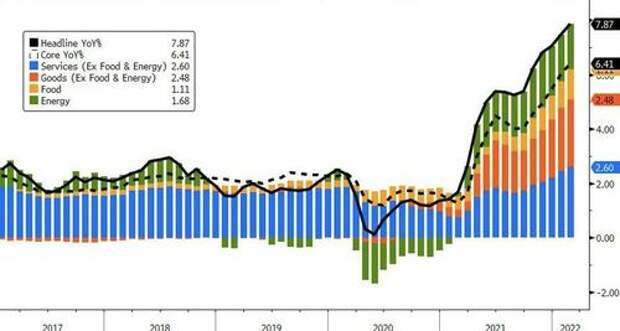

With the Biden administration already setting the narrative yesterday that today's inflation print could be 'high', and expectations for a headline print of +7.9% YoY (from +7.5% YoY in January), the bar was high for any surprises and the headline print came in right in the dot at +7.9% YoY - the highest since Jan 1982.

Source: Bloomberg

That is the 21st straight month of MoM (non-transitory) increases in consumer prices, with Energy (and Services) dominating the recent surge...

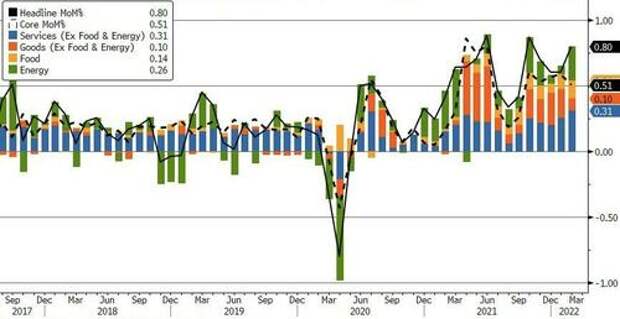

Source: Bloomberg

On a MoM basis, Energy and Services costs also dominated the increases...

Source: Bloomberg

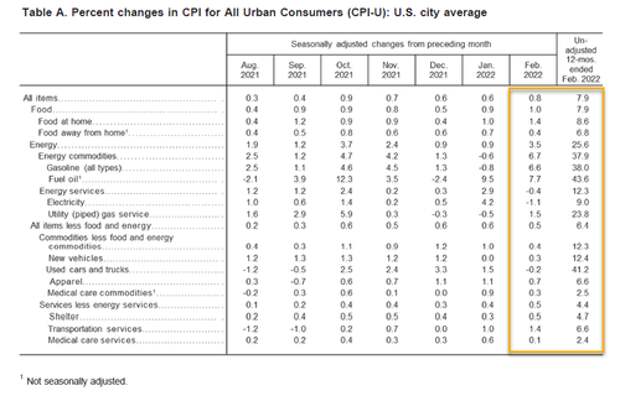

One thing of note... one tiny sliver of hope... Used Car prices fell very modestly in February...

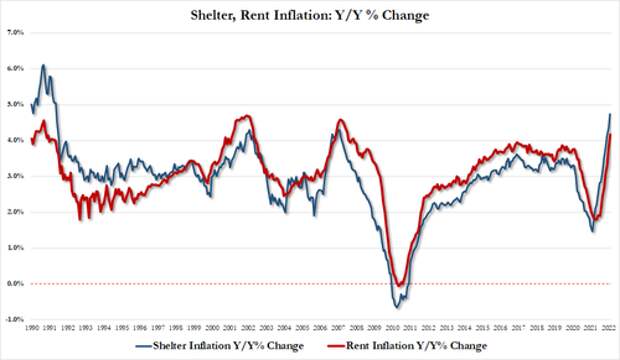

But, in the interest of balance, the costs of a roof over your head are exploding higher...

-

March shelter inflation 4.74%, up from 4.36% in Jan and the highest since May 1991

-

March rent inflation 4.17%, up from 3.76% and the highest since July 2007

Source: Bloomberg

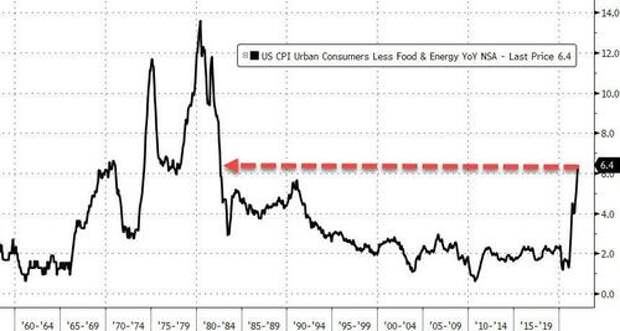

Core CPI rose 6.4% YoY in February (in line with +6.4% expectations and well above +6.0% in January)

Source: Bloomberg

Finally, and to many, most importantly, real wages (average hourly earnings) dropped on a YoY basis for the 11th straight month...

Source: Bloomberg

So the next time the Biden admin tries to tell you to be grateful that your wages are rising, show them that chart!