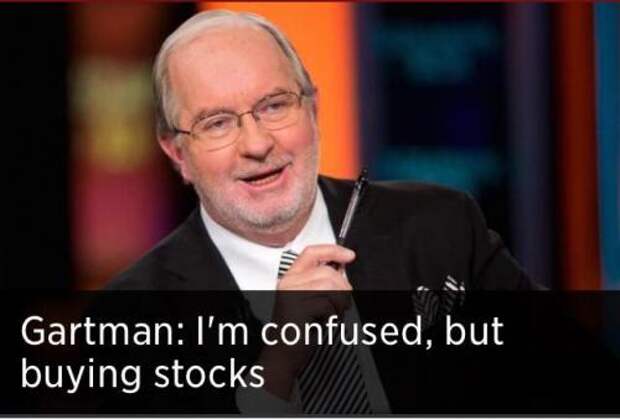

Yesterday's late day market swoon, while blamed on Valeant, was perfectly expected: after all just hours prior we "warned bulls" that the time to take profits has come following Dennis Gartman's latest flip-flop: "We are still of the opinion that the “bear market” that began in late May ran its course, when stocks at their worst were down just a bit more than 19%. We look for stock prices still to move higher, and to finish the year higher, but likely not materially so. As such, we are buyers of any intra-and inter day weakness on balance for that is what one is to do in a bull market."

That this took place just days after warning odf of the latest "end of a bull-run" was perfectly expected.

We also expected that, as he always does, Gartman would flip-flop overnight, thus giving the greenlight to go back to being long risk and frontrunning both multiple expansion, today's goosing of stocks by Mario Draghi and the last stages of central bank intervention, both verbal and printeral, before they lose all credibility and have no choice but the paradrop money.

That is not what happened.

Instead we were pleasantly surprised to observe that even Dennis Gartman is getting sick of his own constant flipflopping. To wit:

We have watched and paid heed to “reversals” over the years, in market after market after market. We have watched tops made with reversals to the downside, and we have seen bottoms forged with reversals to the upside. But… and this is a very, very important “But”…most reversals are rare events, and it is that rarity that has always had our attention. It was… and should have been… the reason why we took action when these sorts of “Reversals” took place. However, in recent weeks and months we’ve seen reversals in the equities markets time after time and far, far too often. They have become common rather than uncommon events and this is the problem we confront today.

The S&P “reversed” to the downside again yesterday, having made a new high by the barest of margins and having closed lower and below the previous day’s low… also by the very barest of margins. The ranges of late have been so small that these sorts of reversals can happen often, and are, causing us very real confusion. We want to… and we will… pay heed to this reversal just as we’ve paid heed and acted upon reversals in the past; but we are growing weary of doing so and we are making that weariness evident here this morning. Flipping back and forth does no one any good, but flip we must if history’s lessons are to be heeded.

That this is horrible news goes without saying, for if the market loses its one most accurate contrarian indicator, namely the overnight Gartman flip, or flop, just how will everyone else make money in this HFT-infested, central bank-rigged casino once known simply as the "market"?