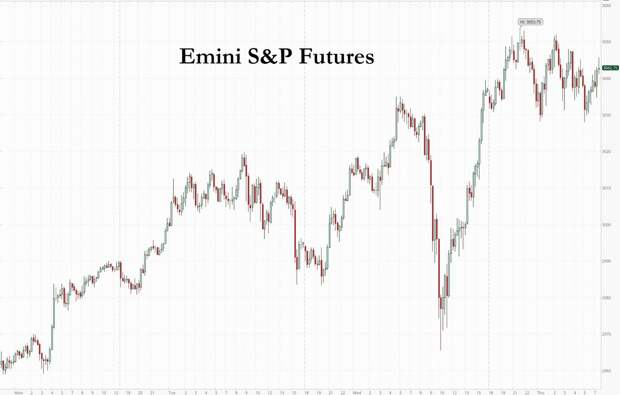

The S&P's remarkable stretch of posting gains in the overnight session continued for another day, with the S&P rising as high as 3,053, and last trading 9 points higher at 3,044, tracking global stocks higher, with Europe's Stoxx 600 rising 1.

3% to session highs as investors weighed again increased friction between America and China and the official passage of China's National Security Law in defiance of Trump, against fresh fiscal stimulus promised by the European Union. Treasuries edged up, while the dollar was modestly lower even as traders "treaded water" ahead of further escalations in the US-China clash.The S&P - which hit a three-month high on Wednesday, closing above the key psychological level of 3,000 amid growing evidence of a pick up in business activity - continued its levitation on Thursday despite a dip in Nasdaq futures, which turned lower amid fear President Trump’s upcoming social media executive order will target tech heavyweights and open door for penalties. Chipmakers, which are sensitive to China’s growth, were also under pressure, with Intel Corp and Advanced Micro Devices Inc dropping about 1% each in premarket trade.

In a bright spot, Boeing Co climbed 4.2%, the most among the 25 Dow components trading before the bell, after the planemaker said it had resumed production of its 737 MAX passenger jet at its Washington plant.

President Donald Trump has promised action over China’s new national security legislation for Hong Kong by the end of the week, and on Wednesday Mike Pompeo said the US will no longer consider Hong Kong autonomous from China, setting the stage for further sanctions.

Analysts have warned the souring relations between the world’s two largest economies in recent weeks over trade and the handling of the coronavirus outbreak pose the biggest threat to the stock market’s strong rally off the March lows, although so far markets have largely ignored such a risk. Today investors will also ignore the Labor Department’s latest data which is expected to show that more than another 2 million Americans sought unemployment benefits for the 10th straight week.

The Stoxx Europe 600 rose for a fourth session, a day after the EU boosted its spending pledge to battle the impact of the coronavirus to €2.4 trillion. A gauge of euro-area confidence inched up from a record low, adding to the bullish mood.

Earlier in the session, shares climbed throughout most of Asia, even as Hong Kong's Hang Seng Index flirted with the lowest level since March after the U.S. said it could no longer certify Hong Kong’s political autonomy, a move that could have far-reaching consequences. Asian stocks were led by finance and industrials, after rising in the last session. Markets in the region were mixed, with Japan's Topix Index and India's S&P BSE Sensex Index rising, and Hong Kong's Hang Seng Index and Taiwan's Taiex Index falling on fears of a China crackdown. The Topix gained 1.8%, with DLE and Enish rising the most. The Shanghai Composite Index rose 0.3%, with Beijing Jingyuntong Tech and Gree Real Estate posting the biggest advances.

Here is a recap of the latest mostly chronological back and forth between the US and China, courtesy of RanSquawk

- US House passed bill calling for sanctions on Chinese officials related to the crackdown on Uighur minorities as expected with the final vote count at 413-1, which sends the bill to US President Trump for signing.

- China Embassy in US reiterated Hong Kong affairs are internal, while it added that US Security legislation is very narrow and China will take all necessary counter measures for meddling. Furthermore, it stated that China legislature will vote on security bill today and the law would allow China to establish security bases in Hong Kong to provide stability as per the Basic Law approved between China and Hong Kong.

- Beijing is “prepared for the worst case scenario” with the US. Chinese government advisers said China expected tensions with the US to escalate, but Beijing’s retaliation would depend on US action, cited by SCMP. (SCMP) While the Global Times reported that China could strongly retaliate if US takes action on Hong Kong; could target US service industries.

