With his fund down ~50% YTD, one wonders if Crispin Odey should be thinking about quietly exiting stage left after along and mostly illustrious career. However, as his latest letter suggests, Odey is just getting his second, or maybe third, wind and is confident that he will ultimately win the war against central bankers, although as he himself points out, the risk is not so much his own fund blowing up as much as LPs saying enough to active investing altogether, and cautioned that "skilled investors are being driven out by mindless (passive) investing.

"Putting it mildly (especially for his own fund), Odey said that “this has been a difficult year for active managers,” and added that “passive investing has taken money which typically would have been in the bond market and deposited it in the equity market.”

While it remains to be seen if active management is on the endangered list, Odey has bigger troubles with his own LPs in the coming weeks, although his fortune may change in 2017 when as he warns, “central bankers will have to respond to what their governments are doing fiscally, rather than bolstering asset prices with low interest rates. There could be trouble ahead.”

There could, indeed, which simply means the cycle starts from scratch and central banks LBO even more of the global capital markets, until the 0.01% own all the assets while the rest "own" the debt.

His full November letter below:

This is not the beginning of a new cycle. This recovery which began in 2009 on the back of zero interest rates is long in the tooth. After 7 years, the benefits of low interest rates – cheaply financed cars and houses – are played out, whilst oil is now a conundrum. For half the world, the problem is that oil has fallen 50% and for the other half the problem is that the price of oil is up 50%.

What is true is that there are two problems for the developed world that have not gone away. They are that house prices, and assets in general, are too expensive to be bought out of income. The disparity between the “Haves” and the “Have-nots” is too great. Secondly and relatedly is the brutal difference in lifestyle of the young and the old.

QE has resulted in very high asset prices and ushered in weaker and weaker productivity gains. Low growth cannot sit alongside rising inequality.

Brexit, Trump, the Italian referendum came about because the problems seem impossible to solve. Everyone is now looking to any individual who believes he can solve the problem.

A world fuelled by government spending initiatives, as demanded by voters, promises to undermine the careful husbandry of the developed economies crafted by the policies of central banks.

If unemployment is already at cyclical lows, new expansionary policies will get reflected in higher inflation reasonably quickly.

At present markets are just pleased to see a yield curve coming back, but there is no thought that inflation will truly come through.

Part of this is a belief in the USA that Trump is like Reagan and 2017 is like 1981. However, Reagan was elected after a re-cession. Interest rates were over 20% when he took office. Indebtedness for the whole economy was at 0.9x GNP and the P/E for the stockmarket was 12x. Trump comes in with indebtedness at 3.5x GNP and the stockmarket on 22x current earnings.

Leverage means every 1% rise in interest rates demands a 3% rise in incomes to keep debt serviceable.

This has been a difficult year for active managers. 70% of turnover is now accounted for by passive managers. Passive investing has taken money which typically would have been in the bond market and deposited it in the equity market. Naturally skilled investors are being driven out by mindless (passive) investing.

Is this the time to dump the active managers? One imagines that their time comes again when this sea of money starts to ebb, driven by inflation and higher interest rates. The UK is already facing it. Companies are encountering higher import prices, which is increasing the working capital requirement as well as wage pressures. Is this the beginning of a new cycle?

Beware leap years! 1994 was the year that deflation came to the world, and a difficult year then was the prelude to many hap-pier years because the skill set required for the subsequent years was exactly the opposite of what was required for 1994.

Similarly a world of inflation and default is a world in which active managers should outperform.

Certainly, politicians are no longer interested in higher prices for assets. Politics demands the solution of the “Haves” and “Have-nots”, the young and the old.

Stockmarkets since the Trump victory have merely served to put cyclical sectors on the same high ratings of growth compa-nies. Whether it is the oil price or other commodities, spot prices are now almost flat going out along the curve. There is little to go for in this area unless inflation comes through.

China is now the source of inflation. Tax changes in the USA involving raising import prices by 20% effectively and lowering export prices by 12%, will also increase inflationary pressures.

2017 looks to be a year when central bankers will have to respond to what their governments are doing fiscally, rather than bolstering asset prices with low interest rates. There could be trouble ahead.

* * *

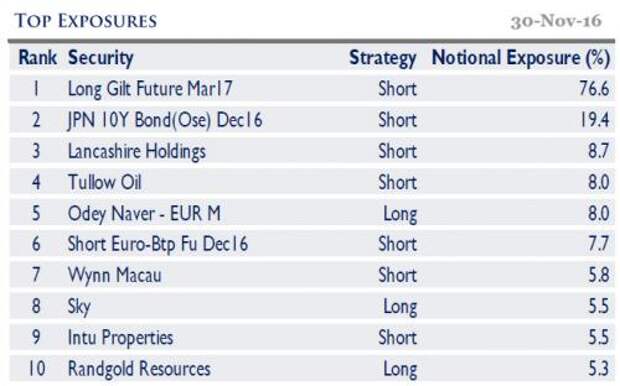

Curious what Odey's biggest positions were as of November 30? The answer is below.