The Nasdaq is in the middle of its worst drawdown since the Lehman crisis and the Dow just suffered its longest losing streak in 99 years.

As that is happening, faith in The Fed is crumbling as Powell faces the central bankers' nemesis of stagflation... and all in an election year (threatening the confidence in The Fed's independence should it falter from its path of uber-hawkishness).

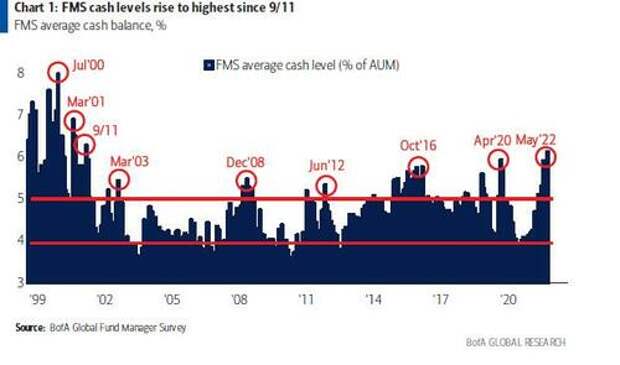

According to the latest BofA Fund Manager Survey, the grim 'market' has sent investors reeling with those equity funds tracked by EPFR Global suffering six straight weeks of outflows (the longest stretch of withdrawals since 2019), and cash levels among investors soaring to their highest level since September 2001.

Additionally, the BofA survey also showed that technology stocks are in the 'biggest short' since 2006.

The 'proverbial' dip-buyer appears to have abandoned hope as the strike on any Fed Put (at which Powell will fold like a cheap lawn chair over the pain) gets marked lower and lower.

But...

There is one group apparently, that is willing to dip a toe in the capital market deadpool - corporate insiders.

As Bloomberg reports, according to data compiled by the Washington Service, more than 1,100 corporate executives and officers have snapped up shares of their own firms in May, poised to exceed the number of sellers for the first month since March 2020 marked the pandemic trough two years ago.

The ratio has surged to 1.04 this month from 0.43 in April.

Notably, the insider buy-sell ratio also jumped in August 2015 and late 2018, with the former preceding a market bottom and the latter coinciding with one.

“It is a function of investors functioning at the '30,000 foot level' or 'macro' whereas insiders are functioning at the 'boots on the ground', company-fundamentals level,” said Craig Callahan, chief executive officer at Icon Advisers Inc. and author of 'Unloved Bull Markets'.

“We believe the company-fundamentals view is usually correct.”

Nicholas Colas, co-founder of DataTrek Research, is not as confident:

“All we know for sure is that the valuation of any stock or the entire market hinges on whether investor confidence in future cash flows is rising or falling. At present, confidence is falling,” he wrote in a recent note.

“This is not because stocks expect a recession. Rather, it is because the range of possible S&P 500 earnings power runs in a wide channel and can become wider still.”

Starbucks' Interim Chief Executive Officer Howard Schultz and Intel CEO Patrick Gelsinger are among corporate insiders who scooped up their own stock amid the latest market rout that took the S&P 500 to the brink of a bear market.

With their share prices plunging, we can't help but wonder if this 'buying' is mere virtue-signaling so that the board won't fire them for their absymal loss of market cap?