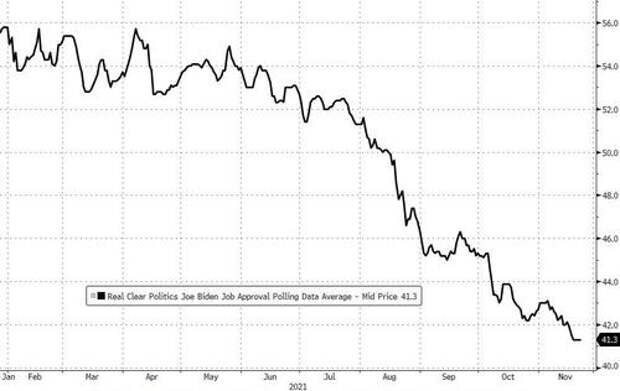

The much anticipated - and much poo-poo'd - release from global reserves (of 50 million barrels) was announced this morning as the Biden administration desperately tries to stop the freefall in its approval ratings.

So they "did something" - but it's not working.

As @GreeKFire32 notes so succinctly: "this accomplishes nothing... we consume 20 million barrels a day!"

LOL! this accomplishes nothing and the SPR is supposed to be used for emergencies not curing shitty poll numbers. 50 million barrels over several months?….we consume almost 20 million barrels a day https://t.co/nwT7miwflX

— GreekFire23 (@GreekFire23)

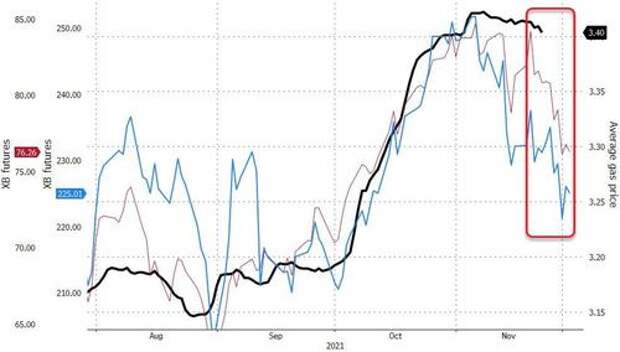

So, it should not be any surprise that while the kneejerk reaction was a brief jolt lower, prices are now notably higher post-SPR headlines...

Is this peak policy panic?

Kyle Bass explains that higher prices are coming and "it’s this kind of childish thinking that will compromise US National Security and harm the poor and underserved."

Get ready for explosively higher oil. 7 years of dramatic underinvestment in hydrocarbons fueled by ignorance like this will inevitably generate $100+ crude oil and $5+ prices at the pump for years to come.We all would love to see an overnight transition to alternative energy 1/3 https://t.co/fwJkRZzgQs

— 🇺🇸Kyle Bass🇺🇸 (@Jkylebass)

Bass adds:

But it’s this kind of childish thinking that will compromise US National Security and harm the poor and underserved.

A coordinated SPR release is a quick shot of morphine for a major infection.

It fixes nothing and is evidence of a panic 😱 in DC.

Prepare for $100 now...

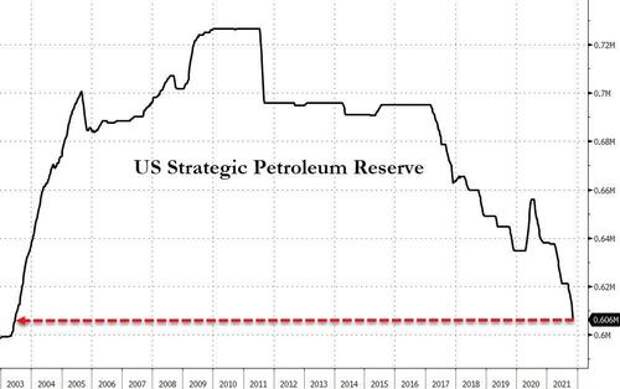

If anyone took the time to review US SPR data, the administration has been selling many millions of barrels each month for the last 90 days.

And for context, the globe consumes 100 million PER DAY.

A coordinated release of 50 million is nothing at all. Rounding error.

Who could have seen this coming? Well, us and Goldman for one: "A Biden SPR Release Is Now Fully Priced In And Will Send Oil Price Even Higher In 2022."

Finally, we note that gas prices at the pump are already likely to dip in the short-term as the supply chain lag from crude to wholesale to retail...

We can only imagine the back-patting and self-aggrandizement that this drop in gas prices will prompt (just don't be too quick to gloat).