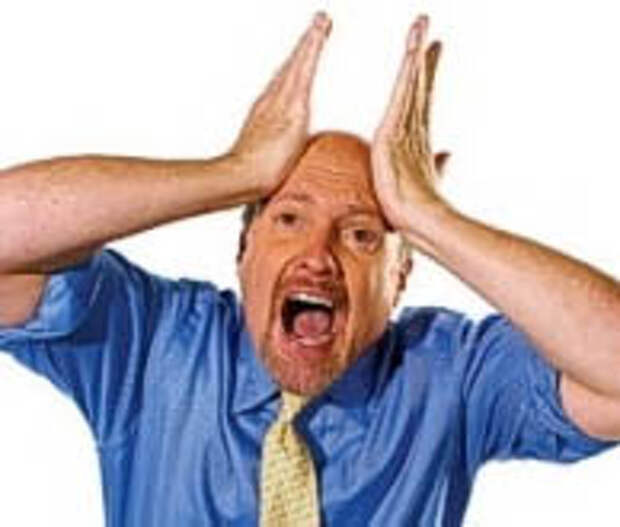

On April 6, just as the market was topping out, Jim Cramer wrote a column laying out what he called were "49 Stocks to Buy Right Now" which he qualified as "stocks that are clearly marked as winners no matter what, because they are domestic and because they do well precisely in this kind of environment."

He further rammed his picks down the throats of anyone gullible enough to actually listen to Cramer by saying that "every single one of these companies reported excellent last quarters, and with no exceptions their charts are pretty much perfectly made for this downturn.... You would not be able to get into these stocks without this selloff, and all of these companies are simply not going to skip a beat because of what came out on Friday."

One person decided to test just how "made perfectly for this downturn" Cramer's stock choices really were.

On April 6, a retired Professor of Finance in Southern Illinois, David England, unveiled the "Cramer Challenge" when he bought $1,000 of each security on Cramer’s list (in a paper-trade account of course - because in this day and age, everyone "trades" virtually, plus who would actually risk real money listening to Cramer) at the close of the following day.

England further put his own money on the table with his Gentleman’s Challenge. His offer was that after six months (October 7, 2015), if more of Cramer’s stock picks were up than down, England would pay for Cramer to fly from New York to Marion IL, put him up in a local Holiday Inn, and treat him to dinner. Cramer was to return the favor in New York, if more than half of his picks were down.

Cramer never responded to the wager offer.

England proceeded to tack the portfolio’s performance. England kept a weekly record of the results for the last six months. He also had the results audited by an independent third party.

Six months later, on October 7, England unveiled the results, and the performance of Cramer's "Buy Right Now" stocks that were "marked as winners no matter what."

His findings: only 14 of Cramer’s 49 stocks closed higher than their April trading price, 28% success rate. It also means that 35, or 72% of the total, closed lower than the day Cramer recommended said portfolio of stocks.

What was the total portfolio return? A 7.09% loss in just 6 months.

In lieu of a free dinner paid by the Mad Money host, England had this to say:

"No one is looking out for the little guy – the investor on Main Street,” England says.

“Wall Street will always be taken care of. When was the last time you saw any national media audit the results of the so-called 'Market Gurus'?""I have nothing against Mr. Cramer personally, but investors have to be aware of the risks if they blindly follow these so-called Market Guru’s. As a trader, investor, and Financial Educator, I have seen students of all ages jump in head first, purchasing stocks on “Buy” lists without using any buying systems as analysis. I understand the temptation because it’s so easy to just follow these recommendations and purchase the stocks. But it can be a recipe for financial disaster."

* * *

None of this should be news to anyone, and we are confused why England wasted his time with this particular exercise when he could have simply done the opposite of what Gartman recommended for the past 6 months (with the benefit that it changes every single day), and be the owner of several Greek islands by now.

For those curious, here is Cramer's "Buy Right Now" portfolio as announced on April 6, and how it traded through October 7.

Свежие комментарии