Goldman's Top Strategist Reveals The Two Biggest Risks To The Market Today

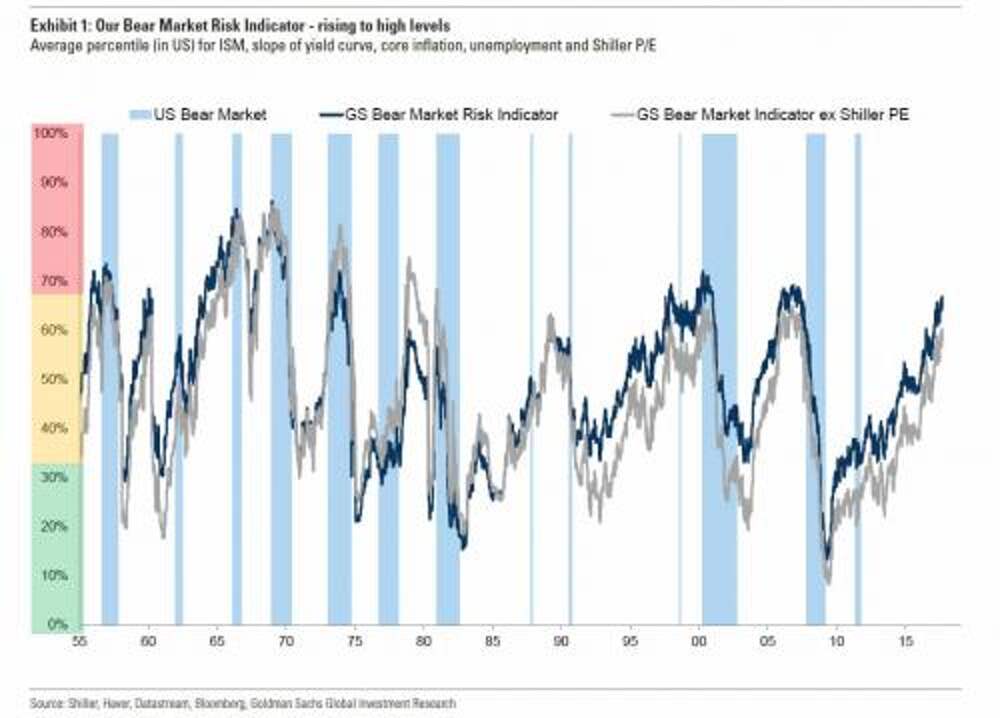

The past few months have been a very nervous time at Goldman Sachs, and not just because Gary Cohn wasn't picked to replace Janet Yellen as next Fed chair. Back in September, Goldman strategist Peter Oppenheimer wrote that the bank's Bear Market Risk Indicator had recently shot up to 67%,

...Далее