One of the bigger, if unde- reported, stories to emerge from the various Fed speakers yesterday, is that Fed members, if maybe not Yellen herself, are actively contemplating the reduction of the Fed's balance sheet, and whether credibly or not, it launched not one but two trial balloon efforts to give those traders who are paying attention advance notice.

The first one was when Philly Fed's Harker said that when rates hit 1%, the Fed will "need to look at unwinding its balance sheet"; several hours later St. Louis Fed's Bullard added that a "balance sheet rolloff may be better than aggressive hiking."Overnight, that theme was noticed by various sellside analysts, who are now making a Fed balance sheet rolloff their base case for 2017, most notably the head of rates strategy at RBC, Michael Cloherty, who in a note previewing the Fed's balance sheet over the next year, says that "the Fed's balance sheet will start shrinking in Q4 of this year. Fed Chairs usually like to get major initiatives under way before they leave, and Yellen is likely to feel more strongly about that because some potential successors have talked about a relatively disruptive balance sheet reduction "

Here is the rest from RBC's Cloherty, who appears more concerned with the impact of such a rolloff on the MBS market rather than TSYs. We disagree, but we'll cross that bridge when Yellen does suggest that balance sheet reduction is indeed what she is contemplating.

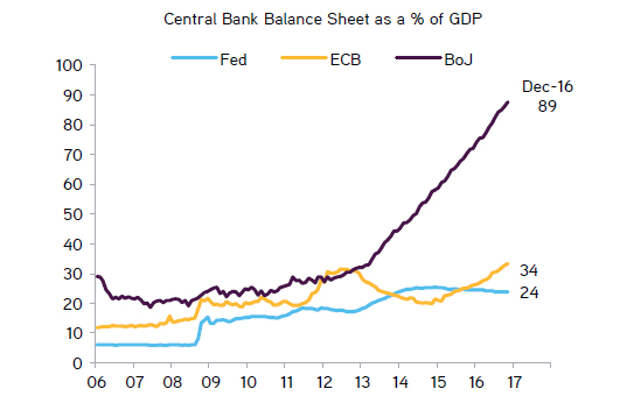

Fed balance sheet outlook

We think the Fed's balance sheet will start shrinking in Q4 of this year. Fed Chairs usually like to get major initiatives under way before they leave, and Yellen is likely to feel more strongly about that because some potential successors have talked about a relatively disruptive balance sheet reduction (sales).

The Fed will not sell. When the Fed was buying they targeted the issues investors most wanted to sell, so liquidity was sufficient to do large volumes every month. But if the Fed sold, they could only sell what they own. And they primarily own a mix of high WALA mortgage pools and deep off-the-run Treasuries, which have a very different liquidity profile.

Instead they will stop reinvestment and mature their portfolio away. We look for an extended taper lasting almost three quarters.

We think the decline in the balance sheet will be relatively modest. While it is extraordinarily difficult to predict demand for reserves for LCR purposes, our best guess (stress guess) is north of $1T. On the last day of 2016, reserve balances probably got close to $1.75T. For LCR, averages are irrelevant—since banks always need to meet the LCR standard, it is the extreme low points in liquid assets like reserves that matter for bank balance sheet planning.

With more than $100bn of reserves disappearing every year as reserves get converted to other Fed liabilities (currency, Treasury deposits, etc.), the annual low in reserves is likely to hit that $1T level about two years after the runoff begins (timing depends highly on MBS prepayment rates).

Each dollar of Treasuries that the Fed allows to run off will boost the Treasury's financing need by one dollar. But there is a supply scarcity in the bill sector that suggests that a meaningful portion of the additional financing will be in very low duration bills that will have little market impact. There will be some incremental supply out the curve (probably hitting more in 2019), but it is unlikely to be enough to cause a major change in rates or swap spreads. The only issue would be a possible curve steepener if the Treasury decided to use the increase in auction sizes to extend the average maturity of the debt. Until we know more about who will be in the relevant seats at the Treasury, it is premature to speculate on this.

Once reserve supply and demand is balanced, the Fed will continue to allow its MBS portfolio to decline as it tries to move back to an all-Treasury portfolio. Declines in MBS would drain reserves, so we think the Fed will need to start buying Treasuries in 2020 to offset the slide in MBS holdings.

That means that the duration shock to the Treasury market will be small and short lived, while the duration shock to the MBS market will be much larger. This leaves us thinking the Fed portfolio story is primarily an MBS spread story.

When prepayments accelerate, it will cause duration to move off the Fed balance sheet to the market. This means Fed runoff of MBS will have a stabilizing effect on the market — lower (higher) rates will cause increases (decreases) in prepayments that will force more (less) MBS duration to hit the market. However, there will be a lag before the securities leaving the Fed balance sheet will reappear in the market as new production.