NFLX reports earnings right after the close (~4:02pm ET) with conference call at 4:45pm ET.

With 1Q marking the first quarter of no subscriber / net adds disclosures, the tactical ‘subs’ debate has quieted down (yes, still some q/q questions off the big 4Q and/or how to think about the WSJ story earlier in the week about the company hitting a $1 trillion market cap, which seemed like a planted attempt to smoke out shorts ahead of earnings and give the stock a buffer to fall from on disappointing news) with most of the debate around who will be the ‘incremental buyer’ of Netflix shares post print as the valuation us starting to stick out relative to large-cap Internet peers (albeit vs expectations for Netflix to deliver what may be a rare ‘beat’ on earnings given perceived insulation from a number of the ‘headwinds’ out there - e.

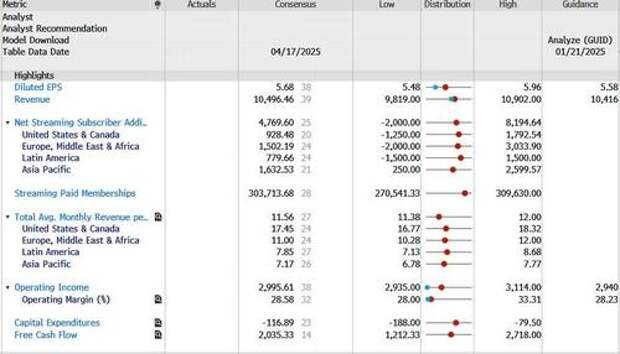

g. macro slowdown, tariffs, AI capex, etc).Here are Wall Street consensus estimates

- Q1 EPS $5.763

- Q1 Revenue $10.496BN

- Q1 Operating Profit: $3.00BN

- Q1 Net Income $2.484BN

... and UBS' bogeys:

- Q1 Revenue Growth Reported: $10.5bn/up 12% y/y

- Q1 Revenue Growth FXN: $15%

- Q1 EBIT: $3 bn

- Q2 Revenue Growth FXN: up 16%

- Q2 EBIT: around $3.3 bn

- FY25 Operating Margin: reiterate versus prior guide 29% (some hopes for a slight walk up)

- FY25 Revenue Guide: reiterate versus prior guide $43.5-44.5 bn/14-17% y/y

And visually

In its preview of NFLX earnings, UBS writes that "shockingly" the amount of inbound on bogeys has only picked up over the course of this past week. Netflix is a crowded long and has been a defensive safe haven with investors.

According to UBS, the bar seems low, and they are the first one out of the gate, which has proved to be a lucrative move for them in the past.

Despite the broader market carnage, Netflix still comes up as a top name to own into 2025, so price action may be dictated more so by what management says to update (though not expected) FY25 and margin expansion (bulls playing for upside to the 100bp of growth, though it doesn’t feel like investors are playing for them to update this quarter).

Netflix is also seen as a secular winner, with pricing power and solid underlying sub momentum given the competitive backdrop.Investors will be focused on:

- tone and confidence in ability to sustain double-digit revenue growth and margin expansion in 2025;

- impact of recent pricing changes;

- impacts to ad business given softer macro versus guide for double ad revs in 2025;

- any implications for transitioning onto in-house ad platform along with any early learnings thus far;

- updates on live content/sports strategy and gaming;

- updates on content spend ($18 bn content spend versus $17 bn in 2024); and

- competitive dynamics and what the pullback at peers is doing to their business.

Here, Goldman's sellside desk chimes in and writes that in terms of idiosyncratic company debates coming out of the last earnings report, the bank expects investor debates to remain centered around:

- the perceptions of competitive moat (both against traditional media competition and increasingly forward competition from YouTube, TikTok & Meta);

- the ability for the company to continue to efficiently close the monetization gap when compared to consumption patterns;

- how the ad supported tier might continue to scale; &

- the rising focus on live entertainment in terms of the company’s content investments.

In its latest model, Goldman updated its forward estimates as follows:

- slightly lowered forward net add trajectory by ~0.5mm on an annual basis (with a skew toward more ad supported subscriber adds in the coming quarters in terms of mix);

- modestly lowered advertising revenue assumptions throughout the remaining quarters of 2025 reflecting a weakening (& less certain) advertising environment (especially among the type of brand advertising dollars that are deployed into NFLX’s platform).

Goldman remains Neutral (on the shares on the back of a balanced risk/reward from current levels) and lowered its 12-month price target from $960 to $955.