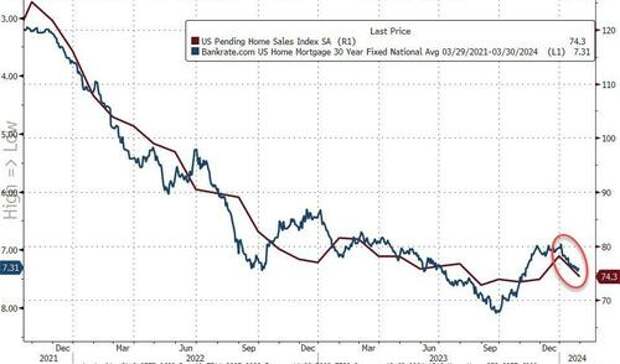

Pending home sales puked in January, tumbling 4.9% MoM (vs +1.5% MoM exp). This was made worse by a large downward revision for December (from +8.3% MoM to +5.7% MoM)...

Source: Bloomberg

That was the biggest MoM decline since August and dragged the YoY sales decline to -6.

82%, tumbling back near record lows...Source: Bloomberg

Realtors gonna realtor...

“This combination of economic conditions is favorable for home buying,” Lawrence Yun, NAR’s chief economist, said in a statement.

“However, consumers are showing extra sensitivity to changes in mortgage rates in the current cycle, and that’s impacting home sales.”

WTF are you talking about Larry?

Earlier this week, a gauge of US mortgage applications for home purchases fell for a fifth week, nearing its lowest level since 1995.

Who could have seen that coming? As rates surged once again...

Source: Bloomberg

The pending-home sales report is a leading indicator of existing-home sales given houses typically go under contract a month or two before they’re sold.

The index of contract signings decreased 7.3% in the South, the nation’s biggest housing market.

Pending sales also fell 7.6% in the Midwest, but climbed 0.8% in the Northeast and 0.5% in the West.

“Southern states and those in the Rocky Mountain time zone experienced faster job growth compared to the rest of the country,” Yun said.

“As a result, long-term housing demand is increasing more significantly in these regions. However, the timing and number of purchases will largely depend on the prevailing mortgage rates and inventory availability. ”

Overall sales are expected to increase 13% this year, according to NAR’s economic outlook, but as the chart above shows, unless rates start tumbling soon, that ain't gonna happen.