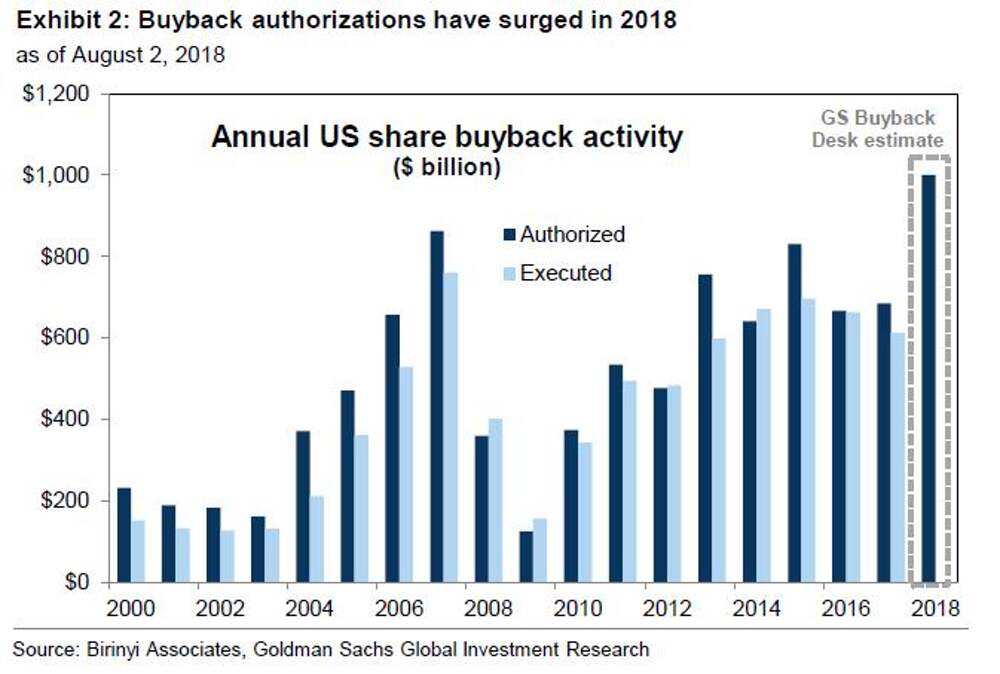

One JPMorgan Strategist Finds The Buyback Party Is Over, Hopes Not To Be Lumped In With The "Fake News"

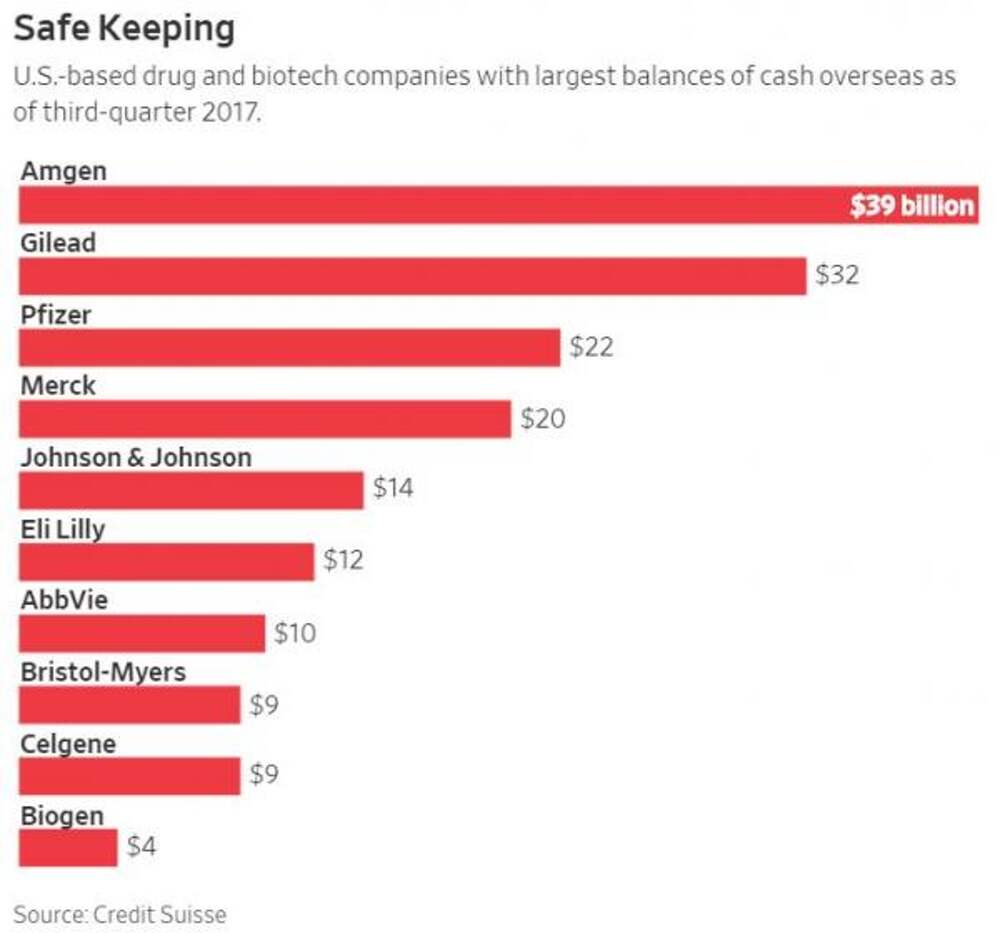

It was a little over a year ago, when Trump's then chief economic advisor, former Goldman COO Gary Cohn had an epiphany in which he realized that Trump's entire overarching economic policy of encouraging tax repatriation so companies would invest in the US, spend on R&D and hire more workers,

...Далее