Layoffs at technology firms are only getting started, and the real carnage could be just ahead. The latest sign of what happens when financial conditions tighten is at payment startup Bolt Financial Inc., which decided to axe 250 employees, according to Bloomberg, citing people familiar with the situation.

In a memo on Wednesday, Bolt CEO Maju Kuruvilla informed employees about staffing cuts and broader restructuring.

"It's no secret that the market conditions across our industry and the tech sector are changing, and against the macro challenges, we've been taking measures to adapt our business," Kuruvilla wrote.

Bolt is one of those unicorns investors valued at $11 billion in its latest funding round. In another funding round, the company attempted to raise money at $14 billion, though it abandoned fundraising plans in today's turbulent macro backdrop.

"In an effort to ensure Bolt owns its own destiny, the leadership team and I have made the decision to secure our financial position, extend our runway, and reach profitability with the money we have already raised," he continued.

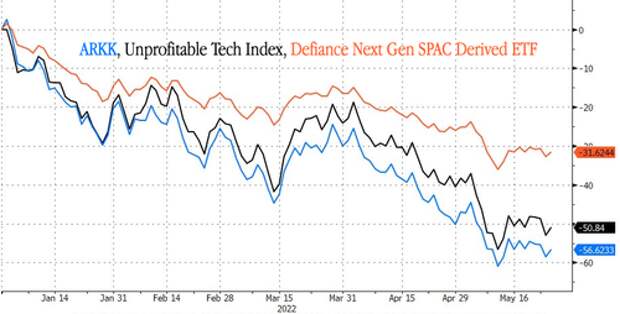

The job cuts at Bolt were abrupt but came as no surprise after inflated tech valuations and crypto have gone bust amid the Federal Reserve's mission to remove froth from markets to cool the hottest inflation in four decades. In the tech-heavy S&P 500, which has lost one-fifth of its value, Amazon has tumbled by 36%, Tesla -38%, Meta -45%, and Zoom -44% this year.

The tech bust of 2022 feels widely familiar with the one of the Dot Com era. Some say the real carnage is just ahead.

"We actually haven't seen any real carnage yet.

"The things that tend to happen when money really dries up. I think a lot of people are either uncertain or in denial," venture capitalist Elad Gil told Bloomberg.

The bust in unprofitable tech stocks implies the worst has yet to come.

Netflix, Robinhood Markets, Vroom, Carvana, Noom, Better, and Peloton have been some of the high-profile job cutters this year.

Globally, tracking site Layoffs.fyi says more than 13,000 tech workers have been laid off since the beginning of April. There's probably much more ahead if financial conditions remain tight in the back half of the year.