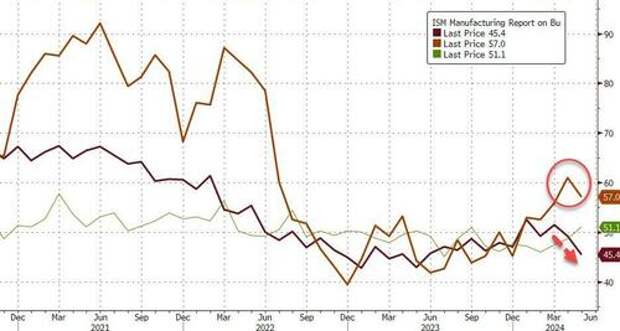

With 'hard' data plunging in May, it is surprising that S&P Global's flash survey of Manufacturing sentiment showed an uptick. Today we get the final print, with many asking will it catch down to ISM's drop.

. and will the ISM drop extend...Sure enough - despite the plunge in real data - S&P Global's Manufacturing PMI survey showed an even stronger improvement from 50.0 final in April to 50.9 flash for May to 51.3 final for May.

However, ISM's Manufacturing PMI tumbled further - dropping from 49.2 to 48.7 versus expectations for a small rise to 49.6. This tied the lowest forecast among analysts.

Source: Bloomberg

The ISM survey showed new orders declining at their fastest rate since Dec 2023 and Prices Paid down a smidge but well above the last 18 months levels...

Andrew Harker, Economics Director at S&P Global Market Intelligence, said:

“It was pleasing to see new orders return to growth in May following a blip in April. Although modest, the expansion in new work bodes well for production in the coming months.

In fact, manufacturers cited confidence in the future as a factor contributing to increases in employment, purchasing activity and finished goods stocks.

But...

“Cost pressures continued to build, however, with inflation on that front the strongest in just over a year.

Although output prices rose at a slower pace in May, this is unlikely to be sustainable should cost burdens ramp up further in the months ahead. ”

So hard data crashed, inflation expectations surged... not exactly the 'data-dependence' that dovsh Fed members are hoping to see.

Свежие комментарии