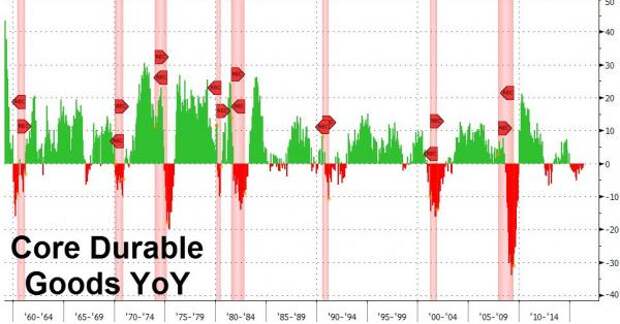

Despite the longest winning streak for US macro data in US history, Durable Goods Orders collapsed in June. The 4% MoM plunge (vs -1.4% exp) is the biggest drop since Aug 2014. This represents a 6.6% YoY crash - the biggest drop since July 2015.

The drop appears driven by plunge in airplane orders (non-defense aircraft and parts).

Which should not be surprise:Airbus Group SE and Boeing Co. racked up their lowest tally of aircraft orders in six years at the aviation industry’s annual showcase, as a slowing global economy and concern about the impact of Britain’s decision to quit the European Union curbed demand.

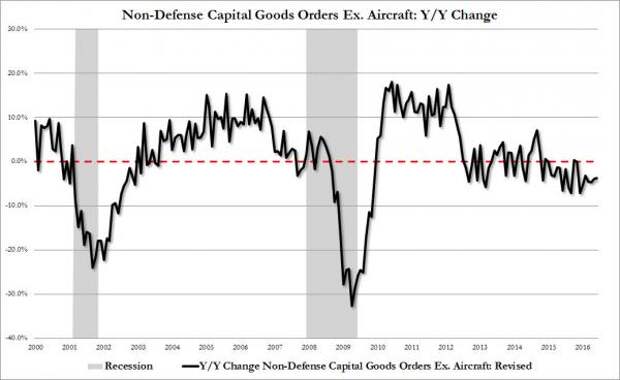

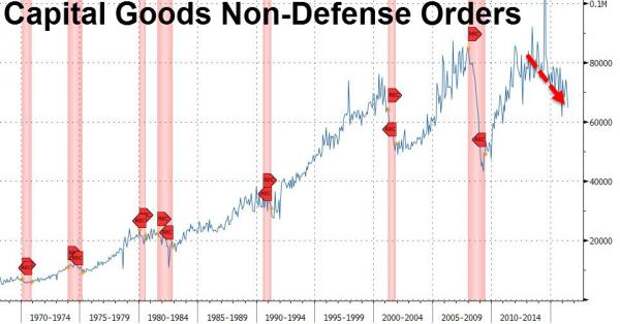

Core Capex continues to slide...

Does this look like a "non-doom-and-gloom" economy?

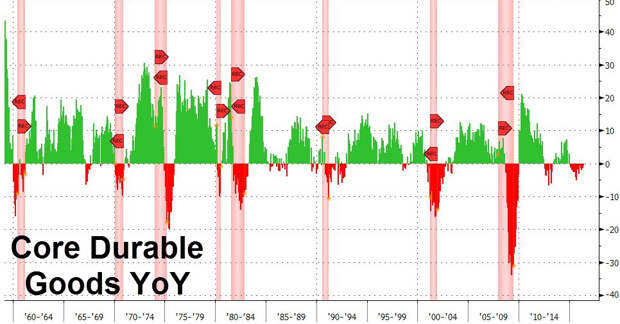

Worse still, core durable goods orders extended their annual declines to 18 months straight - the longest non-recessionary streak of declines in US history.

"It's probably nothing"

Charts: Bloomberg