Robo-advisors are a new class of financial advisor that manage clients money based on predetermined characteristics. Clients fill out surveys and based on those responses portfolios are automatically created. Robo-advisors began to garner attention as early as 2008. By 2017 the assets under robo-advisor management grew to an estimated $600 billion.

Current Robo-advisor offerings range from industry veterans like Vanguard to startups such as Wealthfront. This new investment management model claims to offer sophisticated investment allocations at lower fees than traditional managers.This new industry has dedicated hundreds of millions of dollars to marketing the benefits of robo-advisors. Despite this massive effort, the jury is still out on whether robo-advisors will just be a fad. Here are five different reasons why robo-advisors may not be for you.

1. Financial Management Depends on Individuals Not Algorithms

Every type of wealth management business uses the same marketing playbook. They want you to believe that investing is rocket science. They would like us all to think that the financial markets are too complex and that the individual can never compete against hedge funds, investment managers and proprietary algorithms.

This could not be farther from the truth. Investing requires only two things, patience and good decision making. Patience is important because it allows you to only invest in the most attractive opportunities. You don’t always need to be invested in the market.

An investment management firm, where I previously worked, had a slide that it regularly shared with clients. The slide highlighted the differences between the S&P 500 returns of a buy and hold strategy vs missing the best 20 trading days of the 20-year period. The buy and hold strategy returned 9.2% annually while missing the best 20 trading days returned 3.0% annually.

If you looked closely at the slide though there was a small asterisk above the 3.0% annual return amount. The footnote connected with the asterisk highlighted that if you had missed the 20 worst days of the period your returns would have increased to 17.2% annually. Clearly there is some value in being patient and having cash available for opportunistic investing opportunities.

This is not to say that we encourage people to actively try to time the markets. Day trading and market timing is a losing strategy. Investing has more to do with patience and finding high probability opportunities.

Warren Buffet has repeatedly said that “An investor should act as though he had a lifetime decision card with just twenty punches on it”. The Oracle from Omaha knows that patience and selective investing is the true key to building wealth. Delegating responsibilities to robo-advisors will never let individuals full exploit these principals. Here is a Harvard research paper that proves that individuals can beat the market.

2. Robo-Advisors Offer No Real Protection from Human Emotion

In January 2016 Wealthfront posted a blog article about “The Biology of Good Investing”. This interesting post discusses the typical pitfalls of human psychology. The article does a good job at discussing various findings before ultimately concluding that people would be better off investing in an automated robo-advisor service. A common theme among robo-advisors is to subtly (or not so subtly) claim that investment performance will be better in their system because they help calm human emotions.

Unfortunately for robo-advisors their service does not add anything to help calm human emotions. An investor in Wealthfront or Betterment can withdraw their funds at any time. There are no restrictions on selling assets for cash withdrawal in an account with a robo-advisor. When the markets are falling rapidly it seems unlikely that someone with a robo-advisor account would react less emotionally than a normal investor.

In fact, it might be more helpful to have a human advisor to help talk through the best investment decision. People who delegate all of their investment decisions to a computer are not prepared to weather the storm of market volatility. The lack of information that robo-advising fosters will also help contribute to an overtly emotional reaction from the investor when markets turn south.

3. Robo-Advisors Rely on Inherently Flawed Modern Portfolio Theory

Robo-advisors use modern portfolio theory as a basis for most of their algorithms. Modern portfolio theory as developed by Markowitz attempts to maximize a portfolio’s return based on the riskiness of the assets contained therein. The way that this theory measures risk is through the volatility of an asset’s price. However, volatility is not risk!

