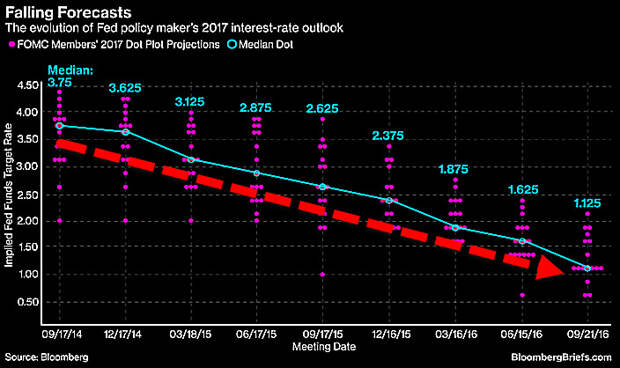

With The Fed expected to raise interest rates in a few minutes, (and likely jawbone about how the path to normalization is now progressing well), we thought it worth a reminder that FOMC officials’ quarterly interest-rate projections have gone nowhere but down since the last time they were marked up in September 2014.

As the infamous 'dot plot' reveals, Fed forecasts of rates for 2017 have fallen in line with the market's perceived credibility of the failing institution.

..You decide if what The Fed says today is worth paying any attention!

As Bloomberg notes, the latest projections, submitted in mid-September of this year, showed that the median forecast of the 17 policy makers on the Federal Open Market Committee was for two rate increases in 2017, down from the three-hike projection submitted in June.

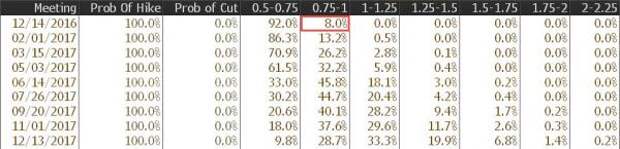

We also note that there is 8% chance priced in the market that The Fed hikes by 50bps today...