Having failed to secure a private sector rescue after its anchor investor Qatar balked at sinking another $1 billion into the perpetually insolvent bank, Italy's Monte Paschi is set to be nationalized as soon as 7:30pm CET today when the Italian cabinet is expected to meet and decide on a bank decree.

The EU is said to have approved the Italian bank decree.As Bloomberg notes, the Italian government set to intervene soon after expected failure of Monte Paschi recapitalization plan, says senior Italian official who asked not be named before cabinet discusses banks’ decree. The decree would set up a €20 billion fund which would intervene when recaps by banks are not supported by market.

Paschi and other troubled lenders will not be named in the decree, but it will apply to them. While shareholders will be hit, something which is obvious by the market cap of the company which is now below €500 million, the aim is to limit losses for stock and bondholders. The cabinet is also expected to announce a 6-month extension for popolari banks.

Some other details:

- DTA provision on taxes paid in advance for banks, can be turned into fiscal credits.

- Decree to include intervention on resolution for four banks rescued from collapse last year

Ahead of the announcement, the bank’s subordinated bond risk has risen to a record high. Monte Paschi’s 379 million euros of junior notes due in September 2020 fell 2 cents on the euro to an all-time low of 46 cents. Credit swaps insuring the bank’s junior bonds for five years imply a 70% chance of default, data compiled by CMA show; it remains to be seen whether ISDA would treat yet another nationalization by the government, which is expected to take at least a 50% equity stake in the bank, as a credit event.

State intervention and a hit to bondholders is the most likely scenario for Monte Paschi, Manuela Meroni, an analyst at Intesa Sanpaolo SpA wrote in a note to clients Thursday. "The solution to the Monte Paschi issue could reduce the systemic risk for the sector," Meroni wrote.

Bloomberg notes that if government funds are used in the bank’s recapitalization, bondholders will probably have to take losses under European burden-sharing rules, however the specific terms of the "bail in" are still to be formalized. The cabinet is considering a so-called precautionary recapitalization that may reduce the potential losses.

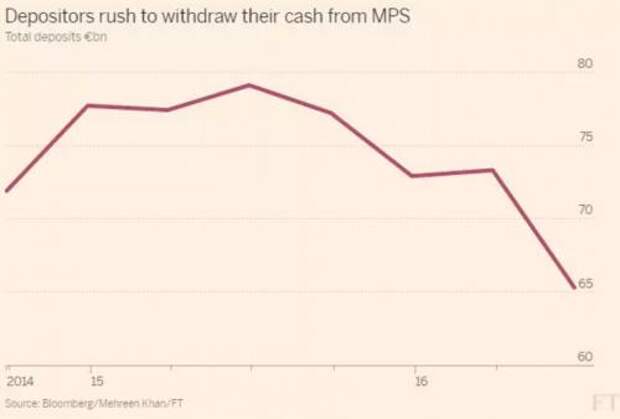

The bigger problem for Monte Paschi, is the recent plunge in deposits, which as reported yesterday has suffered a €14bn rush of deposit outflows in the nine months from January to September this year – 11 per cent of its total deposits, as shown in the following FT chart.

Should the nationalization fail to stem the bank run, either at Monte Paschi, or other Italian banks, more bailouts are imminent.