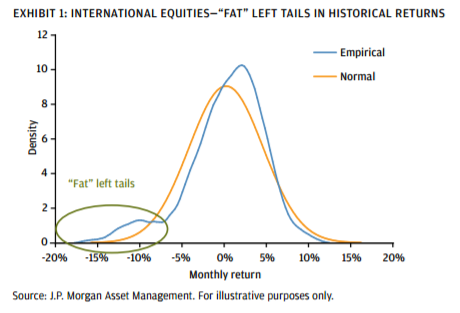

The riskiness of an asset has to be evaluated on a structural basis rather than a probabilistic analysis. The riskiness of a company has to do with the amount of debt it holds, what types of products it sells, the moral character of its leaders, the management ability of its leaders and its financial results. The modern portfolio theory makes several important assumptions about the market having Gaussian or bell curve-like results. The unfortunate reality however is that the market does NOT have Gaussian returns. It is commonly understood that markets have non-normal returns, the proverbial fat tail.

Modern Portfolio Theory also utilizes the efficient frontier model. This model shows what the ideal asset allocation is at any particular period of time. Unfortunately, this model is only backward looking – it will tell you today what the ideal asset allocation would have been for the year 2016. The model is not predictive of the future.

J.P. Morgan

This report from JPMorgan discusses the non-normality of markets in great detail. Modern portfolio theory fails to describe system wide events like crashes or liquidity crisis. How can you base your investing strategy on a theory that doesn’t explain the most difficult events in an investor’s experience? Famous and successful options trader Nassim Taleb described his view on modern portfolio theory in his book The Black Swan,

“After the stock market crash (in 1987), they rewarded two theoreticians, Harry Markowitz and William Sharpe, who built beautifully Platonic models on a Gaussian base, contributing to what is called Modern Portfolio Theory. Simply, if you remove their Gaussian assumptions and treat prices as scalable, you are left with hot air. The Nobel Committee could have tested the Sharpe and Markowitz models - they work like quack remedies sold on the Internet - but nobody in Stockholm seems to have thought about it."

4. Robo-advising is an Unsustainable Business Model

Perhaps the most important criticism of the robo-advisor industry is that it isn’t sustainable. Some large wealth management companies have successfully entered the robo-advising industry. Unfortunately, there are a large number of startups that also offer robo-advisory and receive a large percentage of the media’s attention. Low cost investing options are important but when an individual is paying only 0.25% how good can the service really be?

Wealthfront currently has $4.65 billion under management. At a rate of 0.25% of assets this means that Wealthfront is bringing in around $11.6M of advisory fees. The wealth management industry has traditionally been a high paying field for both investment and technology professionals. If the average Goldman Sachs employee makes around $300k then Wealthfront would be able to hire the equivalent of about 39 professionals. This also incorrectly assu

If I had my assets with Wealthfront or any other robo-advisor with a similar model I would be very concerned. Only 39 professionals are not many people to be writing the algorithms and creating the sophisticated technology systems needed to invest an individual’s hard earned money. What happens when growth slows?

5. Robo-Advisors are Low Cost… But ETFs Are Lower

ETFs are still the lowest cost alternative for individual investors. Let’s take a look at the portfolio recommendation that Warren Buffet made for his wife’s assets. In the 2013 letter to investors Warren Buffet said,

“My advice to the trustee could not be more simple: Put 10% of the cash in short-term government bonds and 90% in a very low-cost S&P 500 index fund. (I suggest Vanguard’s.) I believe the trust’s long- term results from this policy will be superior to those attained by most investors – whether pension funds, institutions or individuals – who employ high-fee managers”.

For equity exposure, you could choose Vanguard’s S&P 500 ETF VOO with an expense ratio of 0.05%. This is a very reasonable cost for the instant diversification and exposure to the S&P 500 that the ETF provides. For bond exposure, an investor can purchase Vanguard’s short-term bond ETF “BSV” which has an expense ratio of 0.09%.

Using Buffet’s formula this would produce a combined expense ratio of 0.063%, far lower than the heavily marketed robo-advisor alternatives.

Conclusion

The benefits of robo-advising seem very questionable to us. The advice that individuals receive is based upon flawed financial theories and the startup companies behind them are of questionable viability. Investors are better off taking responsibility for educating themselves about investing and for investing their hard-earned cash. Investing in low cost ETF’s are a much better choice than delegating your future to unproven algorithms.

Article originally published at Boom Bust Market