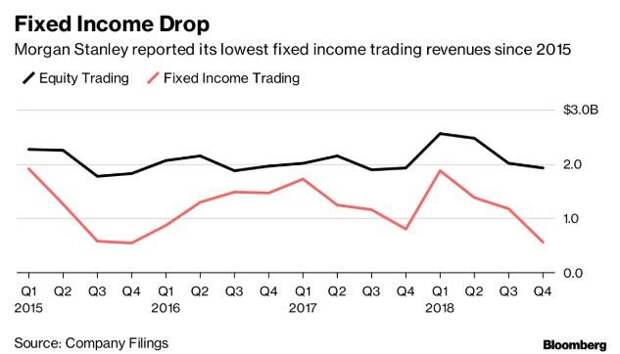

After 5 out of 5 big investment banks reported disappointing FICC revenue results, hopes that Morgan Stanley would break the trend when it reported Q4 earnings this morning were subdued at best, and for good reason: moments ago the bank reported Q4 FICC revenue of just $564MM, a huge miss to the $823MM consensus expectation and a whopping 30% drop Y/Y which was also the lowest fixed income trading revenue since 2015.

Had that been all, the bank may have scraped through unscathed like so many of its peers, but whereas other banks managed to cover up for FICC disappointment with the outperformance of other groups, Morgan Stanley did not, and as a result Q4 revenue printed at just $8.55BN, far below the $9.35BN expected and in fact below the lowest estimate in the range of forecasts of $8.97BN to $10.17BN.

This also resulted in a painful EPS miss, with the company reported 73 cents in Q4 EPS, far below the 89 cents expected, a number which excluded a 7 cent per share tax benefit. And while net income more than doubled to $1.53 billion from $643 million a year earlier, that is because the firm took a $1 billion charge related to the U.S. tax overhaul last year.

So alas whereas other banks could at least pretend the core business is doing well, MS had no such luxury, especially since equity sales and trading revenue of $1.93BN also missed expectations of $2.01BN; the number was "essentially unchanged from a year ago reflecting higher revenues in the financing business, partially offset by lower results in execution services." As for the FICC plunge, the bank said that this is due to "unfavorable market making conditions that resulted from significant credit spread widening and volatile rate movements."

The company's key Wealth Management group also disappointed, reporting pre-tax income from continuing operations of $1.0 billion compared with $1.2 billion a year ago. Net revenues for the current quarter were $4.1 billion compared with $4.4 billion a year ago principally driven by losses related to investments associated with certain employee deferred compensation plans. Even so, total client assets were $2.3 trillion and client assets in fee-based accounts were $1.0 trillion at the end of the quarter.

There was a silver lining in the bank's investment banking revenue of $1.49BN which while unchanged from a year ago, was better than the $1.35BN expected.

- Advisory revenues of $734 million increased from $522 million a year ago on higher levels of completed M&A activity across all regions.

- Equity underwriting revenues of $323 million decreased from $416 million a year ago reflecting lower revenues primarily on IPOs.

- Fixed income underwriting revenues of $360 million decreased from $499 million a year ago driven by lower bond and loan issuances.

Alas, this was not enough to offset the broader gloom. To be sure, the bank tried to make up for the drop in revenue by slashing expenses, as compensation costs of $3.8 billion decreased from $4.3 billion a year ago on lower net revenues, partially offset by

a reduction in the portion of discretionary incentive compensation subject to deferral (non-compensation expenses of $2.9 billion increased from $2.8 billion a year ago).

Of course, CEO James Gorman was optimistic, saying that "In 2018 we achieved record revenues and earnings, and growth across each of our business segments – despite a challenging fourth quarter. We delivered higher annual returns, producing an ROE of 11.8% and ROTCE of 13.5%, as we continued to invest in our businesses. While the global environment remains uncertain, our franchise is strong and we are well positioned to pursue growth opportunities and serve our clients."

Yet after the first truly dreadful bank results of the earnings season the market disagreed, and MS stock, which is a 0.2% contributors to the S&P, tumbled 5% and sent US equity futures near session lows and in danger of breaching 2,600 - the new key support - in the S&P500.