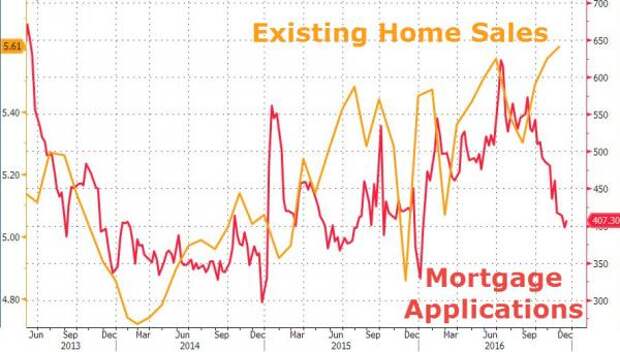

Despite soaring mortgage rates, tumbling affordability, and crashing mortgage applications, existing home sales soared to fresh cycle highs. At 5.61mm SAAR, this is the highest existing home sale print since Feb 2007 (+0.7% MoM vs -1.8% exp).

- Sales increased 18.2 percent before seasonal adjustment from November 2015, when changes in mortgage regulations delayed closings

- Median sales price climbed 6.8 percent from November 2015 to $234,900

- Inventory of available properties dropped 9.3 percent from November 2015 to 1.85 million, marking the 18th consecutive year-over-year decline

However, today's data does not reflect the post-Trump spike in rates and collapse in mortgages.

What happens next?Lawrence Yun, NAR chief economist, says it's been an outstanding three-month stretch for the housing market as 2016 nears the finish line.

“People who had locked in their rate," followed through with their purchases last month, but still, “we have this inventory shortage, this housing shortage, for the past five years, hurting affordability for first-time buyers.” "Rental units are also seeing this shortage. As a result, both home prices and rents continue to far outstrip incomes in much of the country."

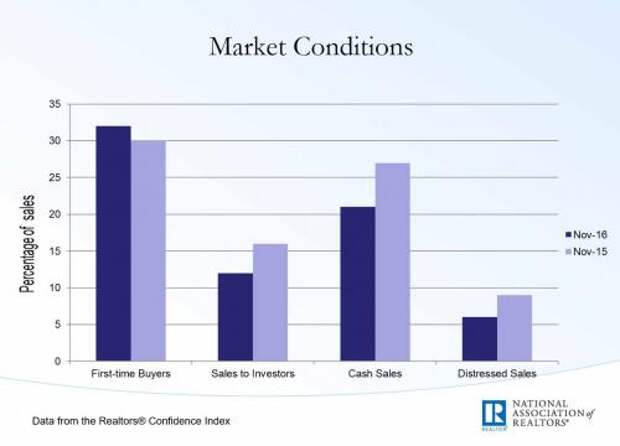

Breaking down the activity, first-time buyers were 32 percent of sales in November, which is down from 33 percent in October but up from and 30 percent a year ago. NAR's 2016 Profile of Home Buyers and Sellers — released in November 5 — revealed that the annual share of first-time buyers was 35 percent (32 percent in 2015), which is the highest since 2013 (38 percent).

"First-time buyers in higher priced cities will be most affected by rising prices and mortgage rates next year and will likely have to stretch their budget or make compromises on home size, price or location," said Yun.

The chart below notes the notable decline in cash and investor sales, as these groups of buyers believe the market has peaked, and instead first-time buyers are the proverbial bagholders.

Meanwhile, the breakdown of existing home sales by price bucket shows an ongoing feeding frenzy in the higher ranks, with transactions for houses priced $1million+ jumping by 34%.