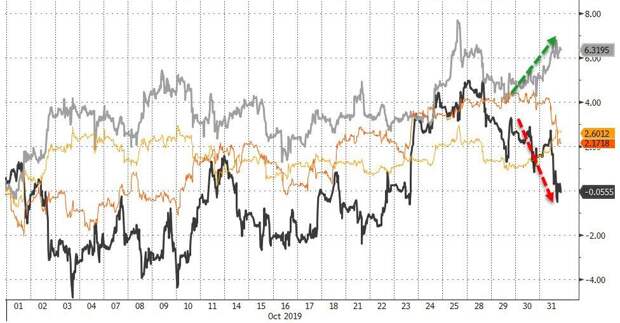

October ended with the most disappointing macro-economic data since April 2017...

Source: Bloomberg

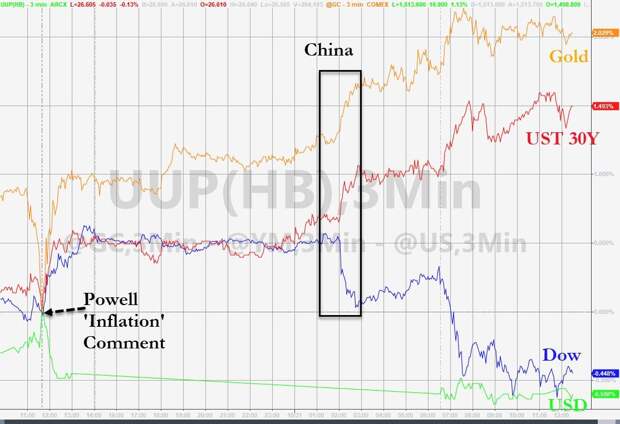

But stocks were holding up well until China blew it...

China chundered in the trade-deal punchbowl overnight, claiming that a deal was unlikely and despite Kudlow and Trump's best efforts, the odds of a trade deal tumbled (but remain up on the month).

..Source: Bloomberg

And that crushed the gains in stocks that Powell had created...

Source: Bloomberg

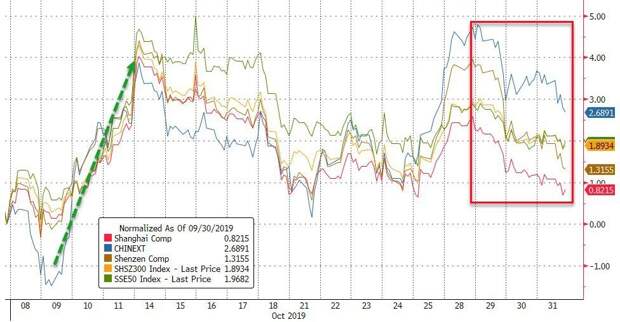

Chinese stocks managed to hold on to gains from post-Golden-Week buying but faded the last few days as reality of the non-deal trade-deal hit investors...

Source: Bloomberg

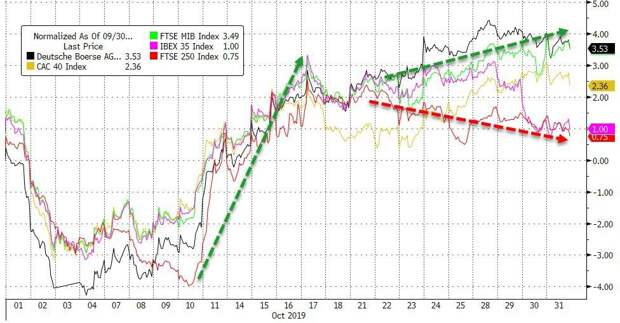

European Stocks ended October higher with UK's FTSE lagging and Germany's DAX leading...

Source: Bloomberg

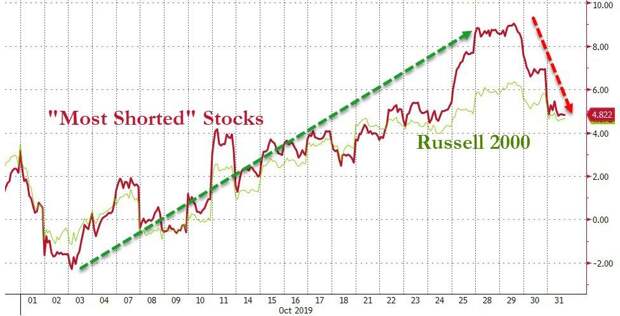

All major US Stock indices were higher in October, led by Nasdaq (Dow was a laggard) but the last few days has seen selling...

Source: Bloomberg

NOTE that US, Europe, and China all saw stocks rise once China returned from Golden Week

A daft end to the day...

US equity gains came on the back of an almost non-stop short-squeeze...

