Looking at the stock of Hertz today, one would think the rental company launched a blockchained, cannabis-enabled version of ZOOM that also slices bread instead of, you know, filing for bankruptcy.

Why? Because as Bloomberg notes, Hertz became the most heavily traded U.S. stock Wednesday, with shares posting the largest gain on record before paring gains.

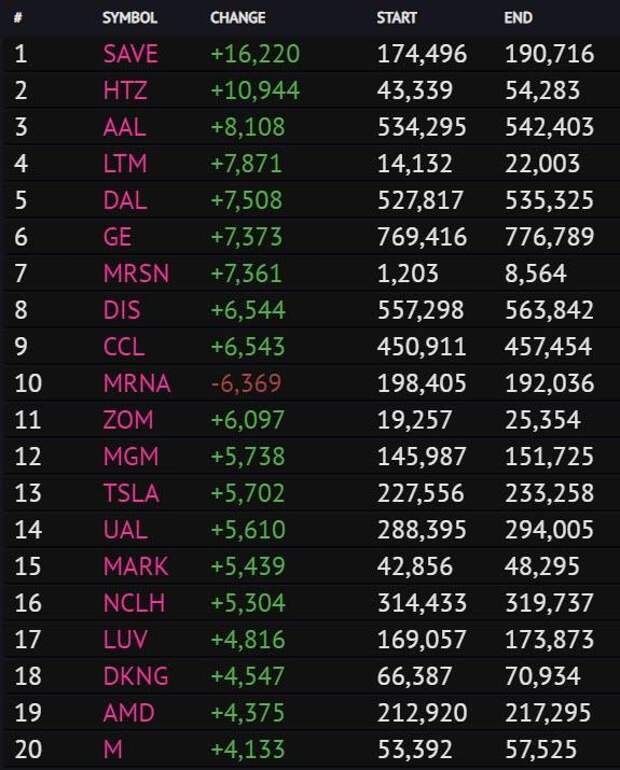

HTZ volume of 264 million was the most among US companies and more than double that of GE, which saw the second most activity; this flurry of activity helped the now worthless stock briefly reach $1.49, a record 168% increase, before paring gains to $1.00 only to rebound again and close at $1.31.

Why? Well, a familiar figure emerges once again: the retail investor. According to Robintrack which keeps tab on all the latest moves in the online platform (which was offline at the start of trading Wednesday for several hours until that whole pesky selloff nonsense was resolved), after the number of Robinhood retail holders of HTZ soared heading into the bankruptcy, on Wednesday, the bankrupt company was the second most popular stock on the free exchange...

... as investors first bought the fucking dip, and then bought the fucking bankruptcy.

And while it is unclear just what sparked today's furious retail buying, maybe the hope that Chair Powell will start buying all those used Hertz cars that will soon flood the market and push the bankruptcy company back into solvency, one thing we do know is that as retail traders were buying, Carl Icahn - formerly the company's largest sharehodler - was dumping right into their willing lap". From Bloomberg:

Billionaire investor Carl Icahn has sold out of Hertz Global Holdings Inc., the rental-car company that filed for bankruptcy last week and counted him as its biggest shareholder.

“Hertz has encountered major financial difficulties and I support the board in their conclusion to file for bankruptcy protection,” Icahn said in a regulatory filing Wednesday. “Yesterday I sold my equity position at a significant loss, but this does not mean that I don’t continue to have faith in the future of Hertz.”

A holding company controlled by Icahn, 84, held more than 55 million shares of Hertz as of the end of the first quarter, a roughly 39% stake, according to data compiled by Bloomberg. Icahn described himself as “an investor and supporter of Hertz since 2014,” when his holding company began building its position.

And thanks to the retail buying frenzy, funded by the government's stimulus checks, he had more than enough willing buyers. Incidentally, a similar pattern was observed in late April when Warren Buffett was liquidating his airline holdings. Guess who was buying.

This week Buffett said he sold his airlines.

— Jim Bianco (@biancoresearch)

At Robinhood, retail piled into "JETS"

Held by Robinhood accounts

#5 AAL (American) 500,642 accts

#6 DAL (Delta) 463,007

#16 BA (Boeing) 252,883

#18 UAL (United) 248,559

#39 JBLU (Jet Blue) 142,272

#41 LUV (Southwest) 141,746 pic.twitter.com/XkNBZ5FdtF

And while retail investors continue to steamroll hedge funds in their unbooked YTD performance, a reminder that it's not an actual gain until it is sold. For now, however, Joe Sixpack appears to be imitating the Fed's trading pattern to the dot: buying, but never selling. Yet while the Fed can always print more money if it needs it, there will come a time over the next few weeks, when the stimulus checks that have funded this period of especially acute insanity, will stop.