All year we’ve warned that the auto loan market is beginning to look quite a bit like the housing market in the lead up to the financial crisis.

The dynamic is simple. It’s just the originate to sell model all over again and it’s having the predictable effect of causing underwriting standards to deteriorate. Banks can offload credit risk by packaging loans and selling ABS to investors thus freeing up their balance sheets to make still more loans.

The race to get in on the action causes banks to compete for an ever smaller pool of eligible borrowers. ZIRP adds fuel to the fire by i) enticing households to take on more debt, ii) creating demand for ABS as investors hunt for yield in a low rate environment.

The pool of creditworthy borrowers is of course limited and so, at a certain point, the only way to generate more securitizable debt is to lower your underwriting standards so that previously ineligible borrowers are suddenly eligible. That way, the loans keep getting extended and Wall Street’s securitization machine keeps getting fed.

There’s plenty of evidence to support this contention and we encourage you to go back and have a look at Santander Consumer (see here for instance) and Skopos Financial (see here) on the way to evaluating the degree to which loans are being made to borrowers who probably can’t service their debt just so those loans can be sliced, diced, and sold to yield-starved investors.

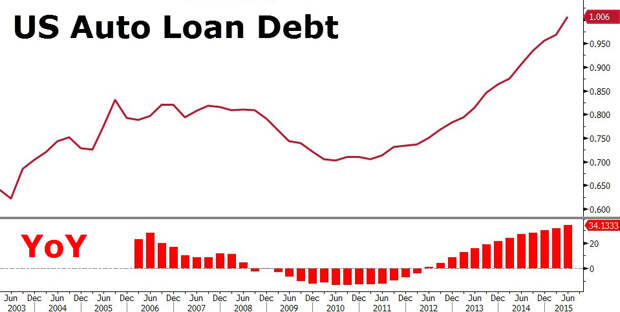

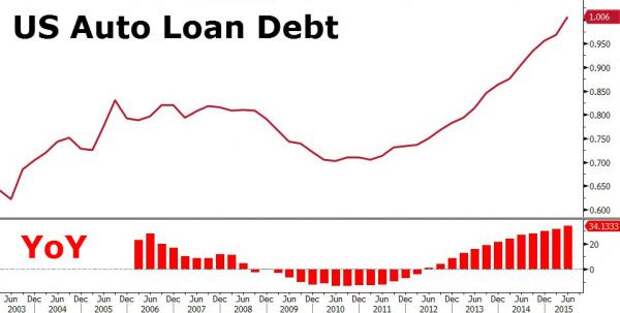

Here’s a look at America’s auto loan bubble. As you can see, total auto debt has now soared above the $1 trillion mark right along with student debt:

It’s with all of this in mind that we bring you the following from WSJ who reports that Comptroller of the Currency Thomas Curry is seriously concerned about the extent to which the auto loan market now resembles the pre-crisis housing market.

While policy makers have generally declared the U.S. banking system recovered from the financial crisis, Comptroller of the Currency Thomas Curry raised a rare red flag, saying in a speech that some activity in auto loans “reminds me of what happened in mortgage-backed securities in the run-up to the crisis.”

“We will be looking at those institutions that have a significant auto-lending operation,” he told reporters after the speech. Many mortgage-backed securities thought to be safe turned sour during the financial crisis, leading to heavy losses across Wall Street.

The comments are likely to raise concerns in particular at firms like Wells Fargo & Co. and other national banks active in auto lending that are regulated by the comptroller’s office. Mr. Curry’s vow of closer scrutiny wouldn’t affect their competitors at lenders owned by large auto manufacturers.

When the comptroller in the past has raised questions about loans being risky—as it has done since 2013 with leveraged loans to heavily indebted corporations—regulators have turned up the heat to the point that banks have dialed back products, even when they were profitable.

This isn’t the first time regulators have cast a spotlight on auto lenders.

In March, the Consumer Financial Protection Bureau raised concerns about consumers taking on too much auto debt, and some large financial firms have faced investigations regarding unfair auto-lending practices.

But Mr. Curry’s concerns focused on the risks auto loans may pose to banks’ safety and soundness. Lower-level OCC officials have previously raised similar concerns.

Auto lending has been increasing in recent years amid historically low interest rates, cheap gas and stronger consumer demand. Auto loans also performed relatively well during the financial crisis, which market watchers have interpreted as a sign that the loans are safe because even cash-strapped households must pay for transportation.

Auto lenders also have an easier time collecting collateral on a delinquent auto loan—by repossessing the car—than they do foreclosing on a house covered by a bad mortgage.

Those factors have emboldened banks and other financial firms to offer relatively attractive terms even to borrowers with low credit scores. In the second quarter of 2015, auto debt owed by U.S. households rose above $1 trillion for the first time, up more than 10% from a year earlier.

Mr. Curry said auto lending at banks supervised by the comptroller’s office, which includes most of the largest banks in the U.S., accounted for more than 10% of retail lending during the second quarter, up from 7% four years earlier. Banks are increasingly moving these loans into securities, rather than holding them in a portfolio, he said, similar to the way mortgages were packaged and sold to investors ahead of the financial crisis.

Through early September, Wall Street firms issued nearly $70 billion in securities backed by auto loans, up 9% from the same period a year ago, according to J.P. Morgan. About $21 billion of those were backed by subprime loans to relatively risky borrowers.

Subprime car-loan originations have taken off in recent years as lenders have loosened underwriting criteria in this sector, allowing for borrowers with low, and often no, credit scores to get access to financing. During the first half of 2015, lenders gave out $56.4 billion in subprime auto loans, up 13% from the same period a year ago and up 181% from the first half of 2009, when the market for these loans bottomed out, according to credit-reporting firm Equifax Inc.

Subprime car loans account for 20% of the car-loan dollars given out from January through June, the highest share for the period since 2008, according to Equifax.

Count us among those who doubt if very much will come of this very "serious" inquiry. After all, auto loans and student debt have served as the lone bright spot for the US "recovery", as every American with a pulse can now get themselves into a used car (even if it means taking out a loan with a term of 84 months) and every college student in the country can borrow from the taxpayer government not only to pay for tuition, but to fork over exorbitant monthly rents to the landlord, and to finance an iPhone 6S, an iPad Pro, and an Apple pencil, because let's face it, no one slums it in college anymore.

So lest the entire "recovery" illusion should suddenly be shattered by a regulator erroneously seeking to do his job, Mr. Curry may want to just back off and let the originate to sell model work its magic (just forget the fact that this will unquestionably end in tears)- the fate of the US economy might just depend on it.