Source: Bloomberg

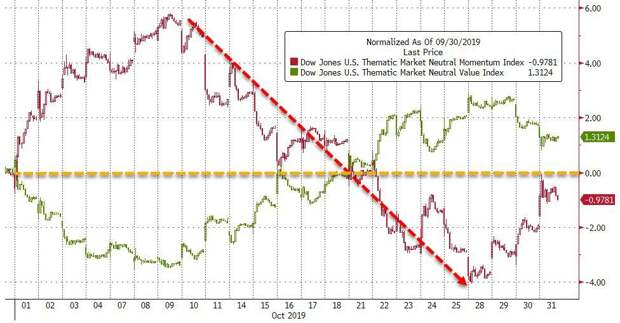

Momo ended October just in the red, after a big slide intramonth...

Source: Bloomberg

Defensives and Cyclicals were practically unchanged on the month, thanks to a surge in cyclical risk-taking mid-month...

Source: Bloomberg

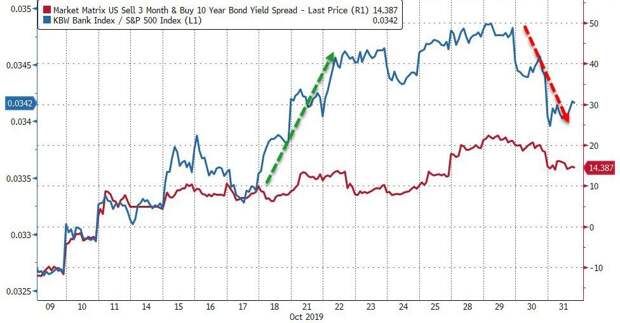

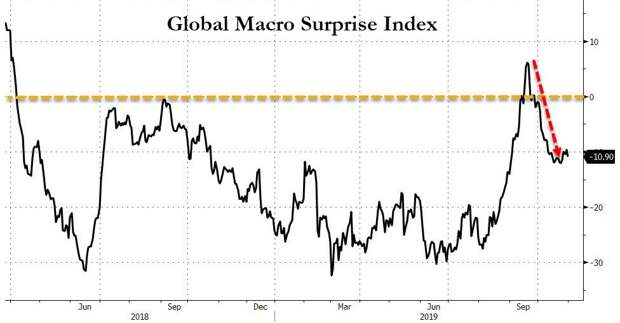

Financials outperformed on the month but started to fall back in line with the yield curve in the last few days...

Source: Bloomberg

Smart Money has started to decouple from stocks...

Source: Bloomberg

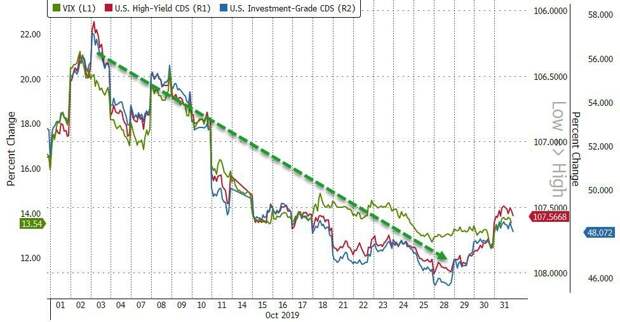

Equity and credit protection costs collapsed in October.

..Source: Bloomberg

Treasury yields were mixed on the month with the short-end lower and 10Y/30Y higher by the end (despite a collapse in yields the last few days)...

Source: Bloomberg

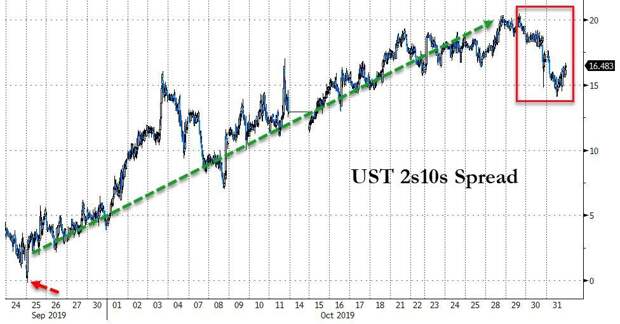

This divergence meant that the yield curve (2s10s) soared in October - its biggest steepening since Dec 2016 (right after Trump elected)...

Source: Bloomberg

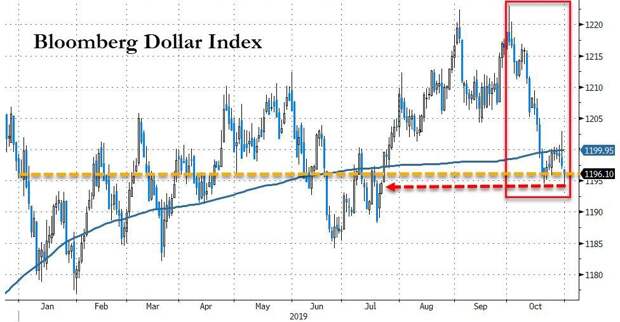

The Dollar Index dived in October (after 3 straight months higher), the worst month since Jan 2018, and back in the red for 2019 (back below 200DMA)...

