Submitted by Lance Roberts via STA Wealth Management,

Do You Need A Recession For A Bear Market

It has often been quoted in the media and by mainstream analysts that economic recessions are the root cause of "bear markets" in stocks. However, is that really true?

George Soros once discussed the idea of "reflexivity" suggesting that:

"Reflexivity sets up a feedback loop between market valuations and the so-called fundamentals which are being valued. The feedback can be either positive or negative.

Negative feedback brings market prices and the underlying reality closer together. In other words, negative feedback is self-correcting. It can go on forever, and if the underlying reality remains unchanged, it may eventually lead to an equilibrium in which market prices accurately reflect the fundamentals.

By contrast, a positive feedback is self-reinforcing. It cannot go on forever because eventually, market prices would become so far removed from reality that market participants would have to recognize them as unrealistic. When that tipping point is reached, the process becomes self-reinforcing in the opposite direction. That is how financial markets produce boom-bust phenomena or bubbles. Bubbles are not the only manifestations of reflexivity, but they are the most spectacular."

This idea of reflexivity is important in understanding the relationship between market psychology and the ultimate outcome of the markets themselves. While the vast majority of the media and analysts continue to assert the markets are fine because there is currently "no signs of recession," it ignores the impact of the psychology of the participants.

Eric Parnell recently noted the same stating:

"The basic assertion is the following: the U.S. economy is not showing signs of entering into recession, thus stocks are not at risk of falling into a sustained bear market.

Unfortunately, this conclusion is not necessarily true. For history has shown on numerous occasions that you do not need to have an economic recession looming on the horizon to see U.S. stocks fall into a bear market."

Eric is correct on his point for two very important reasons:

- Bear markets are a result of the switch of market psychology from "greed" to "fear" driven by an event that leads to a broad market "selling panic" that triggers a negative feedback loop in the market. (reflexivity)

- Recessions are coincident with market declines ONLY IN HINDSIGHT. The reason is due to the annual revisions to past economic data that only reveal the start and end of the recession after the fact. (The chart below shows this effect.)

Ponder this for a moment. If the above statements are true, then it is NOT recessions that cause bear markets but rather "bear markets" that cause recessions.

Giving credence to this thought was the Ben Bernanke's own admission in 2010, as he announced the start of the QE-2, that supporting asset prices was important to consumer confidence. In other words, falling asset prices reduce consumer confidence, and thereby their consumptive activity, which sparks the onset of economic recessions.

As Eric correctly notes:

"In a number of cases over the past century, a bear market in U.S. stocks was well underway long before a recession had taken hold of the U.S. economy."

The point is simply this. If you are waiting for the confirmation of a recession before taking actions to protect your investment portfolio, it will likely be far too late.

The 401k Crisis Is Getting Worse

I have written much about the sad state of financial affairs for the bottom 80% of Americans. To wit:

In order for individuals to invest, they must have discretionary "savings" with which to invest with. Unfortunately, between weak economic growth, stagnant incomes, rising costs of living and two major "bear" markets; nearly 80% of Americans simply are not able to participate as shown by numerous studies and statistical facts over the last few years:

* The number of Americans on food stamps has grown from 17 million in the year 2000 to more than 46 million today

* 47% of households save NOTHING.

* The percentage of the 16-54 population working today is lower than during the financial crisis.

* The number of workers over the age of 65 in the labor force is at record levels.

* Social benefits as a percentage of real disposable incomes is at record levels.

* The middle 20% of the income scale has a lower net worth today than in 2008.

* The NYT reports that the typical "American Household" is worth 36% less today as compared to a decade ago.

* 53% of American workers earn less than $30,000 a year.

* 76% of all Americans are living paycheck-to-paycheck

You get the idea. The economic backdrop has not been one that allows for participation by the average investor in the financial markets. As I discussed in "For 90% Of Americans There Has Been No Recovery," the Federal Reserve shows that the majority of the benefit of surging asset prices has been concentrated in the top 10% of income earners in the country, or those with capital to invest."

A recent Bloomberg article show the situation continues to worsen for many.

"The lack of plans is fueling a retirement-savings crisis. Few workers save anything outside of employer-sponsored plans. Only 8 percent of taxpayers eligible to set aside money in an IRA or Roth IRA did so in 2010, according to the IRS.