- China's Parliament has voted to approve the Hong Kong National Security Bill, as expected. Subsequently, US to reportedly expel Chinese students with military school ties, according to sources via NYT.

- Chinese Embassy said it is strongly dissatisfied and firmly opposes the Canadian court's decision on the Huawei CFO, while it added that Canada is an accomplice to the US efforts to harm Huawei and Chinese tech, as well as urged for the immediate release of the CFO.

Economic optimism was boosted overnight by St. Louis Fed President James Bullard who said the American economy may already have bottomed even as Coronavirus deaths reached 100,000. Australia’s central bank chief said that country’s downturn may not be as severe as first thought. Investors have responding to the recovery by rotating into value stocks most punished in the coronavirus crash. Norwegian Cruise Line and Royal Caribbean Cruises are up more than 25% on Wall Street this week, while Europe’s TUI AG tour operator, Cineworld Group and EasyJet Plc airline have surged more than 35%. Traders will be closely watching today’s unemployment numbers in Washington for further clues on the state of the U.S. economy.

In rates, Treasuries traded in a narrow range with belly outperforming ahead of 7-year note auction at 1pm ET, the final event of this week’s cycle. Firm US equity index futures limited gains for Treasuries while bunds outperform after German regional CPI data. TSY yields were lower by ~1bp across belly intermediates while long-end trades slightly cheaper, steepening 7s30s by ~1.5bp ahead of 7Y supply event; bunds outperform by 2bp vs. Treasuries while gilts lag by 1.2bp

In FX, the Bloomberg Dollar Spot Index pared an earlier advance as European stocks advanced and U.S. equity futures were mostly higher, with traders weighing the reopening of economies against escalating tensions between Washington and Beijing. The euro touched its strongest level against the dollar since April 1 in the Asian session, only to give up those gains in London trading and hover around the 1.10 handle; yields on bunds and Treasuries edged lower. The pound swung between gains and losses; gilt yields reversed an early climb ahead of a speech by BOE’s Saunders where traders may look for his thoughts on negative interest rates. The Norwegian krone and the Canadian dollar were the worst performers as oil prices edged lower ahead of a weekly report over crude oil inventories. The Aussie recovered after earlier falling against the greenback as the world’s biggest economies continued to spar over a new security law in Hong Kong and China’s handling of the virus pandemic.

In commodities, WTI July and Brent August futures saw a session of modest losses thus far with the contracts meandering just around 32.60/bbl and 35.50/bbl respectively (vs. low of USD 31.14/bbl and USD 34.35/bbl) with some pointing to sentiment-led losses amid the rising tensions between US and China, whilst a surprise build in API Inventories (+8.7mln vs. Exp. -1.9mln) only added to the bearish tone.

U.S. economic data calendar includes second estimate 1Q GDP, durable goods orders, initial jobless claims (8:30am), April pending home sales (10am) and May Kansas City Fed manufacturing (11am); personal income/spending, PCE deflator, MNI Chicago PMI and University of Michigan consumer sentiment revision are ahead Friday

Market Snapshot

- S&P 500 futures up 0.2% to 3,041.75

- STOXX Europe 600 up 0.9% to 352.97

- MXAP up 0.8% to 150.65

- MXAPJ down 0.01% to 474.14

- Nikkei up 2.3% to 21,916.31

- Topix up 1.8% to 1,577.34

- Hang Seng Index down 0.7% to 23,132.76

- Shanghai Composite up 0.3% to 2,846.22

- Sensex up 1.6% to 32,123.07

- Australia S&P/ASX 200 up 1.3% to 5,851.10

- Kospi down 0.1% to 2,028.54

- German 10Y yield fell 1.0 bps to -0.424%

- Euro down 0.09% to $1.0996

- Italian 10Y yield fell 4.8 bps to 1.331%

- Spanish 10Y yield fell 1.0 bps to 0.636%

- Brent futures down 0.9% to $34.43/bbl

- Gold spot up 0.7% to $1,721.09

- U.S. Dollar Index down 0.2% to 98.92

Top Overnight News

- Chinese lawmakers approved a proposal for sweeping new national security legislation in Hong Kong, defying a threat by U.S. President Donald Trump to respond strongly to a measure that democracy advocates say will curb essential freedoms in the city

- Donald Trump is poised to take action Thursday that could bring a flurry of lawsuits down on Twitter, Facebook Inc. and other technology giants by having the government narrow liability protections that they enjoy for third parties’ posts, according to a draft of an executive order obtained by Bloomberg

