Well that escalated quickly...

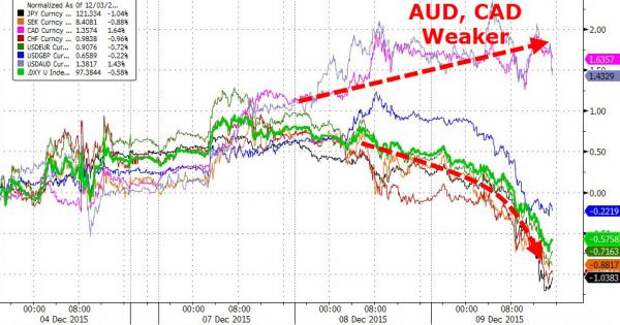

The big story of the day - as long as you don't watch CNBC - was the bloodbath in currencies. China's devaluation to 4 year lows overnight...

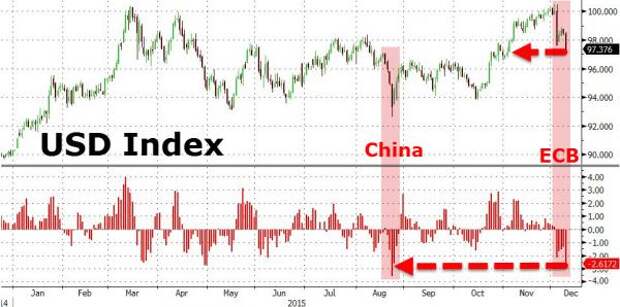

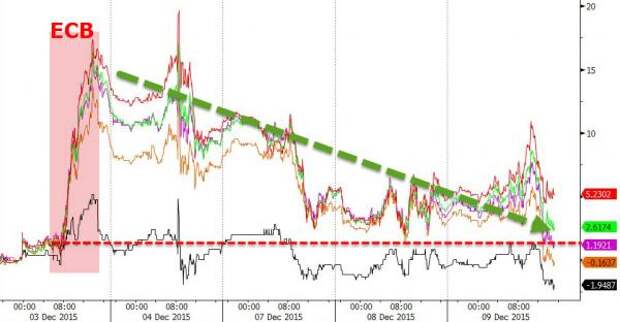

Appears to have acccelerated a shift away from the USDollar across all the majors... (biggest USD drop ex-ECB since the post-China devaluation collapse) - the only thing saving the USD modestly was weakness in commodity currencies (AUD and CAD).

..

Slamming the USD to 6-week lows... with the biggest 5-day drop since China devalued

Some context for that move are evident in the world's most used carry currency - USDJPY crashed...

And in EURUSD, which had its biggest (ex ECB) jump since the China devaluation....

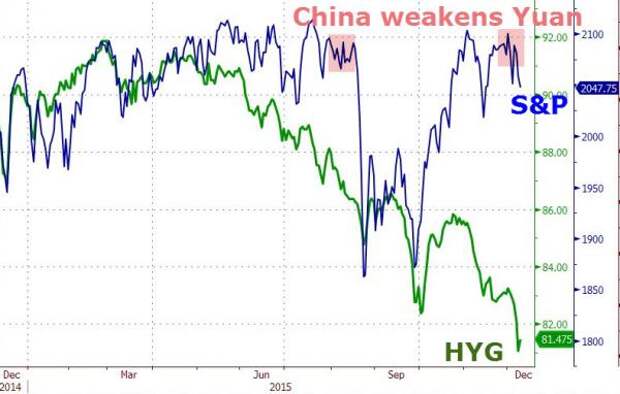

In case you were wondering what "fundamentals" were weighing on stocks...

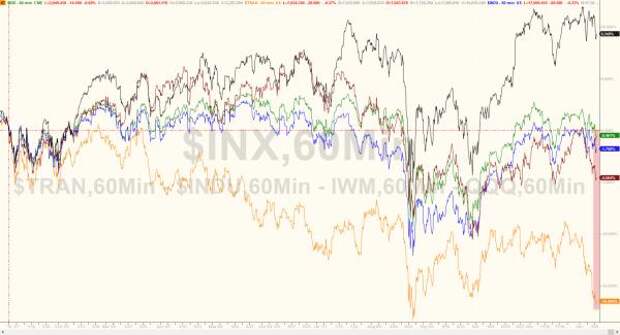

Focusing on stocks, futures provides the cleearest view of the last few days/weeks...

On the day, it was extremely volatile... with stocks ending up back to pre-payrolls levels...

Nasdaq was the worst on the day... Dow was saved by DuPont which added 50 points...

S&P broke below its 50- and 200-DMA...

As FANGs faded...

With Trannies worst on the week...

Leaving all the major indices back in the red for 2015 (apart from Nasdaq)...

Since The ECB let the world down (and implicitly left The Fed set to remove up to $800 bn of liquidity next week)... Gold and EUR are the winners, stocks and Crude the losers...

Stocks played nicely with crude all day...

What happens next?

Treasury yields were mixed today with the short-end rallying, long-end flat (dragging yields below pre-ECB levels...

Commodities ignored the USD dump as once again the 8ET to 12ET period saw dramatic volatility across all...

The post-DOE data ramp perfectly tagged $39 stops and then dumped back below $37 finding support there again...

Charts: Bloomberg

Bonus Chart: What happens next?