Agree with his proposed policies or not, it's difficult to argue that Trump is delivering on his promises to the autoworkers of the Midwest who single-handedly voted him into the White House. Before even taking office, the mere threat of import tariffs has caused Ford to cancel the construction of a $1. 6 billion new facility in Mexico, and has automotive CEO's from Toyota to Chrysler walking on eggshells as they carefully try to flaunt all of the capital investments they're making in U.S.-based facilities.

While likely secretly hoping for the status quo, Fiat Chrysler's U.S. CEO, Sergio Marchionne, admitted earlier today that if Trump's import tariffs are "sufficiently large" he would be forced to shutter all of his manufacturing capacity in Mexico as it would be rendered "uneconomical." Per the FT:

Fiat Chrysler may close its Mexican car plants if Donald Trump imposes sufficiently stringent tariffs on vehicles coming into the US, chief executive Sergio Marchionne said on Monday.

“It’s possible that if economic tariffs are imposed…and are sufficiently large, it will make production of anything in mexico uneconomical and we would have to withdraw,” he said in Detroit on Monday. “It’s quite possible.”

As it turns out, purchasing 18mm cars per year, even if those purchases are fueled by a massive subprime auto lending bubble, affords the U.S. some leverage on where those vehicles are manufactured. And, as Marchionne points out, the manufacturing capacity in Mexico was specifically designed and tooled to manufacture vehicles for the U.S. market which means that attempts to "re-purpose" the facilities for the export market would almost certainly be uneconomical.

Chrysler produces 503,000 vehicles in Mexico a year at two sites and is heavily dependent on exports to the US, with 86 per cent of its cars sold to US or Canada in 2015.

Mexico’s car industry has blossomed under the North American Free Trade Agreement, with the industry making 3.4m cars a year and automakers from Ford and GM to Nissan and Volkswagen producing vehicles in the country.

But the industry is heavily reliant on access to the US and Canadian markets, accounting for 82 per cent of the country’s 2.7m exports.

“The reality is the Mexican auto industry has been tooled up to try and deal with the US market,” said Mr Marchionne at the Detroit Motor Show. “If the US market were not to be there, then the reasons for its existence are on the line.”

Some car makers, such as Nissan and Volkswagen, use Mexico as a base to export to Europe or Latin America. But Mr Marchionne said it would be too expensive to repurpose the company’s existing Mexican site to export all over the world.

“That transition would be costly and it would be very very uncertain, there is no easy transition, those plants were designed built and purposed at a time when nafta was alive and well,” he said.

According to the Ann Arbor-based Center for Automotive Research, Mexico accounts for one-fifth of all vehicle production in North America and has attracted more than $24 billion in investment since 2010. As we noted a few months ago, as of right now, this is where all of that money was spent.

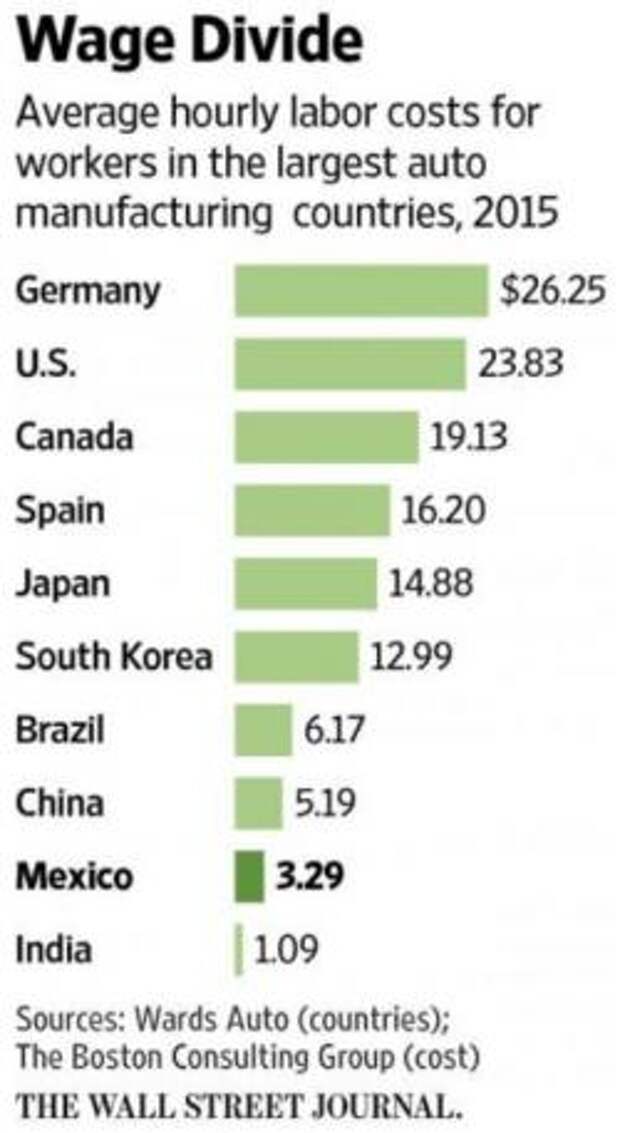

And with America's United Auto Workers making just over 7x what comparable workers make to build the same products in Mexico, we suspect car shoppers in the U.S. should get accustomed to pay a little more for their Ford Focus or Chevy Cruze.