The cooler than expected CPI print sparked the somewhat expected chaos in markets as Fed rate trajectory expectations puked dovishly. Fed terminal rate has plunged back below 5.00% and subsequent rate-cut expectations are soaring. ..

December has now priced out any chance of a 75bps hike (50bps locked in)...

This fits the narrative...

The October inflation report is likely to keep the Fed on track to approve a 50-basis-point interest-rate increase next month

— Nick Timiraos (@NickTimiraos)

Officials had already signaled they wanted to slow the pace of rises and were somewhat insensitive to near-term inflation datahttps://t.co/jVTJvMkjg3

Stocks immediately exploded higher. Nasdaq is up over 4%...

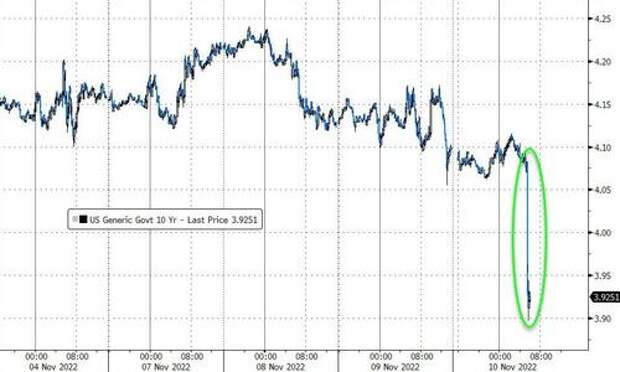

Bond yields puked (10Y back below 4.00%)...

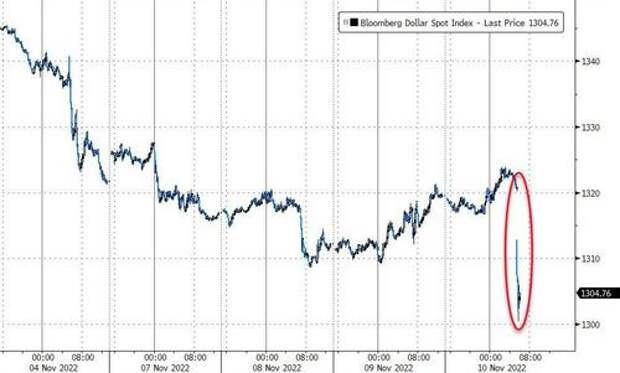

And the dollar plunged...

Which helped send Gold futures surging up to $1740 - its highest in 2 months...

Some are arguing this is the start of The Fed 'pivot'...

⚠️ This is the start of the Fed pivot. The breadth of US CPI is down sharply and moving back to a level that isn't showing 'scary' inflation. This is what matters for the Fed. One data point doesn't make a trend... but chart below shows we're moving in the right direction $USD pic.twitter.com/cRlc0vki7t

— Viraj Patel (@VPatelFX)

However, we are reminded of Powell's press conference reversal and wonder how long before The Fed jawbones this financial condition easing impulse away?