Via RBS' Alberto Gallo,

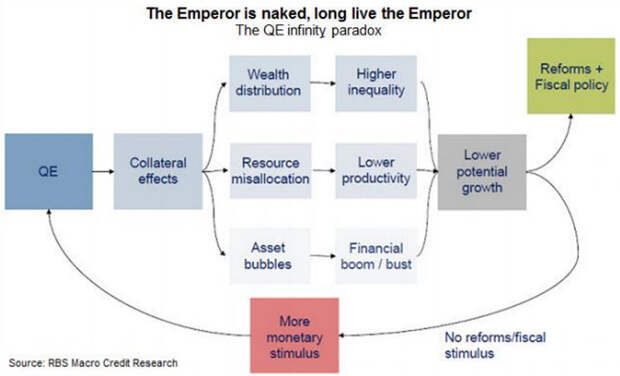

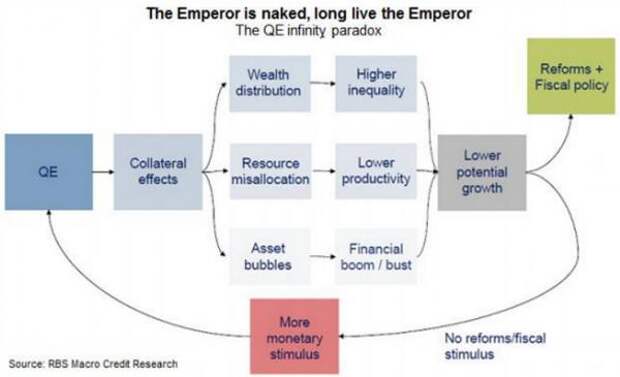

"Policymakers responded to the financial crisis with easy monetary policy and low interest rates. The critics — including us — argued against 'solving a debt crisis with more debt.' Put differently, we said that QE was necessary, but not sufficient for a recovery. We are now coming to the moment of reckoning: central bankers look naked, and markets have nothing else to believe in. "

The Emperor Is Naked...

Gallo believes an overreliance on excess liquidity has actually hindered capital investment — as companies have focused on debt-funded share buybacks and dividend hikes instead — limiting the global economy's potential growth rate.

Now, contagion from China — lower commodity prices, lower demand, currency volatility — has revealed the structural vulnerabilities. More stimulus, in his words, "could be self-defeating without fiscal and reform support."

As for Fed hike timing, Gallo sees the odds of a September liftoff at just 30 percent, down from 36 percent last week, based on futures market pricing. December odds are at 60 percent.

The open question is: Should the Fed delay its rate hike and the People's Bank of China ease, will stocks actually rebound? Or has the Pavlovian reaction function been broken by a loss of confidence? We're about to find out.