Today's market was brought to you by three simple words...

SNAP... goes the social-media/ad-spend bubble

Social media meltdown as Snap slashed its guidance, throwing the entire ad-supported tech sector into turmoil, and leaving gaping wide questions about the strength of the consumer.

SNAP's stunning collapse (over 40%) weighed on the entire social media landscape, crashing below pre-COVID levels...

Source: Bloomberg

CRACKLE... goes Fed credibility

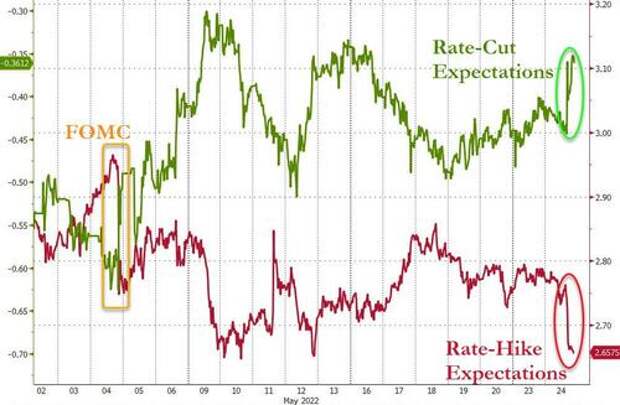

Fed credibility is starting to crack as the ongoing slump in stocks and macro data sent rate-hike expectations down and subsequent rate-cut expectations higher...

Source: Bloomberg

While consecutive 50-bp moves remain locked over the next two policy meetings, the odds of another half-point hike have dropped to 68%, down from 82% on Monday. In total, there remain 134 bps of hikes priced over the next three meetings, down from 141 bps before, signaling a nod to Fed Atlanta President Raphael Bostic’s interest-rate pause in September.

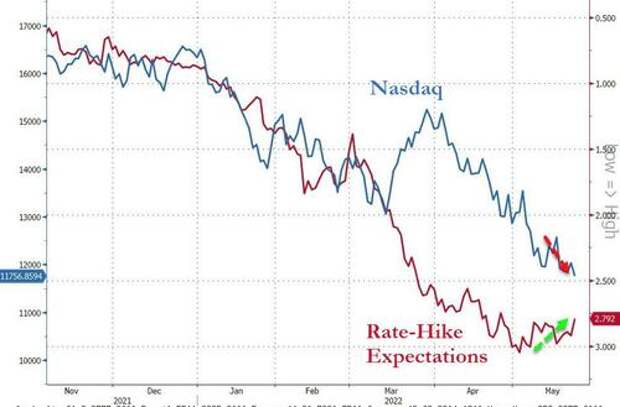

As stocks have accelerated lower recently, the market's faith in The Fed sticking to its hawkish tone is fading...

Source: Bloomberg

POP... goes the economy

Just when you thought it couldn't get worse, today was US macro data disappoint gravely (new home sales and Richmond Fed fell off a cliff), sending the US Macro Surprise Index crashing deep into negative territory to its weakest since October 2021...

Source: Bloomberg

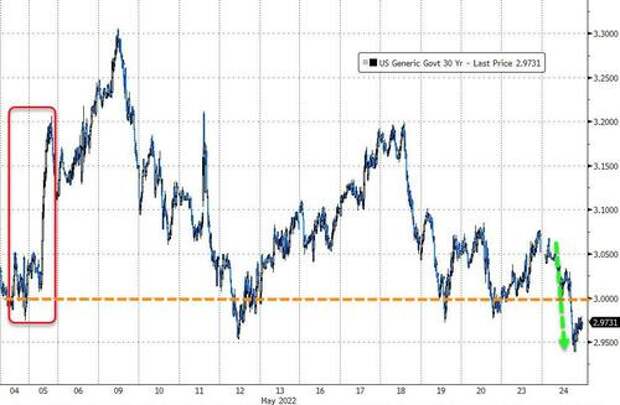

All of which sparked a huge bid in bonds with Treasury yields crashing 15bps at the short-end...

Source: Bloomberg

The 30Y Yield once again joined the rest of the curve back below 3.00%, and back below FOMC lows...

Source: Bloomberg

Gold was also bid as recessionary expectations rise and Fed easing back/loss of credibility builds...

