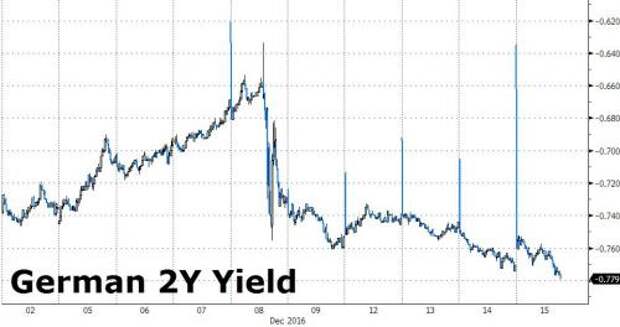

Another day, another mad dash for German 2Y Bunds in a continent deprived of collateral.

As we noted yesterday, when 2Y Bunds dropped to a fresh all time low, the ECB had failed in its bid to fix the European repo market by expanding the eligible universe of collateral to include €50 billion in cash at its meeting one week ago.

Today, it's more of the same, and as longer yields continue to rise around the globe, and Germany as well, the short-end is a different story, with the panic bid for the German short end hiting record levels, and moments ago pushing the yield on the 2Y to a new all time low of -0.78%.

At this point it is safe to say that some is very structurally broken with the European bond market, but what is scarier is that the ECB thought its stopgap measure unveiled last week would fix it. That it failed to do that merely shows that even the ECB has virtually no understanding of what is going on in Europe's bond market.