Quite a day...

-

Navarro dump - US-China trade deal "is over"

-

Trump pump - US-China trade deal "fully in tact"

-

Kudlow pump - "absolutely, definitely" no second lockdown due to virus

-

Fauci slump - "disturbing surge" in infections

-

Fauci pump - "promising" vaccine is imminent

Which of course ended with Nasdaq higher (for 8th straight day - longest streak since Dec - and up 19 of the last 22 days).

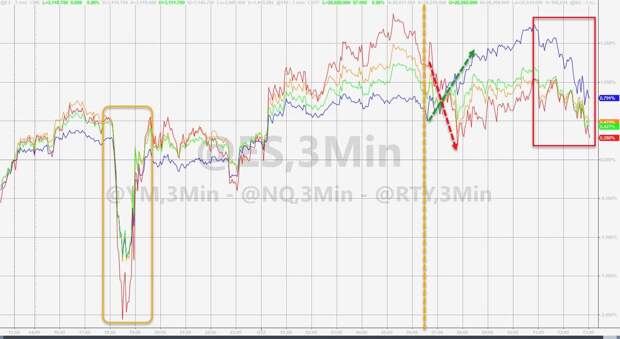

..NOTE how the Nasdaq was instantly bid and Small Caps dumped at the cash open...Led by the FANGs...

Source: Bloomberg

The last time FANGs were this overbought, it did not end well...

Source: Bloomberg

It would appear, thanks to constant jawboning and Powell's Put, that the Nasdaq has gone full Rick Astley...

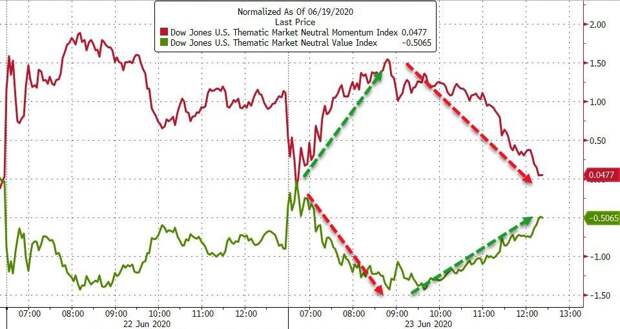

Quite a notable rotation intraday between momentum and value...

Source: Bloomberg

Despite equity gains, bonds were also bid in the belly of the curve...

Source: Bloomberg

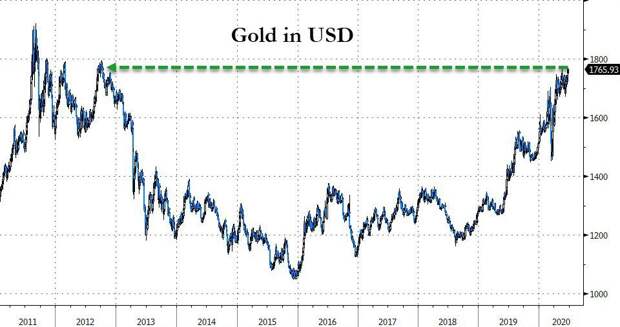

Gold was bid most of the day...

Source: Bloomberg

Pushing to its highest since 2012...

Source: Bloomberg

Silver futures got back above $18...

The dollar chopped up and down on the various headlines but ended lower on the day...

Source: Bloomberg

As the dollar dipped, Bitcoin was bid, trading near $9800 overnight...

Source: Bloomberg

Big roundtrip in WTI today ahead of tonight's inventory data...

Finally, the S&P 500 trades at 22x next 12m consensus EPS and Tech at 25x...

Source: Bloomberg

Bonds ain't buying it...

Source: Bloomberg

And gold's starting to flash red...

Source: Bloomberg

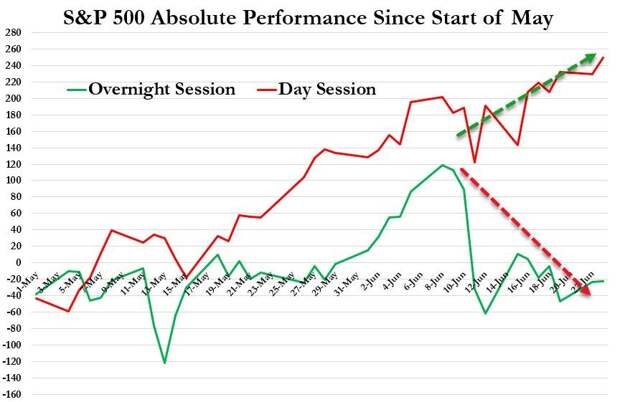

And in case you wondered, since the start of May, the S&P 500 is up 250 points during the overnight session and down 23 points during the day session.

..Trade Accordingly!