- Economic sentiment in the euro area rose to 67.5 in May from a record low 64.9 after companies started to reopen across the continent following the easing of pandemic restrictions; missed an forecast rise to 70.6

- The global jobs slump caused by the coronavirus pandemic is bottoming out, if data from LinkedIn is a guide. The social networking platform says the percentage of its members who joined a new employer stabilized over the past six weeks, after plunging in March

- Measures of high- frequency data and confidence increasingly suggest a bottom has been reached in the worst global recession since the Great Depression

- Citigroup Inc. will gradually start bringing traders back to its London offices in the coming weeks as U.K. leaders continue to craft plans to ease social distancing restrictions

Asian equity markets traded mixed as China concerns counterbalanced the momentum from a firm Wall St handover where ongoing reopening efforts and a continued resurgence of cyclicals underpinned the major US indices. ASX 200 (+1.3%) was higher with the top weighted financials sector leading the broad gains in the index although energy lagged following a pullback in oil prices which was exacerbated by bearish inventory data, while Nikkei 225 (+2.3%) benefitted from favourable currency moves and the KOSPI (-0.1%) failed to stay afloat despite the BoK delivering a widely expected 25bps rate cut to bring the 7-Day Repo Rate to 0.50%. Elsewhere, Hang Seng (-0.7%) and Shanghai Comp. (+0.3%) were choppy with mainland China initially supported after another firm liquidity effort by the PBoC which injected CNY 240bln through 7-Day Reverse Repos. However, the gains were short-lived and Hong Kong markets underperformed due to the ongoing US-China tensions with Trump administration said to be considering suspending Hong Kong's preferential tariff rate for exports to US which means they could face the same tariffs US had imposed on mainland China. Furthermore, Global Times suggested the nuclear option of dumping USD-denominated assets was among the tools for China to exert financial pain on the US and China’s Embassy in US stated that Beijing will take all necessary counter measures for meddling, while the US House passage of the sanctions bill for Uighur human rights abuses and Huawei’s CFO losing a key battle in the extradition case, all added to the ongoing toxic relationship between the world’s top economic powerhouses. Finally, 10yr JGBs were flat amid similar uneventful after-hours trade in T-notes and indecisiveness in stocks, as well as mixed results at today’s 2yr JGB auction.

Top Asian News

- Nissan Reports Losses, New Turnaround Plan to Seek Growth

- Taiwan Lowers 2020 Growth Forecast as Virus Weighs on Economy

- Japan Says Economy Worsening Rapidly Even as Shutdowns Ease

European equities (Eurostoxx 50 +0.9%) have started the session on the front-foot once again as optimism surrounding reopening efforts across the continent continues to out-muscle concerns over mounting US-China tensions. HK-exposed HSBC (-2.1%) and Standard Chartered (-1.3%) are trading lower following reports that the Trump administration is reportedly considering suspending Hong Kong's preferential US tariff rate for exports to US in response to China’s (now passed) security law. However, this is yet to have any major follow-through to broader sentiment with price action in Europe taking a similar shape to those of recent sessions with travel & leisure names top of the pile once again. Specifically, for the sector, easyJet (+8.5%) are trading higher after announcing that summer demand indications are improving and the Co. is to consult on a proposal to lower its headcount by up to 30%. In sympathy, Deutsche Lufthansa (+4.2%), Ryanair (+2.8%), IAG (+2.3%) are all trading firmer once again. However, it is worth noting that the Stoxx 600 travel & leisure index is still trading lower by around 30% YTD. In-fitting with the theme of optimism surrounding travel names and reports yesterday that Boeing has resumed production at its Renton facility and will gradually ramp up output over the year, supplier Safran are trading higher by 2.8%. Elsewhere, support has been seen for the tech sector with the likes of Dialog Semiconductor (+3.8%), STMicroelectronics (+3.8%) and Infineon (+3.1%) bolstered by US-listed Micron Technology raising its Q3 revenue forecast yesterday. To the downside, Centrica (-3.3%) are a noteworthy laggard with the Times noting that the Co. could be at risk of losing its place in the FTSE 100. The article also noted that Carnival, easyJet, Meggitt, ITV, M&G and Prudential could also face the chop in what could be one of the largest reshuffles since the GFC.

