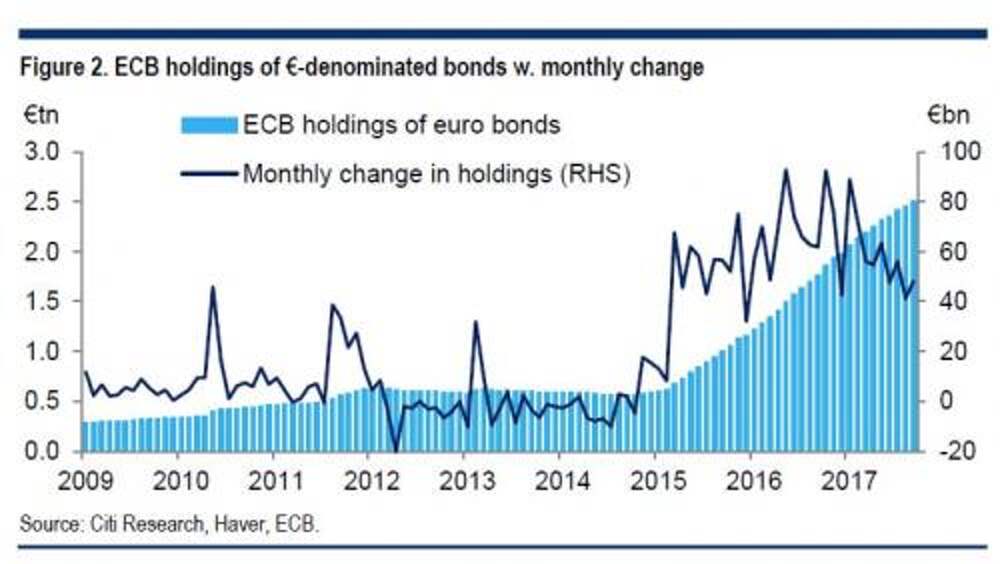

The ECB Has Bought €1.9 Trillion In Bonds: Here Is Who Sold And What They Did With The Money

Since the ECB launched its sovereign debt QE, initially known as PSPP, in March 2015 and later expanded to include corporate debt, or CSPP, in June 2016, the world's biggest hedge fund central bank has created enough money out of thin air to purchase bonds with no consideration for price to grow

...Далее