The 2Y Treasury yield may be higher than every other Treasury maturity except for the 30Y (with the 2s10s inverted by almost 5bps), but that doesn't mean that there was a shortage of demand for today's 2Y auction, in which the Treasury sold $40 billion in two-year paper in the first auction since the 2s10s curve inverted on Aug.

14 for the first time since 2007.The auction stopped at a high yield of 1.516%, which tailed the When Issued fractionally, by just 0.1bp; this was the lowest 2Y auction yield since September 2017, and sharply lower from July's 1.823%.

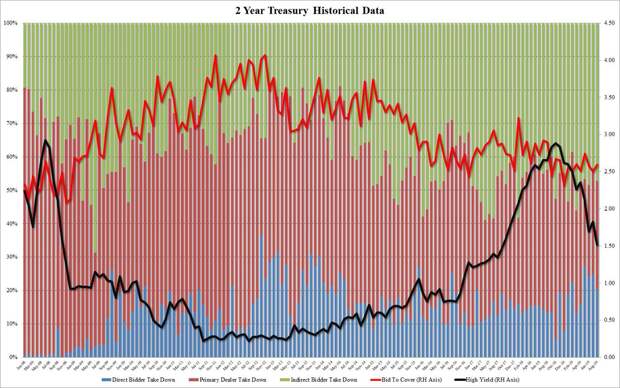

Despite the sharp drop in yield, the internals were quite solid, with the Bid to Cover rising from 2.50 to 2.60, above the six-auction average of 2.57. More importantly, foreign buyers were present unlike July, with the Indirect bid jumping from 43.5% to 47.1%, also above the recent average of 46.8%. And with Directs taking down 20.4%, roughly in line the recent average, that left Dealers holding 32.5%.

Overall, a solid auction which took place just as the 10Y yield dropped to session lows of 1.47%, and which had no impact on the curve due to what appeared to be substantial demand even as yields continue to slide.