With the topic of Yuan's relentless plunge to all time lows clearly bothering China and threatening to breach the symbolic level of 7 Yuan for the dollar, overnight Beijing decided to do something about it. Only instead of actually implementing much needed, and long overdue economic reforms, banking sector deleveraging or financial liberalization, China once again took the easy way out, when it revised its recently introduced trade-weighted FX currency basket by diluting the role of the dollar and adding another 11 currencies as, in Bloomberg's words, "officials seek to project an image of stability in the yuan."

Alas, "projecting an image of stability" for the dollar may be problematic as explained most recently last night in "With China Facing Currency, Liquidity Crises, Ex-PBOC Official Urges Use Of "Nuclear Option." Even more embarrassing for Beijing is that the Politburo believes it can fool the general public with such cheap dollar-store, no pun intended, gimmicks.

As a reminder, the basket was unveiled in December 2015 as a way of shifting focus away from the yuan’s moves against the dollar in the wake of China's unexpected August 2015 devaluation. PBOC Deputy Governor Yi Gang said last month the yuan’s depreciation versus the dollar was largely driven by the strength of the greenback and the market should refer to its performance against the basket as the economy maintains stable growth.

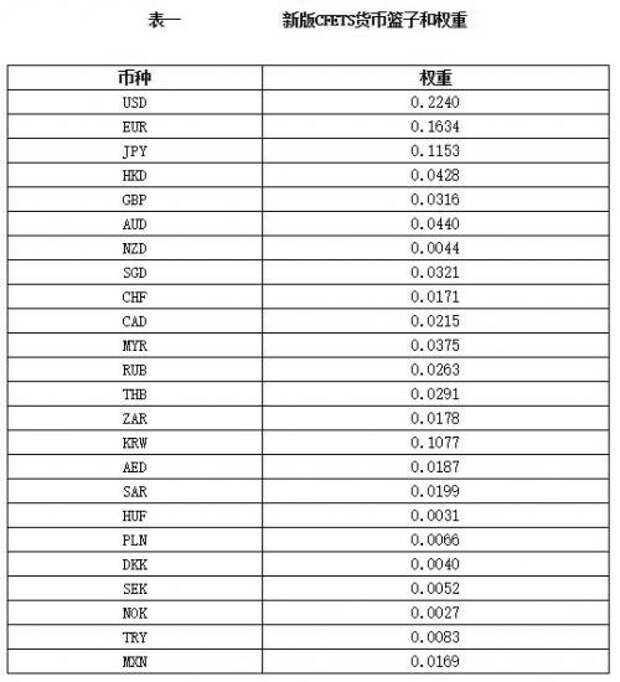

Here are the specifics: starting January 1, the weighting of the dollar will fall to 22.4% from 26.4% in the basket, China Foreign Exchange Trade System said in a statement Thursday. Additions include the South Korean won, the South African rand, the United Arab Emirates’ dirham, Saudi Arabia’s riyal, Hungary’s forint, Poland’s zloty and Turkey’s lira.

The dollar and currencies that are pegged to the greenback, such as the riyal and the Hong Kong dollar, will take up 30.5 percent of the new basket, down from 33 percent currently. The won will have a 10.8 percent weighting when it’s added from next month.

Why is China cutting the weighing of the USD by as much as 15%? Simple: because while much of the rest of China's FX basket has been flat, the USD has been soaring, driven by speculation about Trump's fiscal stimulus and upcoming Fed hikes. This in turn has forced China to respond not so much to broad FX strength, but only to moves in the dollar by devaluing its currency in small increments.

It is seeking to avoid that for the future, and as a result, "the move is aimed to reduce the impact of dollar strength on the overall performance of the basket," said Christy Tan, head of markets strategy in Hong Kong at National Australia Bank Ltd. "It will also make it easier for China to manage yuan stability versus the basket, since the yuan will need to appreciate less versus other non-dollar currencies amid dollar strength."

The divergence between the Yuan's value only relative to the dollar, which is plunging, and the value of the overall trade-weighted basket, which is rebounding, is shown in the Bloomberg chart below.

As Bloomberg adds, the weighting of the basket will be evaluated on an annual basis and updated at the "appropriate time", according to CFETS. The new composition covers exchange rates of the nation’s main trading partners, it said, adding that the newcomers will take 21.1 percent of the overall weighting.

"The new basket is more comprehensive and a better reflection of China’s trade relations," said Sim Moh Siong, a currency strategist at Bank of Singapore Ltd. "In the near term, the PBOC’s target would still be to keep the yuan stable versus the basket."

Meanwhile, no amount of superficial definition revisions can change the fact that the yuan is headed for its steepest yearly plunge against the dollar in more than two decades, and when the year turns, policy makers will be faced with a triple whammy of the renewal of citizens’ $50,000 quota of foreign-currency purchases, prospects of further Federal Reserve interest-rate increases, and concern that U.S. President-elect Donald Trump may slap punitive tariffs on China’s exports to the world’s largest economy, as observed last night.

Furthermore, the real question when determining the "risk" of Chinese exposure to the dollar is not what some arbitrary weighing in FX basket is, but what exposure to USD-denominated debt Chinese companies have as a percentage of total foreign-denominated paper. Here, we are confident that the number is far, far greater than just 22.4%.

Ironically, the move may end up backfiring, and lead to even greater basket weakness should the dollar strength continue in the new year:

"Adding a batch of emerging-market currencies into the basket will likely increase two-way volatility of the yuan’s fixing and the exchange rate," said Ken Cheung, Hong Kong-based Asia currency strategist at Mizuho Bank Ltd. "If the dollar extends its rally next year, particularly against the emerging-market currencies under Donald Trump’s presidency, the onshore and offshore yuan will come under heavier pressures."

Well, if that happens, CFETS will simply undo what it did overnight, and restore the dollar's full weighing, while suggesting to the market it was only joking.