Those most vulnerable include both millennials at startups and managers in their 40s and 50s who've gone from corporate jobs with benefits to small businesses without them. Some 58 percent of the 68 million wage-and-salary workers without a company-sponsored retirement plan in 2013 worked for a business with fewer than 100 employees, according to the Employee Benefit Research Institute.

'The current 401(k) system was designed for a workplace that doesn't exist for most people: lifetime careers at big corporations that offer benefits. Saving consistently -- which you need to do for just a modest retirement income -- isn't remotely likely.' says Teresa Ghilarducci, an economist at the New School who researches retirement policies."

With wage growth on the decline, as increases in technology, robotics and productivity continue to suppress the need for labor, this problem will only become more exacerbated in the future. This all suggests that the drag on consumption will continue to weigh on economic growth and the curtailment of market returns in the future.

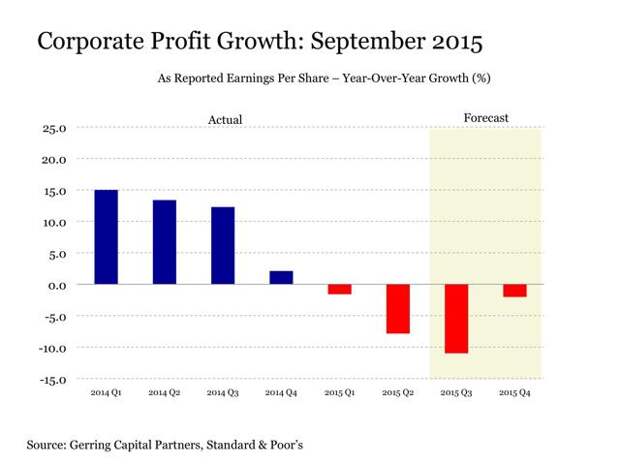

Earnings Revisions Worst Since Financial Crisis

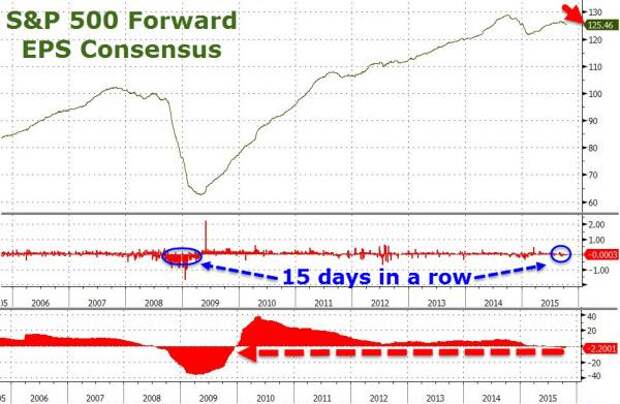

One of the more important data points about predicting "bear markets" is the acceleration/deceleration of earnings growth. Currently, the decline in corporate profits has become most concernings as the "earnings recession" continues to flash warning signals not seen since the last recession. As ZeroHedge noted recently:

"S&P 500 forward earnings expectations are down 15 days in a row - that is the longest losing streak since the financial crisis. In fact, S&P 500 earnings expectations are down over 2% year-over-year."

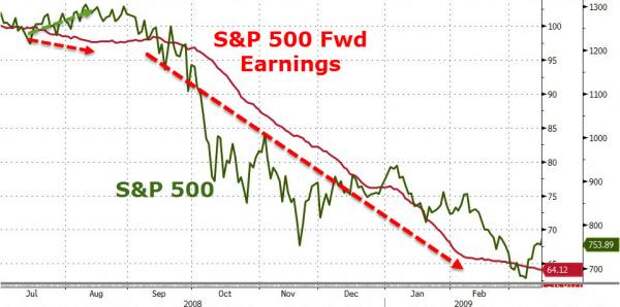

"The last time earnings growth expectation swung from positive to this negative was August 2008... and we know what happened next..."

And as Eric Parnell noted in his missive on recessions and bear markets noted above:

"In the heavily policy managed markets over the last three decades, focusing on an 'earnings recession' instead of an 'economic recession; has demonstrated itself to be a potentially more effective predictive mechanism of a looming stock market decline.

What do we mean by an "earnings recession"? It is when corporate earnings per share, say on the S&P 500 Index for the purposes of this discussion, fall into decline either on a sequential quarterly basis and/or on a year-over-year basis."

This is what it looks like currently...and is getting worse.

Just something to think about.