Top European News

- Swedish Dirty Money Affair Brings Bankers Closer to Police

- Euro- Area Confidence Inches Up From Record Low as Lockdown Eased

In FX, there was little action thus far in the broader Dollar and index as the latter pivots 99.000 having printed an overnight base at 98.773 and a current high at its 100DMA at 99.034. Tensions between US and China will remain a theme with no apparent signs of subsiding for now – with Hong Kong no longer deemed autonomous from China and Beijing reiterating its readiness to retaliate over interference. USD/CNY traded on the softer side of 7.1530-7.1680 band after the PBoC set a firmer CNY fixing than expected, albeit weaker vs. yesterday. CNH meanwhile remains flat around 7.1450 vs. USD after the pair yesterday threatened a fresh record high at 7.1965. In terms of scheduled events State-side, today’s docket sees US Durable Goods and Q1 GDP (2nd) with the former expected to deteriorate further whilst the latter expects no revisions. Fed’s voter Williams is unlikely to add much meat to the bones following yesterday’s remarks.

- AUD, NZD, CAD - All choppy within tight ranges vs. the Buck after earlier sensitivity to the escalating spat between US and China. AUD/USD dipped below 0.6600 despite RBA governor Lowe firmly dismissing negative rate – with some pointing to profit-taking amid trade risk. The pair recovered off lows around 0.6590 vs. high 0.6635. Elsewhere, the RBNZ Financial System Policy chief played down financial stability concerns from negative rates. The Kiwi reversed its earlier move lower but remains sub-0.6200 vs. the Dollar, having had failed to sustain gains above its 100 DMA at the round figure. Meanwhile, the Loonie also tracks softer energy prices with USD/CAD gaining ground above its 100 DMA (1.3709) and eyes a retest of 1.38 to the upside ahead of Q1 Canadian Current account data and stale average weekly earnings for March.

- GBP, EUR - Mixed trade with Cable choppy whilst EUR/USD treads water at 1.1000 following an uneventful start to the session. The Single currency side-lined German regional prelim CPIs - largely followed the expectations for the nationwide release – alongside a mixed EZ sentiment survey. EUR/USD sees EUR 960mln opex at 1.0995-1.1000 with a further EUR 900mln between 1.1020-25 ahead of a Fib level around the 1.1050 psychological level. Saunders did little to change the overall narrative by said it safer to err on the side of easing too much and then tighten if necessary. Meanwhile, the wider focus remains on any hiccups over negotiations both regarding the EU Recovery Fund among EU27 and post-Brexit trade FTA between UK and the EU.

- JPY, CHF - Safe-haven FX trade on the softer side in daily ranges but more so on Dollar influence amid an indecisive risk tone. USD/JPY prods its 50/55 DMAs at 107.84-86 ahead of session highs 107.89 (low 107.67) and with a chunky USD 1.8bln in options expiring at stroke 107.90. USD/CHF oscillates on either side of 0.9700 but within a tight range of 0.9670-9705 relative to yesterday’s trade.

- RBA Governor Lowe said they will maintain expansionary settings until progress is being made towards employment and we are confident on inflation and said there will be a further decline in employment for May but jobs data was not as bad as previously thought. Lowe also stated that 25bps Cash Rate is effectively as low as it can go and that rates are to stay this low for some years and that they could purchase more government bonds if more QE is needed but does not currently see a need to do so, while he suggested that negative rates are extraordinary unlikely which come with a cost to the financial system and that he doesn't think negative rates will work. (Newswires)

In commodities, WTI July and Brent August futures see a session of modest losses thus far with the contracts meandering just around USD 32.60/bbl and USD 35.50/bbl respectively (vs. low of USD 31.14/bbl and USD 34.35/bbl) with some pointing to sentiment-led losses amid the rising tensions between US and China, whilst a surprise build in Private Inventories (+8.7mln vs. Exp. -1.9mln) only added to the bearish tone. Some downside could be emanating from reports that Russian Co's have been raising concerns regarding maintaining cuts with Energy Minister Novak after softly rejecting an extension of current cuts past June – stating that the market could rebalance sometime between June/July. Elsewhere, spot gold sees inflows and investors stock up on the yellow metal ahead of potential US-China tit-for-tat measures. Prices gain a firmer footing above USD 1700/oz and reside around session highs north of USD 1720/oz.

