With the world still napping in a post-Christmas daze, the ECB surprised Italian bank watchers on December 26 when it advised the insolvent, and nationalized, Monte dei Paschi that its capital shortfall had increased by 76% from €5 billion to €8.8 billion as a result of a deposit flight, aka "bank run", that had accelerated and led to a deterioration in the bank's liquidity.

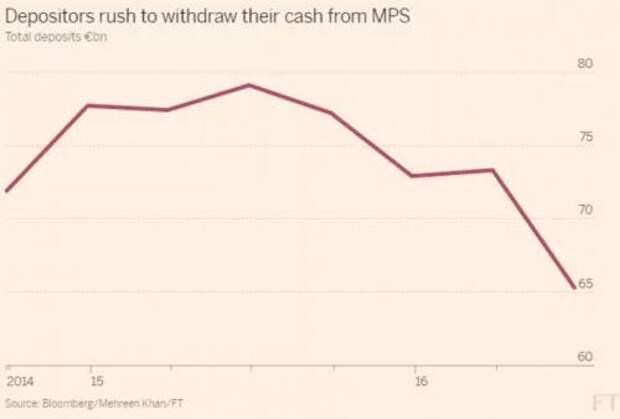

The week before, Monte Paschi admitted, it had already suffered roughly €14 billion in deposit outflows, or 11%, in the first nine months of the year as shown in the chart below.

And then, out of nowhere, the ECB said on Monday that Monte Paschi "was solvent but signaled the bank's liquidity position had rapidly deteriorated between the end of November and December 21."

Needless to say, Italy was furious at the ECB for unexpectedly admitting that the country's banks are not only in a worse shape than presented at a time when the government requested the parliament's approval to issue an additional €20 billion in new public debt to fund bank nationalizations, but that the bank run gripping at least one of Italy's banks was substantially more aggressive than portrayed.

The anger culminated overnight when in unusually critical comments of the ECB, Italy's economy minister Pier Carlo Padoan said in a newspaper interview the central bank's new capital target was the result of a "very rigid stance" in its assessment of the bank's risk profile. He bashed Draghi saying, that the European Central Bank "should have explained more clearly why it nearly doubled its estimated capital shortfall for the ailing Monte dei Paschi di Siena (BMPS.MI) bank, which is being bailed out by the state."

"It would have been useful, if not kind, to have a bit more information from the ECB about the criteria that led to this assessment," Padoan told financial daily Il Sole 24 Ore.

The ECB told the Italian treasury of its decision in a letter, which Padoan said was just five lines long and which has not been made public.

Confusion spread quickly, and as Reuters writes, "it irked the Rome government and has quickly turned into a political issue. A group of lawmakers from the ruling Democratic Party asked Padoan and Italy's foreign minister on Wednesday to explain in parliament what had happened."

In retrospect, Padoan should be grateful the ECB did not provide "more information", because the reason for the capital shortfall is simple: an accelerating bank jog, or perhaps an all out run, affecting at least Monte Paschi and perhaps other banks. And the only thing that makes bank runs worse is the realization that one is taking place. So by keeping its mouth shut, the ECB prevented what may have been a far worse panic.

And, ironically, by protesting, Padoan only makes articles such as this one - which are happy to answer his questions and resolve his confusion - possible, and in turn raises concerns and fears among the Italian population about what else its government isn't telling it.

Ignoring the finer nuances of popular delusions, one side effect of the ECB's unwelcome announcement is that the higher capital requirement substantially increases the cost of the bank's rescue by the government after it failed to raise the €5 billion on the market. The treasury is now set to pump in around €6.5 billion to salvage the lender, "raising concerns that its newly created 20-billion-euro bank bailout fund may not have enough money for other weak banks." The government says the fund is sufficient; others, such as this website, laughed violenetly when the tiny €20 billiion "bazooka" number was announced.

As Reuters notes, the rest of the money Monte dei Paschi needs will come from the forced conversion of its subordinated bonds into shares, in line with European rules on bank crises. The lender fared the worst in EU-wide banking stress tests published in July.

The ECB has declined to comment on its rationale for the larger capital shortfall.

According to a Reuters source close to the matter, the bank's estimate of a 5 billion euros capital gap was based on the results of the stress test, conducted on end-2015 data, and included assumptions such as the sale of its whole portfolio of defaulting loans - a key plank of its plan to raise money privately.

Given that plan's failure and the bank's worsening balance sheet over the past year, the ECB wants to ensure Monte dei Paschi has enough capital to safely meet a Common Equity Tier 1 (CET 1) ratio of 8 percent in an adverse scenario, so it would be able to restore investor and customer confidence, the source said.

At 8% under the adverse scenario, Monte dei Paschi would still be below the average of the ECB's stress test, in which banks would see their CET 1 ratio fall to 9.4 percent from 13.2 percent.

The 8 percent threshold in the adverse scenario was also a requirement the ECB set for ailing Greek banks in a 2015 review.

The new Prime Minister Gentiloni also chimed in, saying during a press conference he was "a bit surprised to receive the news, out of the blue and on Christmas day. It's important that the reasons behind this assessment are shared and that there is a dialogue because we need to handle this issue together ... We will stick to our guns."

Which is odd, because also according to the Reuters source the ECB had offered to explain its stance to both the Italian treasury and Monte dei Paschi. In other words, while the prime minister and Padoan both complain about the ECB's "mysterious ways", the central bank is quite willing to explain to everyone just what is going on, yet Italy won't allow it, for reasons unknown.

Meanwhile, the brand new Italian government did what all of its predecessors have done so well: it stuck its head in the sand and ignore the problem.

Padoan said the exact amount of capital Monte dei Paschi will have to raise will be determined once it presents a new business plan to the ECB and the European Commission, but he played down the bank's problems.

"The bank is in optimal condition and will have great success," he said.

Readers will be forgiven not to believe Padoan, the same person who less than three months ago, on September 2 at the Ambrosetti Forum said that "we are not talking about a bailout. Bailout is ruled out in the European context."

Now we know that a bailout was not ruled out after all. As for the "optimal condition" of Monte Paschi, we will wait a few more weeks for the bank jog to yank another several billion from the insolvent lender, at which point the ECB will "surprise" everyone that the bank has an even greater capital shortfall.