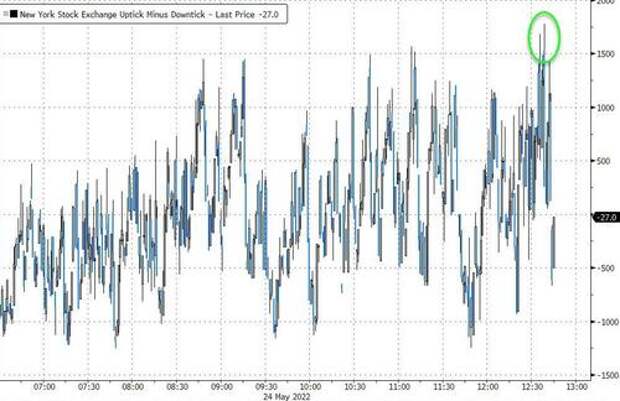

Stocks were slammed overnight by Snap's impact then hammered lower on the dismal data - erasing all of yesterday's gains. Stocks bounced as usual at the European close. then faded, but yet another late-day panic-bid sent The Dow into the green...

It appears all the algos cared about was getting Nasdaq back to even from Friday...but failed...

The pumpfest in the last 15 mins sparked a massive 1778 print for TICK - the 3rd largest buy-program of the year...

TICK just hit a two-day high 1566. Did the Fed just leak its rate hike pause

— zerohedge (@zerohedge)

Discretionary stocks puked today as Staples extended gains...

Source: Bloomberg

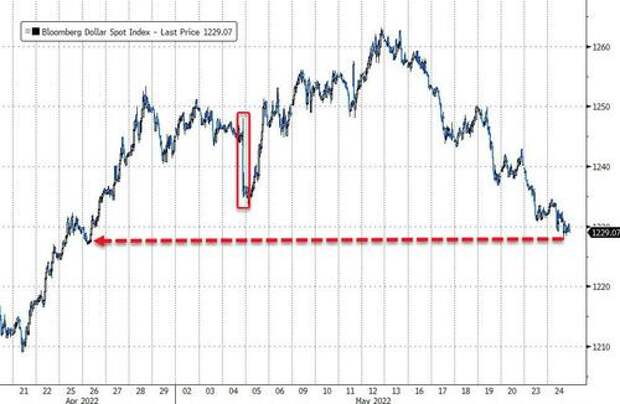

The dollar fell for the 6th day in the last 8 to its lowest in a month (and below FOMC lows)...

Source: Bloomberg

Bitcoin chopped sideways today, testing above $29,500 and below $29,000...

Source: Bloomberg

Oil prices were slightly lower on the day ahead of tonight's API inventory data...

NatGas held on to yesterday's explosive gains (and extended them, testing above early May's highs)...

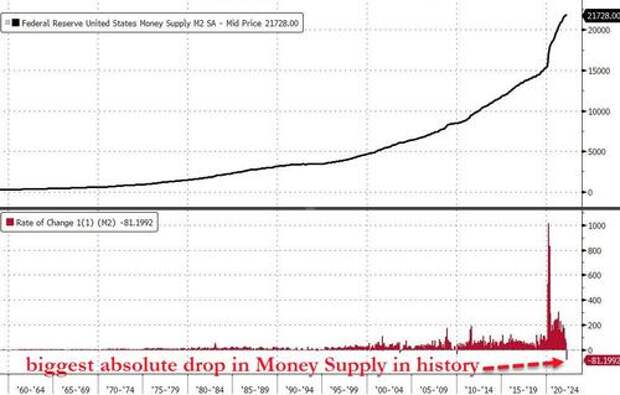

Finally, if you're wondering why stocks are falling, the latest data from The Fed show US Money Supply fell $82 billion in April... its biggest absolute MoM drop in history... and QT hasn't even started!

Source: Bloomberg

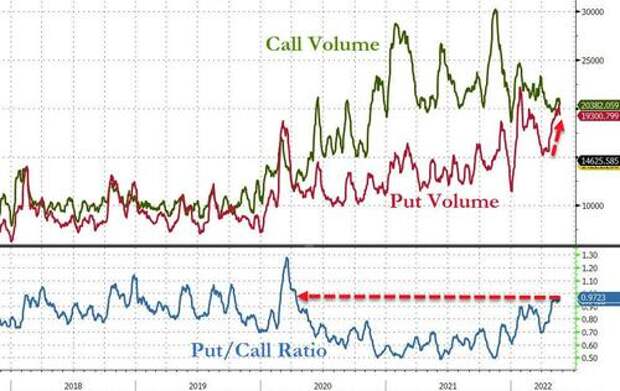

Additionally, we note that the put/call ratio for stocks is back at its highest since April 2020 as volumes of demand for protection catch up to the volumes of levered bullish hope...

Source: Bloomberg

We note that this shift is more of a normalization and not a contrarian signal of a turn yet - just look at 2018/2019 peaks, which are above today's levels.

As SpotGamma notes, while clearly much can happen between now and June OPEX, we think that 4000 will act as resistance, with 3700 a major support line. We assign an edge to markets remaining in that lower window as we do not think there is a compelling “risk on” trigger until June FOMC + OPEX.