US Event Calendar

- 8:30am: Durable Goods Orders, est. -19.05%, prior -14.7%

- 8:30am: Cap Goods Orders Nondef Ex Air, est. -10.0%, prior -0.1%

- 8:30am: Cap Goods Ship Nondef Ex Air, est. -12.2%, prior -0.2%

- 8:30am: GDP Annualized QoQ, est. -4.8%, prior -4.8%

- 8:30am: Personal Consumption, est. -7.5%, prior -7.6%

- 8:30am: GDP Price Index, est. 1.3%, prior 1.3%

- 8:30am: Core PCE QoQ, est. 1.8%, prior 1.8%

- 8:30am: Durables Ex Transportation, est. -15.0%, prior -0.4%

- 8:30am: Initial Jobless Claims, est. 2.1m, prior 2.44m; Continuing Claims, est. 25.7m, prior 25.1m

- 9:45am: Bloomberg Consumer Comfort, prior 34.7

- 10am: Pending Home Sales MoM, est. -17.0%, prior -20.8%; Pending Home Sales NSA YoY, est. -28.65%, prior -14.5%

- 11am: Kansas City Fed Manf. Activity, est. -22, prior -30

DB's Jim Reid concludes the overnight wrap

Every night when I’m home, which is unsurprisingly all the time at the moment, I tend to put the twins to bed and my wife puts Maisie to bed. Out of nowhere last night Maisie asked me to put her to bed for the first time in ages. I wasn’t warned as to how her bedtime routine had changed since I last did it. Unless she was having me on she gets two stories and then is allowed two questions that she wants answers to. Her two questions last night to me were 1) how is conditioner and shampoo made? and 2) how are mirrors made? I had no idea so rather than bluff my way through I showed her a couple of YouTube videos on my phone explaining it. She then said “Daddy, I’d be so much cleverer if you bought me a phone”. She’s 4 and three quarters!! However at least she didn’t ask me to explain why US equities are within a few percentage points of their all-time high again even though large parts of the global economy remain closed. I’m not sure there’s a video for that. Maybe I’d show her a clip of an oil well gushing as a symbol for the remarkable liquidity out there at the moment.

On that note global equities continued their rally yesterday as optimism around vaccines, economies reopening, and the unveiling of a proposal for a €750bn EU recovery fund outweighed another exchange of salvos in the recent US-China sparing match.

The rally indeed survived a US midday dip after an announcement that the US would no longer consider Hong Kong politically separate from China. At that point, the S&P fell to -0.47% on the day. However, by the end of the session the S&P 500 had finished up +1.48% to close over 3000 for the first time since March 5 – reaching an 11-week high. Also helping were remarks by Dr. Fauci, the U.S. government’s top infectious-disease expert, who said there’s a “good chance” a vaccine may be available by November or December.

Yesterday’s rally was much like the day before, with virus laggards leading the broad index while the recent winners lagged. All 24 industry groups finished higher, but one element of the recent leg higher to pay attention to is the into-value-out-of-growth rotation. Bank stocks led yesterday’s rally, up +6.70% on the day and up +15.09% over the last 2 days, compared to the +0.42% Technology sector’s 2-day return. A remarkable turn.

Europe also rose as the STOXX 600 climbed +0.24%. The DAX was up +1.33% and at a 10-week high, the CAC was up +1.79%, the FTSE was +1.26%, while the FTSEMIB also barely outperformed the broader index at +0.28%.

Europe was generally feeding off the European Commission recovery fund plan. President von der Leyen presented a proposal for a €750bn EU recovery instrument, €500bn of which would be distributed in the form of grants and the other €250bn in loans to member states. The debt would be repaid through higher future contributions to the EU budget and possible new revenue streams, including an Emissions Trading Scheme, a tax on high-emission imports and a tax on digital companies. The plan still requires the support of EU member states, and while Chancellor Merkel and President Macron have offered their support, some of the northern countries have balked at the idea of offering grants rather than loans. This comes on top of an EU Budget of €1100bn over the next seven year that roughly matches the pre-COVID-19 proposal from February. See our European economists views on the new proposals here.

The EC’s proposal came shortly after ECB President Lagarde announced that the euro-area economy is set to see output shrink by between 8-12% this year, in line with the central bank’s most pessimistic forecasts. Lagarde will have a better idea when the numbers are published in early June, but said “it’s likely we will be in between the medium and severe scenarios.” In light of the need for further stimulus, Lagarde was confident that higher public spending would not cause a debt crisis. This is especially true if the spending is used to increase country’s productivity, the “use of debt is not only recommended, it’s the way to go.”

