Following yesterday's barrage of bank reports, including solid earnings from JPMorgan offset by disappointing results from Goldman and Citi, this morning Bank of America reported Q3 results which while generally stronger than expected, left a slightly bitter aftertaste.

The bank reported Q3 revenue of $22.81BN, (exp. $22.8BN) unchanged from a year ago, and EPS of $0.56 (exp. $0.50), down 15% from $0.66 in Q3 2018, even as BofA's total share count declined by 8% Y/Y from 10.2MM to 9.4MM thanks to accelerated buybacks. Net income fell 19% from $7.2BN to $5.8BN, including a major $2.1BN charge.

BofA also broke its four-quarter streak of record profits as it took a $2.1 billion impairment charge tied to the end of its payments joint venture with First Data Corp. Excluding the impairment charge, Q3 adjusted EPS was 75c, beating the estimate of 68c.

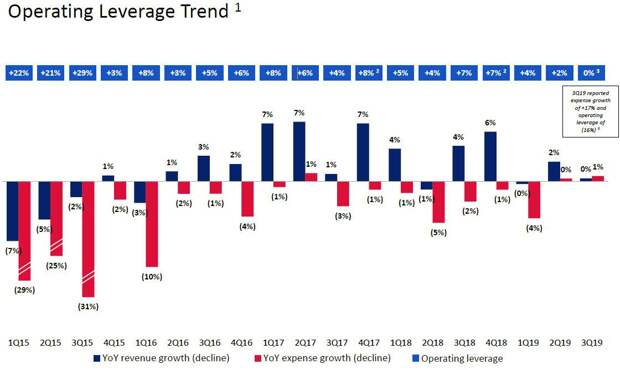

While we will look at the revenue side in depth shortly, first a quick look at the bank's expenses, which after many consecutive quarters of declines, posted a 1% growth in Q3, pushing the bank's operating leverage trend - a figure which BofA had been very proud of - to 0%, the lowest in years.

Commenting on this modest increase in expenses, BofA said that non-interest expense of $13.1B increased $0.1B from 3Q18 "as investments across the franchise as well as higher legacy mortgage-related litigation expense were partially offset by efficiency savings enabled by operational excellence work, lower FDIC costs and lower amortization of intangibles." Yet even as noninterest expense declined $0.2B from 2Q19 "as efficiency savings and lower spend due to timing of investments more than offsethigher legacy mortgage-related litigation expense", the efficiency ratio remained steady compared with 3Q18 and 2Q19 at 57%.

Expenses aside, the bank's Q3 core Net Interest Income was unchanged Q/Q, at $12.3BN, and up 1%, or $0.1BN from a year ago 1%, primarily driven by loan and deposit growth, and offset by impact of lower long-end interest rates. To be sure, the flat Net Interest Income was not due to an increase in the NIM, which declined from 2.44% to 2.41% (including Global Markets), and while the drop was not as pronounced as that of Wells Fargo, it was the lowest NIM in years.

A silver lining: while declining rates hit NIM, they also reduced the bank's deposit cost, as the average rate paid on interest-bearing deposits declined 5 bps from 2Q19 to 0.76%. That 5bps decline was certainly important for a bank which reported that its total interest bearing deposits rose 10% Y/Y to $979 billion.

Yet while the street was hardly impressed with BofA's declining NIM, where the bank shone was in its Global Banking group, where unlike Goldman, debt underwriting fees unexpectedly surged 19% and the firm’s fixed-income traders eked out a slight increase, pushing profit above analysts’ estimates. To wit:

- 3Q total trading revenue (ex DVA) rose 3.8% to $3.22 billion, bearing the estimate $3.12 billion

- 3Q FICC trading revenue dropped -1.2% to $2.07 billion, also stronger than the estimated $2.06 billion

- 3Q equities trading revenue jumped 15% to $1.15 billion, smashing expectations of $1.06 billion

Looking at the bank's FICC and Equities revenue, the numbers have been remarkable stable, barely changing on either a Y/Y or Q/Q basis.

Finally, BofA's advisory fees also surpassed rivals in the best quarter for the investment bank in more than two years, as Q3 investment banking revenue surged 27% to $1.53 billion "driven by higher M&A and debt underwriting fees." Specifically, BofA's debt underwriting fees were $816MM, beating the $673MM forecast.

Putting the bank's performance in context, on Tuesday, JPMorgan posted a surprise jump in revenue from investment banking, as well as the biggest increase in fixed-income trading revenue in almost three years, while Goldman Sachs reported a bigger drop in investment-banking fees than analysts had predicted, down 15% from last year’s third quarter, as its prop trading revenue tumbled on a variety of writeodwns.

Yet just as the overall bank, noninterest expense for the global banking division also increased 4% from 3Q18, "primarily due to continued investments in the business, including technology spend and client-facing associates."

A quick look at the bank's balance sheet, and specifically quality of its loans, BofA reported Q3 net charge-offs of $0.8BN, which decreased $76MM from 2Q19; The Net charge-off ratio of 34 bps decreased 4 bps from 2Q19. Similarly, provision expenses of $0.8B decreased $78MM from 2Q19, with 3Q19 including a small reserve release of $32MM, similar to 2Q19. Overall nonperforming loans (NPLs) of $3.5B decreased $0.7B from 2Q19, driven by a loan sale.

Bank of America shares advanced 2.3% to $30.40 in early trading in New York; they gained 21% this year through Tuesday, compared with a 17% increase for the KBW Bank Index.

Full Q3 earnings presentation is below: