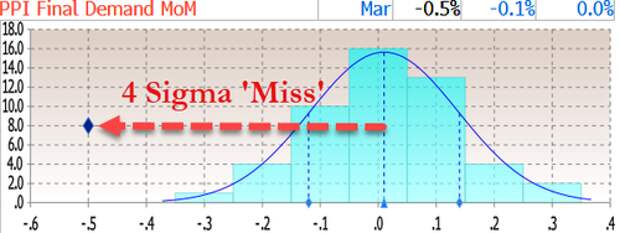

After yesterday's mixed picture on CPI (cool headline, hotter than expected sticky core), all eyes are on Producer Prices this morning which are expected to be unchanged MoM and tumble notably on a YoY basis. The print was actually considerably cooler than expected with the headline declining 0.

5% MoM pushing PPI down to just 2.7% YoY...Source: Bloomberg

That is the biggest MoM drop since April 2020 and the lowest YoY print since January 2021 (when the Biden term began) and a 4 standard deviation 'miss' from expectations...

Source: Bloomberg

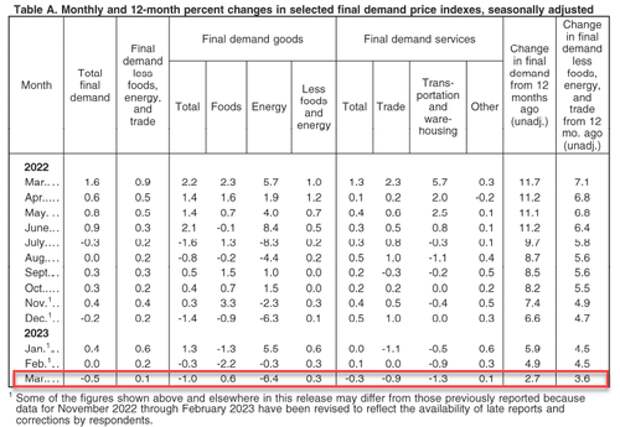

Eighty percent of the March decline in the index for final demand goods can be traced to an 11.7-percent drop in prices for gasoline. The indexes for diesel fuel, residential natural gas, jet fuel, electric power, and fresh and dry vegetables also fell. Conversely, prices for light motor trucks increased 0.7 percent. The indexes for chicken eggs and for meats also moved higher.

A 7.3-percent drop in margins for machinery and vehicle wholesaling was a major factor in the March decrease in prices for final demand services. The indexes for truck transportation of freight, portfolio management, fuels and lubricants retailing, loan services (partial), and automobiles and automobile parts retailing also moved down. Conversely, prices for guestroom rental rose 4.6 percent. The indexes for food retailing and for transportation of passengers (partial) also advanced

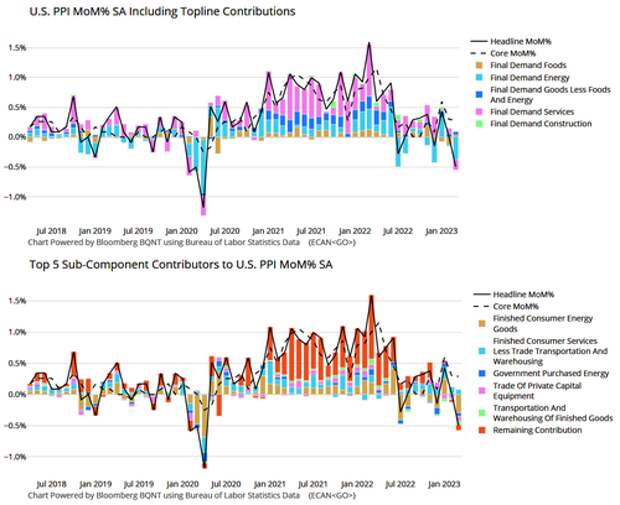

Energy's decline dominated the deflationary impulse in PPI...

As we warned last month, it was clear this was coming as the pipeline for PPI had already dropped to a drag...

Source: Bloomberg

Intermediate Demand is now deflationary.

Finally we note that this is positive for margins theoretically as the CPI-PPI spread is at a record high...

Source: Bloomberg

Markets are reacting positively to this news (as they did with yesterday's CPI). The question is, can they markets hold these gains or unwind them like yesterday.