The news of the pending recovery plan and especially the mix of grants and loans proposed were net positive for peripheral spreads yesterday. Greek 10yr bonds tightened the most (-9.4bps) to German 10yr bunds. Italian BTPs were -6.3bps tighter, while Portuguese bonds tightened -7.0bps. Spanish bonds, on the other hand, were mostly unchanged.

German 10yr bond yields were +1.5bps higher to -0.414%. In other sovereign debt, US 10yr treasuries rallied even as equities continued to outperform with yields -1.1bps lower to 0.685%. European credit also benefited from the news yesterday, with high yield cash spreads -25bps tighter. Euro IG tightened -7bps on the day, while US HY and IG cash spreads tightened -5bps and -2bps respectively.

Oil prices had their worst day in some time though as news came out that Moscow wanted to scale back its cuts once the current agreement lapses in July. Even though President Putin and Saudi Arabia later pledged to continue coordinating ahead of the OPEC+ meeting in early June, WTI front-month futures fell -4.40%, the largest one-day fall in a month, while Brent crude futures fell -3.79%, the most since 11 May.

Overnight, Asian markets have traded more mixed with the Nikkei (+1.24%) and ASX (+1.08%) posting gains while the Hang Seng (-1.81%) and Shanghai Comp (-0.35%) are down following the US announcement mentioned at the top. The Kospi has also faded to trade down -0.83% after the Bank of Korea cut rates by 25bps to a record low of 0.5%. The BoK also cut the GDP growth target to -0.2% yoy from a forecast of +2.1% yoy growth in February. One talking point from the press conference was the reference by Governor Lee to “should it be deemed necessary to expand the accommodative stance of monetary policy further, we could actively respond with policy tools other than rates”. Our economists have previously suggested that the BoK could go down the YCC route.

Moving on. The positive risk moves yesterday were weighed down somewhat by another round of tensions tightening between the US and China. Following reports on Tuesday that the US was looking to sanction China over implementing a new national security law, which would curtail the rights and freedoms of Hong Kong citizens, Secretary of State Pompeo said yesterday that the U.S. has certified Hong Kong is no longer autonomous from China politically. The move could have consequences on Hong Kong’s special trading status with the US. The CCP-aligned Global Times posited that a countermeasure to Pompeo’s move would be to expedite the new security law’s progress. After the market closed, the US House voted almost unanimously (413-1) to pass the Senate’s bill authorizing sanctions against Chinese officials for human rights abuses against Muslim minorities. The bill now goes to President Trump’s desk, who has not indicated how he will proceed. On the trade front, there was a Bloomberg report that China is looking to buy Brazilian soybeans – while not bidding for American soy yesterday – in a sign that the country is readying for another round of tensions with the US. With virus cases appearing to remain in-check in most developed economies and economies starting to slowly reopen, a deterioration in this relationship may be risk factor to pay attention to.

Yesterday, there was not much data to mention, though the Fed released its Beige Book, which collects anecdotal information on current conditions. The highlights included that many contacts expressed hope that overall activity would increase when businesses reopened, but that the outlook remained uncertain and they were pessimistic about the pace of recovery. The other development of note was the challenges to get employees back to work, including workers’ health concerns, limited access to childcare, and generous unemployment insurance benefits. Also in the US, the Richmond Fed manufacturing survey came in at -27 (vs. -40 expected), up from -53 last month. In Europe, France released business and manufacturing confidence readings. Business confidence was up to 59 (below the 69 expected) from 53, while manufacturing confidence was up to 70 (below the 85 expected) from 68 (revised down from 82). The absolute readings of both confidence indicators are near the record lows seen in 2009 and 1993.

In terms of data for today, weekly jobless claims are likely to continue improving but still remain over three times as high as the pre-coronavirus record high. Our US economists are forecasting a 2.1m reading for the week through May 23, compared to the 2.438m last week. Individual states continue to have problems with the massive number of initial filers and so there may be heavy revisions. If initial claims do come in less than last week, they will have slowed for their eighth straight week, a strong signal we are likely well beyond the peak.

To the rest of the day ahead now, data out of Europe will include consumer and economic confidence readings for the Euro Area, Italy’s May consumer confidence index levels and Germany’s preliminary May CPI print. In the US, the second estimate of Q1 GDP will be released along with the aforementioned weekly initial jobless claims. There will also be US durable goods orders, capital goods orders, pending home sales and May Kansas City Fed manufacturing activity readings. The Bank of Korea will release their monetary policy decision, in addition to remarks from the Fed’s Williams. Finally, earnings releases include Salesforce, Costco, Dollar General, and Nissan.