On Wednesday, Ray Dalio joined CNBC’s Andrew Ross Sorkin and Becky Quick for the Davos edition of Squawk Box which is inexplicably being filmed outdoors next to some snow-laden conifers despite the fact that it’s 19 degrees in Switzerland.

The “zen master” - whose “All Weather”, risk parity portfolio got caught in the rain without an umbrella during the flash crashing madness that unfolded in late August - weighed in on a number of topics, including the outlook for US rates.

The Fed, Dalio claims, is destined to abandon liftoff and the nascent tightening cycle in favor of more QE.

Why? Well because there’s an “asymmetric risk on the downside” for markets thanks to the fact that the Eccles cabal has spent seven years going “full-Krugman”, as it were. More specifically, by pumping trillions of dollars in fungible liquidity into the system, the FOMC has managed to inflate bubbles in virtually all financial assets meaning there’s really nowhere to go but down from here.

When those bubbles burst, Bernanke’s fabled “wealth effect” will reverse and the virtuous circle wherein Americans supposedly spend more because their 401ks look better will cease to go round, triggering a downturn and forcing Janet Yellen into a humiliating mea culpa.

More QE, more Keynesian insanity, and more leverage. Got it.

So much, we said, for Dalio’s “beautiful deleveraging.”

For those who needed MOAR Ray, you got it on Thursday when Dalio participated in a Davos panel discussion that touched on, among other things, China.

Although Beijing has a “balance of payments challenge,” Dalio says China’s problems are manageable.

Ben Bernanke agrees. "I don't think China's economic slowdown is that severe to threaten the global economy," the former Fed chair said at the Asian Financial Forum this week, before insisting that "the U.S. and China are not as closely tied as the market thinks."

Back in Davos, Dalio called the fact that Chinese debt is growing faster than incomes "unsustainable but understandable". Debt restructurings have been managed “superbly” in China, he adds.

Yes, a “superb” management of debt restructurings, where “superb” means simply refusing to allow banks to report real NPL numbers and stepping in to prop up SOEs and pseudo-SOEs when they miss a bond payment.

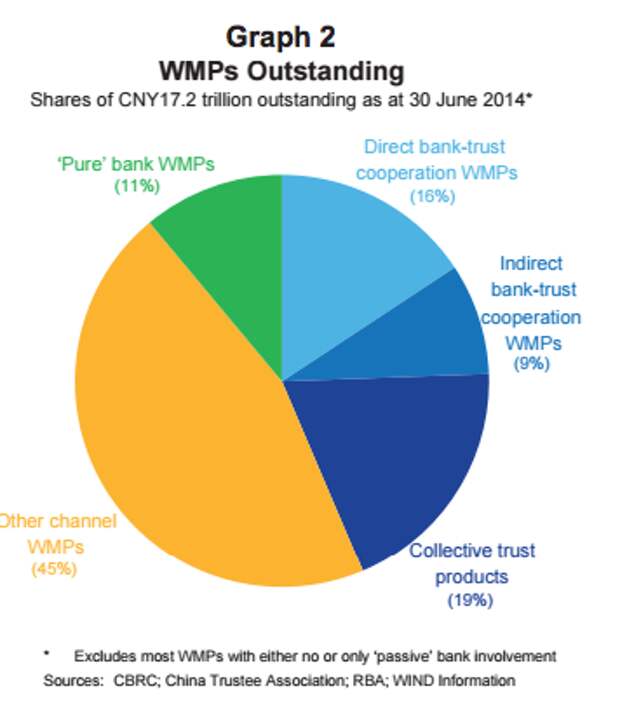

Dalio also weighed in on Beijing’s out of control shadow banking system which, you’re reminded, is responsible for the creation of the 8 trillion yuan, maturity mismatched black swan that we all know as China’s WMP industry. “China has developed its shadow lending system with a lot of balance,” Dalio supposes. Here's what "a lot of balance" looks like:

But the real punchline came when Dalio opined on the folks running the show in China's runaway markets. China is "not being run by loose cannons," he insists, adding that the country has a "real commitment to market reform."

Right. So bascially, "move along, nothing to see here."

We wonder if Dalio will change his tune once the "weather" (so to speak) worsens and China finally buckles under the weight of its $28 trillion debt burden, which Bernanke said on Tuesday is merely an "internal problem."

Check back in six months once the "beautiful" restructurings multiply.