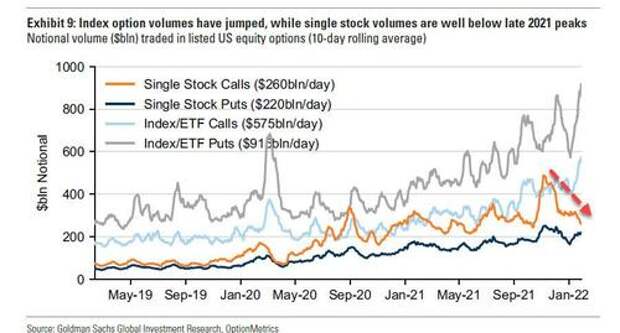

At a time when risk sentiment has foundered, BTFD has mutated into STFR, and even retail investors are hedging for a crash by buying puts in record amounts...

... two banks are throwing caution to the wind and staking their reputation that this time the rout is finally ending and the bottom is in.

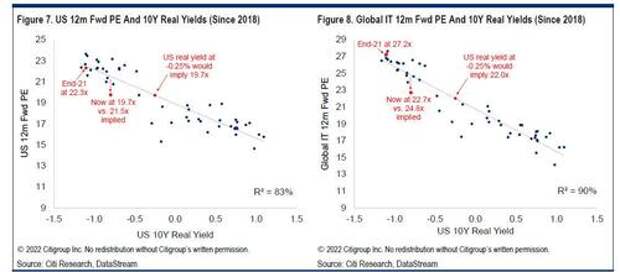

The first one is Citi (the same Citi which yesterday closed its short oil reco from Feb 3 after suffering a painful 11% loss in just one month, which for levered traders could mean a year's worth of performance wiped out), and which today said that it is raising "US equities and the global IT sector" - i.e., growth names - back to Overweight.

As the bank's chief strategist, Robert Buckland notes, "both are Growth trades that should benefit, in relative terms at least, from the recent sharp drop in real yields" to wit:

Equity markets have been less quick to price in the drop in real yields. We have frequently highlighted that these have been a big driver of the global Value/Growth trade in recent years (Figure 6). However, this latest drop in 10 year TIPs has yet to drive a similarly sharp reversal in the Value rotation trade that has dominated global equity markets YTD. Other Growth trades, such as US versus RoW have also lagged.

While correct in theory, Citi ignores why real yields are tumbling, and it has nothing to do with a benign risk environment and something to do with the fact that breakevens (the other leg of the pair trade that makes up nominal yields) are exploding as commodities have their best week since the oil crisis of 1973, stagflation is imminent and global growth is about to hit a recession.

Meanwhile, in the now traditional weekly pep talk from JPMorgan, the bank published not one but two sermons urging clients to buy the dip (something it has done again and again in just the past few weeks), the first one from JPMorgan trader Michael Gormley, who writes the following justification for why last week's short-covering rally has "a strong basis to continue." He explains why below:

SPX has rallied +7% since the intraday lows on Feb24 on the back of short covering and technical factors like gamma hedging and extreme short positions for CTA investors. While we are far from having clarity on the Russia/Ukraine situation, a few points are observably improving for the risk outlook:

1. With the staunch support of Ukraine from the globe driving a unification of Western interests to confront the Russian threat – an outcome most wouldn’t have envisaged–combined with Ukrainian resolve, there is a more likely outcome of a ceasefire orchestrated by Russia as today’s headlines suggested, which creates an early ‘off ramp’ for the conflict and easing of oil prices. This same point also has helped to lower the concern of a near-term China invasion of Taiwan.

2. Along with this point, we are likely through the ‘shock and awe’ of headlines related to sanctions and most investors are already factoring meaningful hits to growth from higher commodity prices. While this has stoked a stagflation narrative, growth data has remain strong (US Feb ISM beat yesterday @ 58.6) and Powell keeping door open to several 50bps hikes later in year should help assuage some concerns on this.

3. Equity risk premium is at one of the highest levels over the last six decades making the short case less compelling. This is also against ongoing positive EPS revisions.

4. Valuation is still compelling with Europe, Japan PE multiples down to 2018 levels and US just a turn above 2019 levels. Meanwhile, Russell is still in territory indicative of a recession and several sections of tech are in oversold territory.

5. Positioning remains very low with systematic in the 7th %tile and CTAs still near max short levels. Gamma is still short -$30bn and liquidity is thin, which can exacerbate a move higher (and lower).

6. Post Powell’s testimony a 50bp hike in March has been removed offering equities some relief and showing the measured approach the Fed is taking in this rising rate cycle.

That said, Gormley concedes that we remain "dependent on the route the Ukraine conflict takes and oil prices" which unfortunately does not hint at a material de-escalation any time soon, even if "there are a number of factors to suggest the bounce in risk could sustain from here."

Meanwhile, in another JPM note Kolanovic published his latest weekly BTFD sermon, which is similar to all his previous weekly BTFD recos, and lists 6 reasons why the "worst may be behind us."

- The announced sanctions, though severe, appear to have limited impact on economic growth

- Energy price increases have been contained so far;

- CB hawkishness is likely tempered by geopolitical risks;

- The conflict is unlikely to spread to other Eastern European countries that are NATO members;

- US tech approached oversold conditions;

- The rise in oil prices should create some supportive flows for equities via SWF accumulation and oil company buybacks

While the above is nothing more than a vivid example of how one is forced to goalseek reality when they have a clear bullish mandate, anyone reading that "Energy price increases have been contained so far" you have our respect.

But while Marko's bias has been duly noted discussed here for the past 3 years - ever since his promotion from a low-level quant who was truly one of the best on Wall Street with his unique, insightful observations - the following wrap from JPM's trading desk (available to pro subs) may be the most actionable in terms of what to expect:

Near-term, you may consider a market-neutral approach with elements of the barbell trade: long high quality Tech (e.g. AAPL, AMZN, GOOGL, and/or MSFT), long energy (OIH and USO), and long metals/miners (XME, AA, and/or FCX) vs. a short in the SPX. Directionally, if you think we go higher from here, you may consider adding shorts in both LQD and XLP.

If you think we go lower from here, you may consider adding shorts in either XLF and/or XLI. Irrespective of the Russia/Ukraine risk, I do think we remain choppy with elevated vol into the March 16 Fed meeting, hence my caution and preference for a market-neutral strategy.