Last July, a pillar of so-called "Japan Inc" crashed when Toshiba admitted it had inflated profits by a stunning $1.2 billion for no less than 7 years, with fabricated figures amounting to 30% of the company's "profits" since 2008.

In the immediate aftermath of the scandal becoming public, Toshiba's then- CEO Hisao Tanaka said on Tuesday at a news conference, following a 15-second bow of contrition, that he “felt the need to carry out a major overhaul in our management team in order to build anew our company.

" “We have suffered what could be the biggest erosion of our brand image in our 140-year history." As a result, Tanaka, who together with five members of his senior staff, resigned after bowing down to, and apologizing to investors.

Tanaka et al: "Sorry we got caught"

Of course, the only reason Mr. Tanaka apologized and resigned is not because he was actually cooking books the for an unprecedented 7 years, a period during which the CEO most certainly received tens if not hundreds of millions in equity and profit-linked compensation, but because he was caught. This was confirmed because none of his bonuses had been clawed back even as "a panel of external lawyers and accountants said on Monday there was a “systematic” and “deliberate” attempt to inflate profit figures amid a corporate culture in which employees were afraid to speak out against bosses’ pushes for unrealistic earnings targets."

Fast forward to Monday, when in its second major scandal announcement in as many years, Toshiba said cost overruns at U.S. nuclear reactors it is building were likely to force a write-down of as much as several billion dollars, clouding its turnaround plan after the 2015 accounting scandal. Specifically, the company said it may have to book several billion dollars in charges related to a U.S. nuclear power plant construction company acquisition, rekindling "concerns about its accounting acumen."

Toshiba's latest writedown would be another slap in the face for a sprawling conglomerate hoping to recover from a $1.3-billion accounting scandal, as well as a writedown of more than $2 billion for its nuclear business in the last financial year."This will come as an additional shock to Toshiba's institutional investors that may further undermine confidence in company management, as well as significantly weakening its international nuclear credentials," said Tom O'Sullivan, founder of energy consultancy Mathyos Japan.

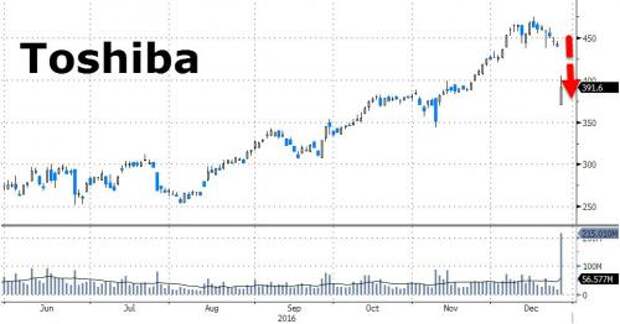

The warning sent the stock price of one of Japan's largest companies crashing over 10% in Tokyo trading, came just as the Japanese conglomerate seemed to have turned a corner thanks to an upswing in its semiconductor business.

Cited by the WSJ, Toshiba execs on Tuesday said the company was looking at emergency steps to raise funds, including borrowing from its main banks. They said they couldn’t rule out the possibility that Toshiba’s U.S. nuclear-power subsidiary, Westinghouse Electric Co., would fall into negative net worth as a result of the write-down.

But most notable, or perhaps frustrating to Toshiba shareholders, is that Toshiba's new CEO, Satoshi Tsunakawa, who only took the helm in June, also took the "apologetic" way out, and became the latest boss of the company to bow before the cameras after the 2015 scandal, which led to a clean sweep of top management after the company acknowledged it had padded its financial results for years.

“I apologize to shareholders, business partners and all stakeholders for the trouble we have caused,” Mr. Tsunakawa said in a news conference at the company Tokyo headquarters.

Tsunakawa: "Sorry we couldn't do math"

Well, if that isn't sufficient to absolve the CEO and his company, not to mention investors, of gross stupidity and perhaps, criminality, we don't know what is.

He continued: "We would have needed to boost our capital base anyway because our shareholders' equity ratio is low" the CEO said in a press conference.

According to Reuters, as of end-September, Toshiba had shareholders' equity of 363 billion yen, or just 7.5 percent of assets, which could fall close to zero if the company is forced to log significant losses. Asked if Toshiba's liabilities would exceed its assets, Chief Financial Officer Masayoshi Hirata said the company had not yet completed its estimation of the charge.

Analysts said further write-downs were possible and expressed fears about the nuclear business weighing down the company, which makes everything from elevators to electronic devices. Already, Toshiba took a ¥260 billion impairment charge in its last fiscal year when it downgraded the book value of Westinghouse. Recently, demand from customers including Chinese smartphone makers has helped Toshiba’s core semiconductor unit boost profits. Before news of the nuclear write-down, the company said it anticipated earning ¥145 billion net profit for the year ending March 2017.

Since Toshiba has positioned its nuclear and semiconductors businesses as key pillars of growth while seeking to scale down less profitable consumer electronics units such as personal computers and TVs, we see much more bowing by the company's current and future chief executives in the not too distant future, especially since it is once again management that was openly lying to shareholders, insisting they remain optimistic when the reality was anything but: Ttoshiba executives have often said the nuclear business has a bright future and will remain a core unit despite the global trend away from nuclear power after the Fukushima Daiichi accident in Japan in 2011.

And then the apologies and the bowing began.