Continuing a point he first noted early this morning, in which JPM's Adam Crisafulli said that the Fed is no longer the driving force behind the market, moments ago the JPMorgan strategist provided his pre-FOMC market update, in which he admits that while the "Fed will dominate the Wed wires" he notes that "monetary policy really isn’t driving the tape at the moment and that won’t change following the final FOMC decision of the year.

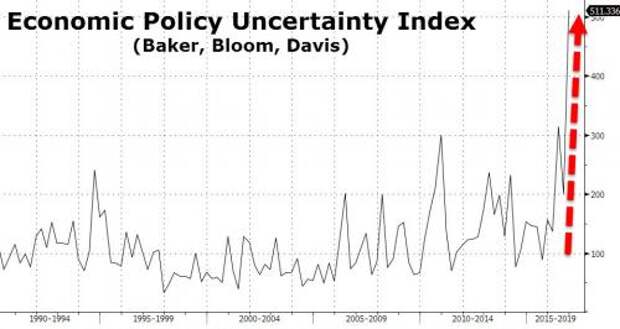

" So what is important? "Far more important is US politics and the specifics around Trump’s tax and regulatory plans – what is in the final legislation, when will that legislation pass, etc."Despite repeated warnings both here and elsewhere about this particular risk factor, the market continues to ignore it and as of this moment the S&P was trading largely unchanged on the day.

Select excerpts from JPM's pre-FOMC market update:

Market update – of course the Fed will dominate the Wed wires but monetary policy really isn’t driving the tape at the moment and that won’t change following the final FOMC decision of the year. Far more important is US politics and the specifics around Trump’s tax and regulatory plans – what is in the final legislation, when will that legislation pass, etc. On the tax front markets over the last few days are beginning to spend a lot more time digesting the particulars of the Trump/Ryan corporate reform platform, specifically the whole border adjustment issue, eliminating net interest expense deductibility, and immediate expensing for all capital spending (one of the lead FT articles Wed morning, “Republicans face corporate tax rebellion”, discusses the enormous pushback occurring from corners of Corporate America to the border adjustment proposals).

The deregulation enthusiasm also is being tempered as the press begins to look at the issue through the realm of political/legal reality (the WSJ Wed morning warned that Trump’s deregulation promises could take years to fulfill http://on.wsj.com/2hEqCb0). As far as news over the last 12-18 hours (in addition to the aforementioned political headlines), the big developments came on the economic front Wed morning as US numbers were weak on growth (retail sales) and firm on inflation (PPI). Bottom Line: the year-end momentum/chase rally continues and it doesn’t seem like much can disrupt it. However, political expectations are a major risk facing the market in CQ1.

US equity sector trends – most major sub-groups are trading lower w/the exception of tech, media, staples, and utilities. Tech remains a beneficiary of rental dollars seeking year-end long exposure (thus the ongoing strength in FB, AAPL, MSFT, GOOGL, etc.). Media has a solid bid w/FOX and CBS leading on the upside (while VIA’b remains an underperformer). The top underperformers include fins, healthcare, capital goods, energy, autos, and materials. Healthcare opened solid but has since faded; UHS is leading on the downside due to more political scrutiny (Raymond James downgraded) while ESRX is weak after its ’17 guidance update and generic/specialty drugs are getting hit on price fixing legal worries (VRX is hitting fresh multi-year lows). Capital goods are trading lower overall; defense stocks are bouncing after a few days of underperformance and LII is up on its ’17 guidance update but this is being offset by CMI, CAT, FLS, HON, GE, and BA weakness (note that GE and UTX will provide 2017 guidance updates later today). The financials continue to digest the recent strong rally (interestingly, two of the core post-11/8 rally areas, the BKX and RTY, have been underperforming all week). Autos are being weighed down by the neg. news out of China (both the OEM sanctions and the small-engine tax news).

Eurozone stocks – Eurozone stocks finished in the red (SX5E -0.76%, SXXP -0.5%). Top laggard groups included banks, retail, healthcare, and utilities. Tech, autos, and media all saw mild gains. It was a pretty quiet morning on the news front (esp. macro headlines although just as the political situation in Italy looks a bit more certain things are growing cloudy in Greece). Micro Focus and Metro AG both gained on earnings while Actelion slumped (after JNJ walked away from bidding although Sanofi is still apparently involved) and Dixons Cartphone was hit too (on earnings).