Today, one person is following the gyrations in the oil market, which first rebounded after the DOE crude storage data only to tumble immediately thereafter after all the upside stops had been taken out...

... with very close attention: the same person many had dubbed the oil trading "god", former Citi and Phibro trader, Andy Hall.

Andy Hall's story has been closely documented here: about a year ago, we learned that as a result of the dramatic move lower in oil and other commodities, 113-year-old Phibro, where Hall worked, would shut down after it was unable to find a buyer.

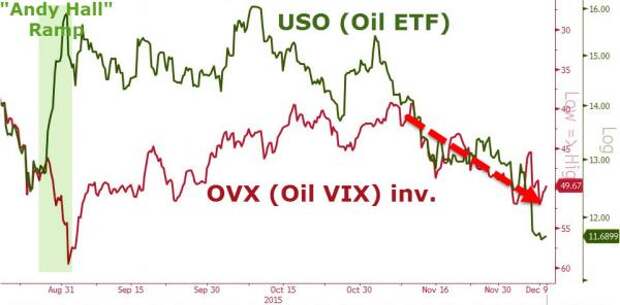

Since then things have gone from bad to worse for Hall, who suffered his second biggest monthly loss ever in July when he was down a whopping $500 million. The next month many thought could be Hall's last, with oil continuing its drop until the very end of the month, before a mysterious and completely unexpected surge in oil (driven by a collapse in OVX, or the oil VIX) send oil soaring on the last few days of trading.

As oil spiked in August to save Hall's month, it was clear that someone was buying calls in massive size - sending volatility soaring (which would typically sync with lower prices). However, as those calls matured and "real'" weakness resumed so unmanipulated prices fell back to reality and Oil vol once again surged.

But while the late August ramp may have delayed judgment day for Hall, it may still be coming in the next few weeks, which would mean the erstwhile oil-trading "god" could be facing two blow ups in the span of one year.

According to the Journal, Andy Hall's Astenbeck hedge-fund lost 9.7% in November, bringing 2015 losses to more than 26%. As a result of capital losses and mounting redemptions, Astenbeck’s assets under management fell to $2.4 billion, down from $3 billion at the start of the year and nearly $5 billion less than three years ago.

The fund is on track for its worst year since its inception in 2008.

Not surprisingly, the WSJ adds, Hall has remained bullish on oil throughout the deep downturn in the crude market this year and last.

In a letter to clients dated Dec. 1, Mr. Hall showed no sign of altering his views on the market. Throughout crude’s 30% fall this year, he has continued to cite data points that suggest a turnaround in prices soon.

Oil companies’ hedges, used to lock in prices, are beginning to expire, Mr. Hall noted in his letter. By next year, most companies will be fully exposed to low prices, with oil futures trading at nearly seven-year lows and the U.S. benchmark contract around $37 a barrel on Tuesday.

”The longer term story regarding oil remains very much intact,” Mr. Hall wrote. “Indeed the longer prices remain at current levels, the more powerful the ultimate recovery will likely be. The oil industry simply cannot function with oil prices stuck at current levels.

”Now is not the time to exit the market,” Mr. Hall added.

Sadly, OPEC did not get Hall's letter to clients. As for Hall himself, unless he can recreate his dramatic option play from the end of August and send oil spiking, the time when the oil trader has to exit the market for good could be in a few weeks when LPs in his fund send in their terminal redemption requests, and lead to an even greater plunge in the price of oil as Hall is forced to unwind all of his massively levered bullish bets.

In fact, according to several traders, some of the heavy offers in the market in recent days have come from the Soutport, CT-based firm itself which may be beyond the point of no return, and which if true, would explain why Goldman is expecting a $20-handle print in crude in the coming weeks.