Oil prices are holding yesterday's gains this morning after US Secretary of State said that Iran will remain under significant sanctions, lowering traders' odds of a sudden rush of supply back into the markets, although we note that Libya’s oil output is picking up again after a pipeline leak that caused a brief reduction was fixed.

"The widespread faith that oil demand growth will trend significantly higher in the second half of the year is paving the way forward for the price rally," PVM analysts said.

For now, the next leg may depend on if US production can remain disciplined as stocks of crude continue to slide.

API

-

Crude -2.108mm (-3.5mm exp)

-

Cushing -420k

-

Gasoline +2.405mm

-

Distillates +3.752mm

DOE

-

Crude -5.241mm (-2.9mm exp)

-

Cushing +165k

-

Gasoline +7.046mm

-

Distillates +4.412mm

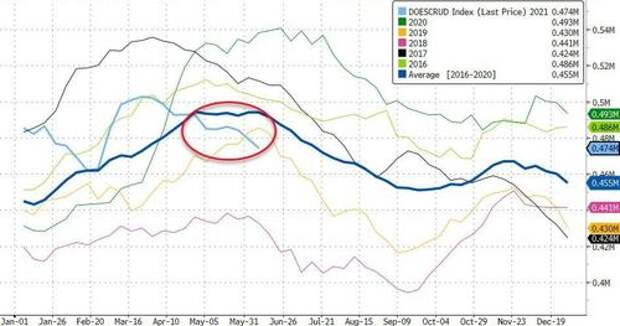

Crude stocks fell more than expected last week but product inventories rose significantly...

Source: Bloomberg

Overall crude stocks are now below their 5-year average...

Source: Bloomberg

US crude production remains rather notably flat (rebounding from the prior week's maintenance drop) in the face of higher prices and rising rig counts...

Source: Bloomberg

How much longer will they remain disciplined?

In a report, the EIA noted that while rigs are being added with recent price increases, it isn’t happening quite as fast as before, and the agency has cut responsiveness of rig deployments in the Permian to upward oil price movements. This could either be down to drillers sticking to austerity measures, or they are simply waiting for prices to jump even more.

WTI hovered around $70.50 ahead of the official inventory data

Potentially dampening prices, the latest crackdown by Chinese authorities to curtail the country's bloated refining sector could see Chinese crude imports fall by around 3%, or around 280,000 barrels per day, according to sources.