Ethereum traders had been exercising caution ahead of the April 12 Shapella hard fork (which allowed stakers to unlock their ETH rewards or stop staking entirely).

Anxiety had built on the possibility of selling pressure as the hard fork can theoretically unlock 18.1 million Ether on the Beacon Chain currently equating to over $34. 8 billion, however, several mechanisms are in place to prevent a flood of ETH from hitting the market, according to the Ethereum Foundation.

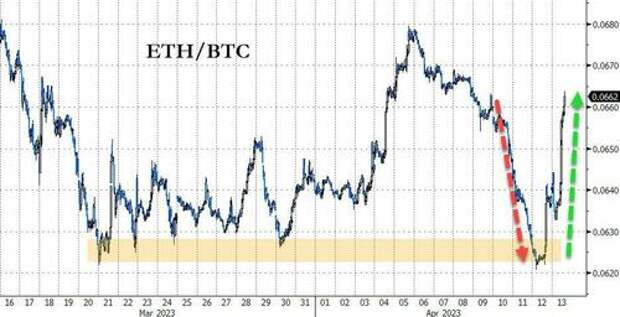

However, one look at the chart, relative to Bitcoin, shows the FUD of the last week has been erased...

As CoinTelegraph reported, according to Paul Brody, EY’s global blockchain leader, one additional reason for ETH's recent price underperformance relative to Bitcoin could be “the battle to keep Ethereum sufficiently and properly decentralized.”

Brody cites exchanges as highly centralized custodial validators, as well as some semi-centralized players and staking pool operations that invest funds from tens of thousands of individual crypto wallets.

However, as the fork was successfully executed, all eyes were on the actual volume of staking unlock requests.

As CoinTelegraph reported earlier, around 44% of validators, or 248,043 of the total active 559,549, can request a partial or full withdrawal.

The majority of withdrawals at this time range between 2.8 to 3.2 ETH, which suggests that it’s mostly staking rewards that are being withdrawn at this time.

The Ethereum Shapella upgrade has been activated and withdrawals are processing! pic.twitter.com/Krly5GB2K7

— eric.eth (@econoar)

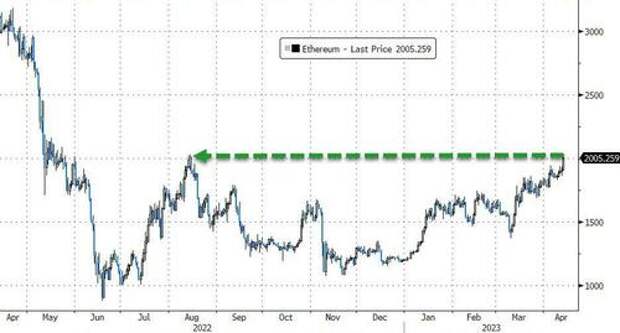

That is good news and the market is greeting it that way with ETH rallying above $2000 for the first time since August 2022...

It is the most significant upgrade since the Merge on Sept. 15 and it moves Ethereum one step closer towards a fully functional proof-of-stake system.