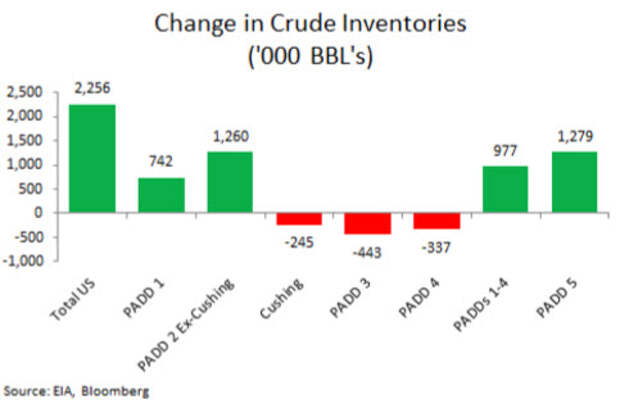

Following API's reported across the board inventory draws, DOE refuted this and saw a surprise notable 2.256mm build (most in 5 weeks). Cushing inventories fell very modestly (biggest draw in 2 months) and Gasoline and Distillates also saw further inventiry dras. Production slid very modestly. WTI is being sold on this print, testing back to a $52 handle.

API

- Crude -4.15mm (-2.5mm exp)

- Cushing +690k (+1.9mm exp)

- Gasoline -1.96mm

- Distillates -1.55mm

DOE

- Crude +2.256mm (-2.5mm exp)

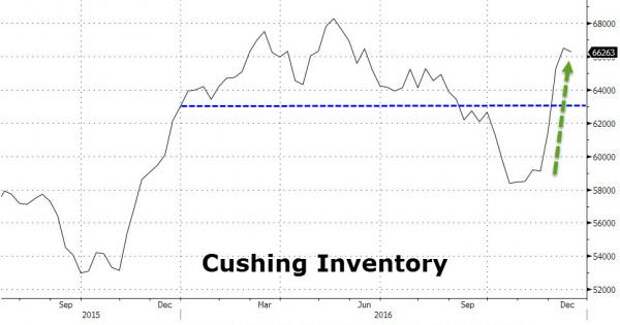

- Cushing -245k (+700k exp)

- Gasoline -1.309mm (+1.375mm exp)

- Distillates -2.42mm (-1.625mm exp)

First overall build in 5 weeks but biggest Cushing draw in 2 months...

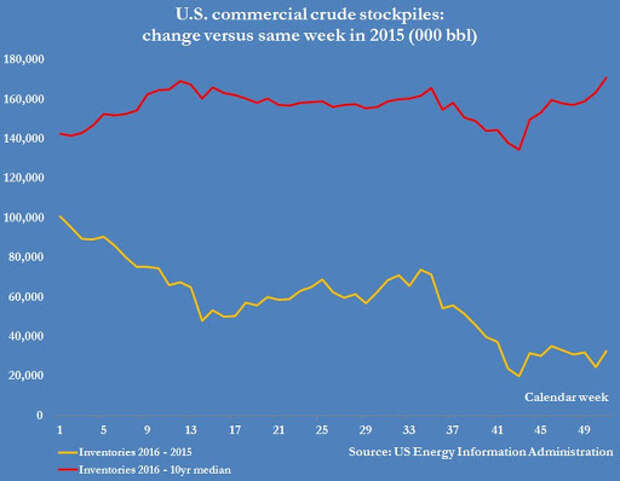

As Reuters notes also, US Crude stocks have not exhibited normal drawdown before the end of the year. Stocks now +171 million bbl (+54%) over 10-yr average

h/t @JKempEnergy

The breakdown...

- Midwest Padd2 Crude Inventories Rose 1.01 Mln Bbl

- Gulf Coast Crude Inventories Fell 443,000 Bbl

- West Coast Crude Inventories Rose 1.28 Mln Bbl

- East Coast Distillate Inventories Fell 2.06 Mln Bbl

Cushing inventories are now notably higher YoY...

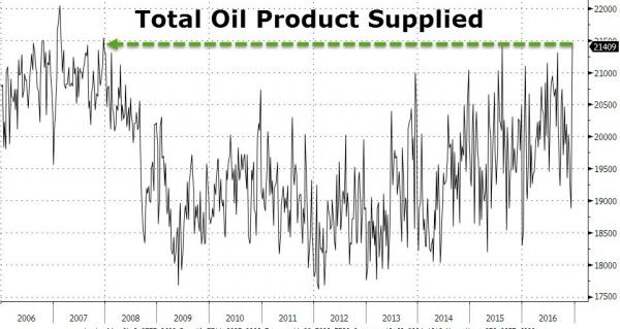

Interestingly, as Bloomberg reports, U.S. demand rebounded sharply last week, with total product supplied reaching 21.4 million barrels a day, the highest weekly reading since December 2007. The increase is a huge swing from last week's reading of just 18.8 million barrels a day. We note howver, that this is a very seasonal norm into year-end (albeit 2016's surge is the biggest in 9 years).

As Bloomberg also notes however, a big word of caution about the recent swings in weekly data. It's December, and some refiners and fuel distributors, particularly in the U.S. Gulf of Mexico basin, try to lower their stocks to reduce their "ad valorem" year-end tax bill. That could lead to erratic data. Demand could be affected, and also the schedule of the offloading of tankers. Mid-January data will provide a better picture.

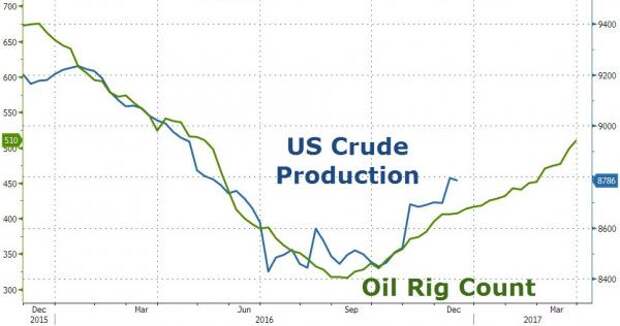

Production fell very modestly on the week but the trend remains tracking the lagged rig count higher..

The reaction (after Libya headlines erased API's gains overnight) was more selling pressure to a $52 handle...

Carsten Fritsch, commodity analyst at Commerzbank, noted “Price movements have seen small intraday moves in thin volumes this week”