You can't make this shit up... two more disappointing US Macro data points today (GDP and pending home sales) sent the US Macro Surprise Index to its weakest since Sept 2021...

Source: Bloomberg

That bad news is apparently being seen as good news by the market as rate-hike expectations slipped further

Source: Bloomberg

Is The Fed really going to fold that easily?

Which brings us to the equity 'market' today. After dropping 1% after yesterday's close on the back of NVDA's earnings, Nasdaq futures drifted sideways to slightly higher all the way into the cash open (apart from a modest dip after GDP), then went full-retard bid-fest. Nasdaaq went from -1% to +3.25% at its highs before some late-day selling/profit-taking wiped some of the lipstick off this pig. The Dow was the day's laggard, "only" managing a 1.5% rally...

The S&P managed to scramble back above 4,000...

Just look at NVDA! Down over 10% after hours after missing the bottom-line and cutting guidance... only to end the day up 6%

A massive reversal in value (lower) relative to growth (higher) in the last two days has erased all the relative performance on the week

Source: Bloomberg

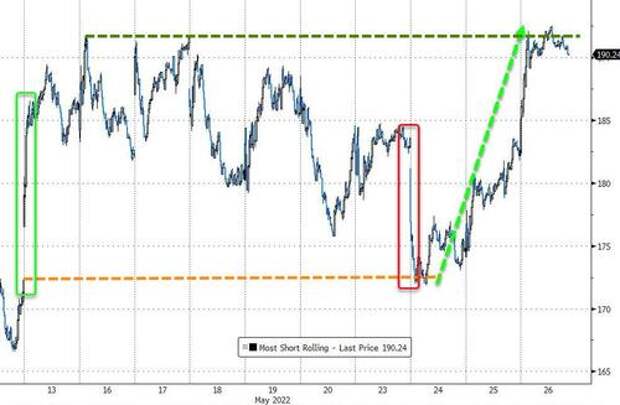

For some context with this rip, "Most Shorted" stocks are up 12% off Tuesday's lows, seemingly stalling at key resistance for now...

Source: Bloomberg

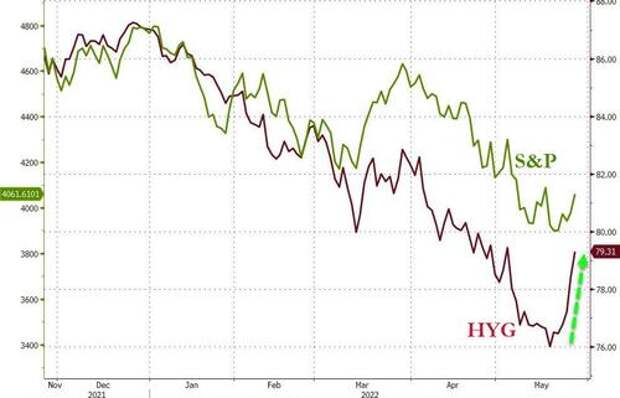

Following yesterday's relatively huge rally in HYG (HY Corporate credit), today saw more follow through...

Source: Bloomberg

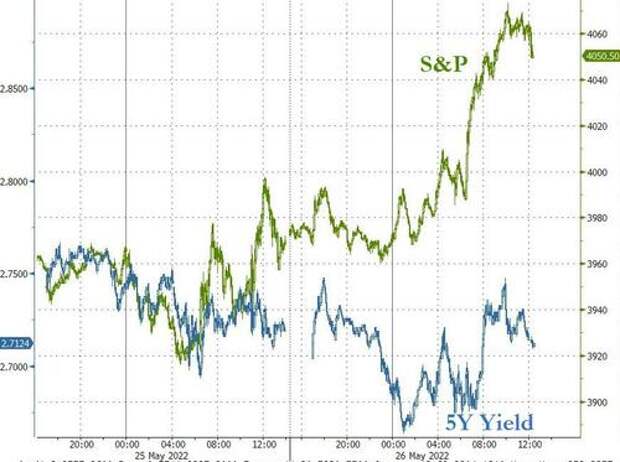

Stocks and bonds have completely decoupled since the Minutes...

Source: Bloomberg

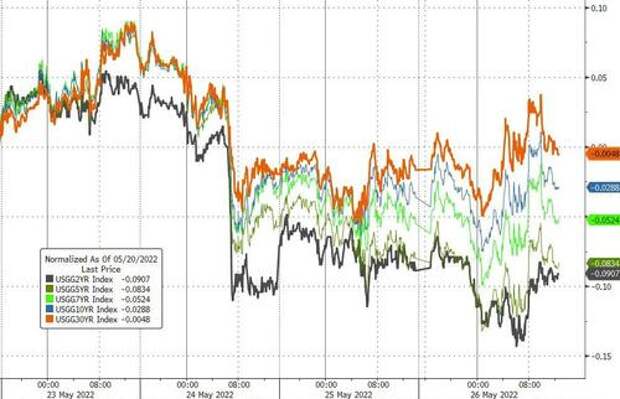

Treasury yields were mixed and marginal today with everything out to 10Y unchanged and 30Y yield sup only 1-2bps. On the week, 30Y is unch while 2Y is down 9bps...

Source: Bloomberg

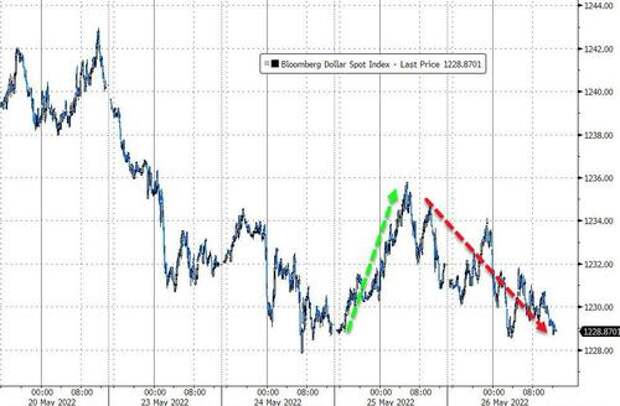

The dollar reversed yesterday's dead cat bounce gains...

Source: Bloomberg

Bitcoin dumped and pumped to end the day practically unchanged...

Source: Bloomberg

Oil prices soared higher today with WTI coming within a tick of $115...

Gold managed gains also, holding above $1850...

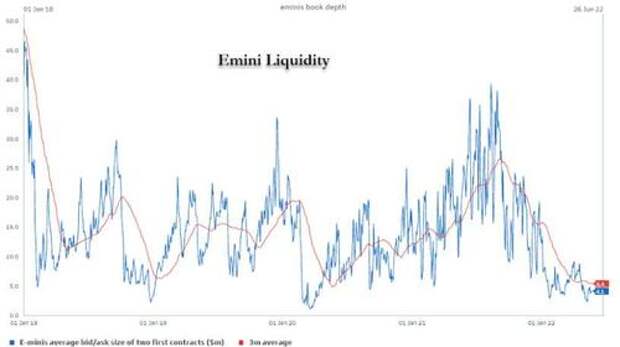

Finally, in case you're wondering about these insane swings in the 'most traded' stock markets in the world, look no further than thew total evisceration of market liquidity...

Financial 'stability' turns to fragility as repositioning books of any size has become impossible.