Source: Bloomberg

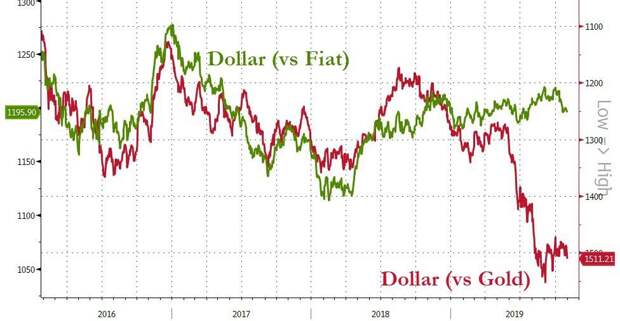

While the rest of the world appears to be weakening vs the dollar, the dollar itself is losing notable ground against 'money'...

Source: Bloomberg

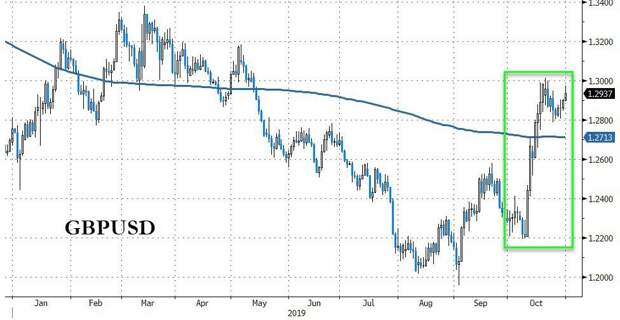

Cable soared over 5% in October, the biggest gain since May 2009 (back above 200DMA)...

Source: Bloomberg

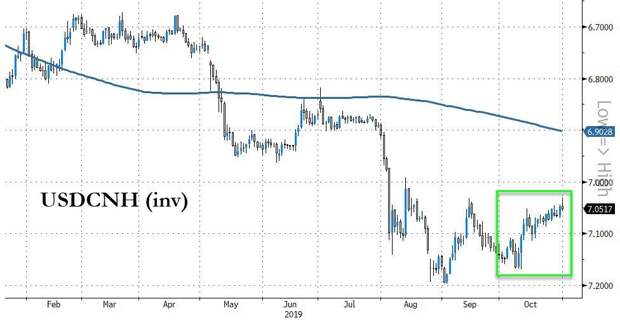

Offshore Yuan surged in October, its best gain since January 2019...

Source: Bloomberg

Despite an ugly puke late in the month, Cryptos ended October higher (after 3 down months), led by Bitcoin Cash...

Source: Bloomberg

Bitcoin bounced perfectly off its 200DMA during the month, roaring back above a key trendline...

Source: Bloomberg

Silver soared in October and while the dollar dived, crude ended lower...

Source: Bloomberg

This is silver's 4th month higher in the last 5, ending back above $18...

Gold managed to end October higher (up 5 of the last 6 months) and back above $1500...

Silver's outperformance of gold erased September's relative gains...

Source: Bloomberg

WTI ended back below $55 after three big legs down this week...

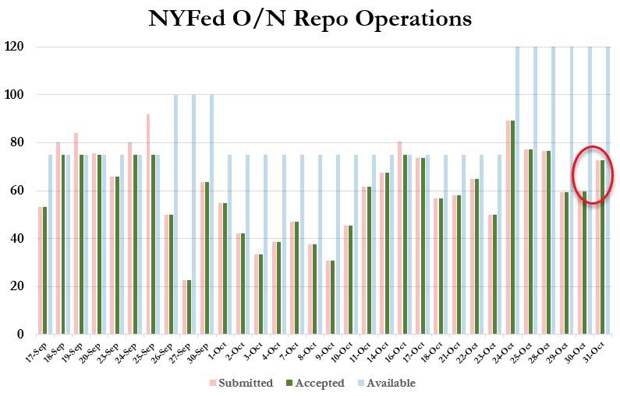

Finally, we note that the Fed's liquidity spigot is wide open and shows no signs of being "fixed"...

Source: Bloomberg

Additionally, after today's vote to formalize the public phase of the House's impeachment inquiry, odds of Trump being impeached by the House have risen to 79% BUT the odds of him completing his first term (i.e. a bet that the Senate will reject the impeachment) is at 70%...

Source: Bloomberg

And for those claim that global economic data is bottoming... it's not!! (October was the worst month since May 2018)...

Source: Bloomberg

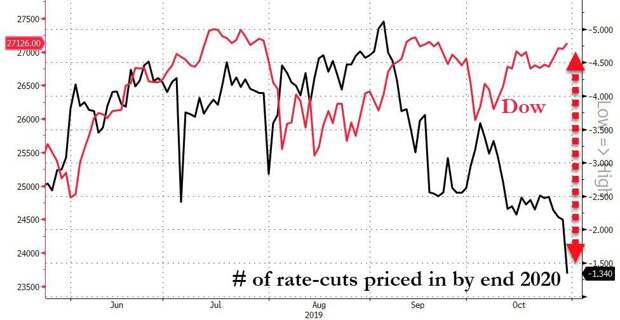

And what happens next, now that The Fed has shown their cards...

Could happen, especially given the stock market's decoupling from Fed expectations...

Source: Bloomberg